CONCEPTS IN FED.TAX.,2020-W/ACCESS

20th Edition

ISBN: 9780357110362

Author: Murphy

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Question

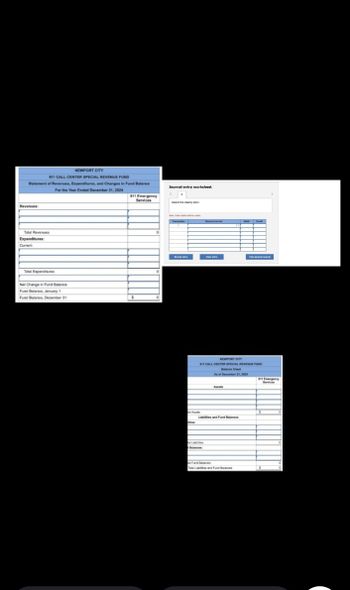

Transcribed Image Text:NEWPORT CITY

911 CALL CENTER SPECIAL REVENUE FUND

Statement of Revenues, Expenditures, and Changes in Fund Balance

Revenues:

Total Revenues

Expenditures:

Current

Journal entry worksheet.

For the Year Ended December 31, 2024

911 Emergency

Services

Record the doing entry

Total Expenditures

Net Change in Fund Balance

Fund Balance, January 1

Fund Balance, December 31

O

T

C

10

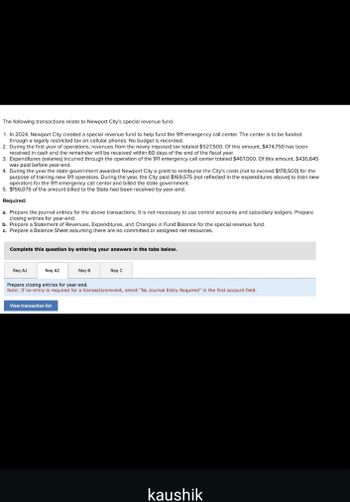

NEWPORT CITY

911 CALL CENTER SPECIAL REVENUE FUND

Balance Sheet

As of December 31, 2024

Labilities and Fund Balances

Fund Balances

Tal Labs and Fund Balances

911 Emergency

Transcribed Image Text:The following transactions relate to Newport City's special revenue fund.

1. In 2024, Newport City created a special revenue fund to help fund the 911 emergency call center. The center is to be funded

through a legally restricted tax on cellular phones. No budget is recorded.

2. During the first year of operations, revenues from the newly imposed tax totaled $527,500. Of this amount, $474,750 has been

received in cash and the remainder will be received within 60 days of the end of the fiscal year.

3. Expenditures (salaries) incurred through the operation of the 911 emergency call center totaled $467,000. Of this amount, $436,645

was paid before year-end.

4. During the year the state government awarded Newport City a grant to reimburse the City's costs (not to exceed $178,500) for the

purpose of training new 911 operators. During the year, the City paid $169,575 (not reflected in the expenditures above) to train new

operators for the 911 emergency call center and billed the state government.

5. $156,075 of the amount billed to the State had been received by year-end.

Required:

a. Prepare the journal entries for the above transactions. It is not necessary to use control accounts and subsidiary ledgers. Prepare

closing entries for year-end.

b. Prepare a Statement of Revenues, Expenditures, and Changes in Fund Balance for the special revenue fund.

c. Prepare a Balance Sheet assuming there are no committed or assigned net resources.

Complete this question by entering your answers in the tabs below.

Req A1

Req A2

Req B

Req C

Prepare closing entries for year-end.

Note: If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.

View transaction list

kaushik

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The following transactions relate to Newport City's special revenue Fund. 1. In 2020, Newport City created a special revenue fund to help the 911 emergency call center. the center is to be funded through a legally restricrted tax on cellular phones. No budget is recorded. 2. During the first year of operations, revenues from the newly imposed tax totaled $489,000. Of this amount $444,000 has been received in cash and the remainder will be received within 60 days of the end of the fiscal year.. 3. expenditures (salaries) incurred through the operation of the 911 emergency call center totaled $449,000. Of this amount $422,000 was paid before year-end. 4. During the year the state government awarded Newport City a grantto reimburse the city's cost ( not to exceed $150,000) for the pupose of training new 911 operators. During the year, the city paid $146,500 ( not relfected inthe expenditures above) to trian new operators for the 911 emergancy call center and billed the state government.…arrow_forwardThe following transactions relate to Newport City's special revenue fund. 1. In 2020, Newport City created a special revenue fund to help fund the 911 emergency call center. The center is to be funded through a legally restricted tax on cellular phones. No budget is recorded. 2. During the first year of operations, revenues from the newly imposed tax totaled $517,500. Of this amount, $465,750 has been received in cash and the remainder will be received within 60 days of the end of the fiscal year. 3. Expenditures (salaries) incurred through the operation of the 911 emergency call center totaled $459,000, Of this amount, $429,165 was paid before year-end. 4. During the year the state government awarded Newport City a grant to reimburse the City's costs (not to exceed $172,500) for the purpose of training new 911 operators. During the year, the City paid $163,875 (not reflected in the expenditures above) to train new operators for the 911 emergency call center and billed the state…arrow_forwardThe following transactions relate to Newport City’s special revenue fund. In 2020, Newport City created a special revenue fund to help fund the 911 emergency call center. The center is to be funded through a legally restricted tax on cellular phones. No budget is recorded. During the first year of operations, revenues from the newly imposed tax totaled $495,000. Of this amount, $445,500 has been received in cash and the remainder will be received within 60 days of the end of the fiscal year. Expenditures (salaries) incurred through the operation of the 911 emergency call center totaled $441,000. Of this amount, $412,335 was paid before year-end. During the year the state government awarded Newport City a grant to reimburse the City’s costs (not to exceed $159,000) for the purpose of training new 911 operators. During the year, the City paid $151,050 (not reflected in the expenditures above) to train new operators for the 911 emergency call center and billed the state government.…arrow_forward

- The following transactions relate to Newport City’s special revenue fund. In 2020, Newport City created a special revenue fund to help fund the 911 emergency call center. The center is to be funded through a legally restricted tax on cellular phones. No budget is recorded. During the first year of operations, revenues from the newly imposed tax totaled $530,000. Of this amount, $477,000 has been received in cash and the remainder will be received within 60 days of the end of the fiscal year. Expenditures (salaries) incurred through the operation of the 911 emergency call center totaled $469,000. Of this amount, $438,515 was paid before year-end. During the year the state government awarded Newport City a grant to reimburse the City’s costs (not to exceed $180,000) for the purpose of training new 911 operators. During the year, the City paid $171,000 (not reflected in the expenditures above) to train new operators for the 911 emergency call center and billed the state government.…arrow_forwardPlease Do not Give image format and solve all parts Thank Youarrow_forward1. The City of Access collects its annual property taxes late in its fiscal year. Consequently, cach year it must finance part of its operating budget using tax anticipation notes. The notes are repaid upon collection of property taxes. On April 1, 2016, the City estimated that it will require OMR 2,500,000 to finance governmental activities for the remainder of the 2016 fiscal year. On that date, it had OMR 790,000 of cash on hand and OMR 830,000 of current liabilities. Collections for the remainder of FY 2016 from revenues other than current property taxes and from delinquent property taxes, including interest and penalties, were estimated at OMR 1,100,000. Required: Calculate the estimated amount of tax anticipation financing that will be required for the remainder of FY 2016. Show work in good form.arrow_forward

- The City of Iroy collects its annual property taxes late in its fiscal year. Consequently, each year it must finance part of its operating budget using tax anticipation notes. The notes are repaid upon collection of property taxes. On April 1, the city estimated that it will require $1,800,000 to finance governmental activities for the remainder of the fiscal year. On that date, it had $700,000 of cash on hand and $760,000 of current liabilities. Collections for the remainder of the year from revenues other than current property taxes and from delinquent property taxes, including interest and penalties, were estimated at $750,000. Required a. Calculate the estimated amount of tax anticipation financing that will be required for the remainder of the current fiscal year. b. Assume that on April 2, the City of Troy borrowed the amount calculated in part a by signing tax anticipation notes bearing 7 percent per annum to a local bank. Record the issuance of the tax anticipation notes in the…arrow_forward3. On the last day of the calendar year, the City of Soccerton borrowed $400,000 from the local bank as a short-term loan in anticipation of property tax collections in the month of January. The note is non-interest bearing, due in 30 days, and is discounted as a rate of 12% per year. Record this transaction from two perspectives: 1) from the governmental activities' perspective on the government-wide statements, and 2) from the General Fund perspective. (1) From the governmental activities' perspective: Date Account Name 12/31 (2) From the General Fund perspective Date Account Name 12/31 Debit Credit Debit Creditarrow_forwardThe City of Troy collects its annual property taxes late in its fiscal year. Consequently, each year it must finance part of its operating budget using tax anticipation notes. The notes are repaid upon collection of property taxes. On April 1, the city estimated that it will require $2,500,000 to finance governmental activities for the remainder of the fiscal year. On that date, it had $770,000 of cash on hand and $830,000 of current liabilities. Collections for the remainder of the year from revenues other than current property taxes and from delinquent property taxes, including interest and penalties, were estimated at $1,100,000. Required a. Calculate the estimated amount of tax anticipation financing that will be required for the remainder of the current fiscal year. b. Assume that on April 2, the City of Troy borrowed the amount calculated in part a by signing tax anticipation notes bearing 6 percent per annum to a local bank. Record the issuance of the tax anticipation notes in…arrow_forward

- The state government established a capital project fund in 2019 to build new highways. The fund is siupported by a 5 percent tax on disel fuel sales in the state. The tax is collected by private gas stations and remitted in the following month to the state. The following transactions occured during 2020: Debits: cash $8,550,000; Taxes receivable $2,700,000; Credits : Contracts Payble $1,950,000; fund balance $9,300,000 1. 42,100,000 of encumbrances outstanding at December 31, 20189 were re-established. 2. During the year, fuel taxes were remitted to the state totaling $23,600,000, including the amount due at the end of the previous year. In addition, $2,870,000 is expected to be remitted in January of next year for fuel sales in December 2020. 3. the state awarded new contracts for road construction totaling $23,650,000. 4. During the year, contractors submitted invoices for payment totaling $23,970,000. These were all under the terms of contracts (i.e., same $ amounts) issued by the…arrow_forwardA city has only one activity, its school system. The school system is accounted for within the general fund. For convenience, assume that, at the start of 2017, the school system and the city have no assets. During the year, the city assessed $400,000 in property taxes. Of this amount, it collected $320,000 during the year, received $50,000 within a few weeks after the end of the year, and expected the remainder to be collected about six months later. The city makes the following payments during 2017: salary expense, $100,000; rent expense, $70,000; equipment (received on January 1 with a five-year life and no salvage value), $50,000; land, $30,000; and maintenance expense, $20,000. In addition, on the last day of the year, the city purchased a $200,000 building by signing a long-term liability. The building has a 20-year life and no salvage value, and the liability accrues interest at a 10 percent annual rate. The city also buys two computers on the last day of the year for $4,000…arrow_forwardDon't give solution in image format..arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you