Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

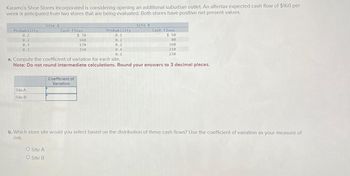

Transcribed Image Text:Karamo's Shoe Stores Incorporated is considering opening an additional suburban outlet. An aftertax expected cash flow of $160 per

week is anticipated from two stores that are being evaluated. Both stores have positive net present values.

Probability

0.2

0.2

0.3

0.3

Site A

Site B

Site A

Cash

Site A

O Site B

FlowS

$ 70

160

170

210

Probability

0.1

0.2

0.2

0.4

0.1

a. Compute the coefficient of variation for each site.

Note: Do not round intermediate calculations. Round your answers to 3 decimal places.

Site B

Coefficient of

Variation

Cash FlowS

$ 50

80

160

210

230

b. Which store site would you select based on the distribution of these cash flows? Use the coefficient of variation as your measure of

risk.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Harry is trying to evaluate a two year project using NPV. There is uncertainty as to the level of sales (in units) in each of the two years: Year 1 Sales units Probability Year 2 Sales units Probability 10,000 0.3 8,000 0.2 10,000 0.8 15,000 0.7 20,000 0.6 10,000 0.4 Required: (a) On what expected level of sales in Year 1 and 2 should Harry base his NPV calculation? (b) Imagine that the project outlay is £230,000 and each unit sold has a contribution of £10. If Harry’s cost of capital is 10%, what is the project’s…arrow_forwardManagement of Daniel Jackson, a confectioner, is considering purchasing a new jelly bean-making machine at a cost of $256,144. They project that the cash flows from this investment will be $102,150 for the next seven years. If the appropriate discount rate is 14 percent, what is the IRR that Daniel Jackson management can expect on this project? (Do not round discount factors. Round other intermediate calculations to 0 decimal places e.g. 15 and final answer to 2 decimal places, e.g. 5.25%.)arrow_forwardPls helps me all parts or kindly skiparrow_forward

- Boston Cola is considering the purchase of a special-purpose bottling machine for $35,000. It is expected to have a useful life of 4 years with no terminal disposal value. The plant manager estimates the following savings in cash operating costs: Boston Cola uses a required rate of return of 14% in its capital budgeting decisions. Ignore income taxes in your analysis. Assume all cash flows occur at year-end except for initial investment amounts. Data Table Year Amount Year 1 $15,000 Year 2 11,000 Year 3 10,000 Year 4 8,000 Total $44,000 (Use factor amounts rounded to three decimal places. Round your answers to the nearest whole dollar. Use a minus sign or parentheses for a negative net present value.) Calculate the following for the special purpose bottling machine: 1. Net present value 2. Payback period 3. Discounted payback period 4. Internal rate of return (using the interpolation method) 5. Accrual…arrow_forwardSky High Partners is evaluating a high-rise office building to add to its investment portfolio. To calculate a value, Sky High plans to use the income approach, based on the following estimates: Gross potential yearly rental income Estimated vacancy rate Yearly operating costs Market capitalization rate a. Compute the net operating income (NOI) for the building. Net operating income $ Valuation $ 890,000 2.75% $ 417,000 14% 448,525 b. Using the income approach, calculate the value for the office building. Note: Round your answer to the nearest whole number.arrow_forwardManagement of Sandhill Mints, a confectioner, is considering purchasing a new jelly bean-making machine at a cost of $312,500. They project that the cash flows from this investment will be $113,000 for the next seven years. If the appropriate discount rate is 14 percent, what is the NPV for the project? (Enter negative amounts using negative sign, e.g. -45.25. Do not round discount factors. Round other intermediate calculations and final answer to 0 decimal places, e.g. 1,525.) NPV=arrow_forward

- The estimated negative cash flows for three design alternatives are shown below. The MARR is 13% per year and the study period is six years. Which alternative is best based on the IRR method? Doing nothing is not an option. Capital investment Annual expenses A. Alternative A B. Alternative C OC. Alternative B EOY 0 1-6 Which alternative would you choose as a base one? Choose the correct answer below. A $79,300 7,900 Alternative B $63,000 12,370 $71,600 10,120arrow_forwardManagement of Paul White, a confectioner, is considering purchasing a new jelly bean-making machine at a cost of $310,439. They project that the cash flows from this investment will be $137,190 for the next seven years. If the appropriate discount rate is 14 percent, what is the IRR that Paul White management can expect on this project? (Do not round discount factors. Round other intermediate calculations to 0 decimal places e.g. 15 and final answer to 2 decimal places, e.g. 5.25%.) IRR isarrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward

- A mini-mart needs a new freezer and the initial investment will cost $432,427. Incremental revenues, including cost savings, are $189,494, and incremental expenses, including depreciation, are $30,950. There is no salvage value. What is the accounting rate of return (ARR)? Round the nearest whole percent, no decimal places.arrow_forwardPR 11-1A Average rate of return method, net present value method, and analysis for a service company Obj. 2, 3 The capital investment committee of Arches Landscaping Company is considering two capital investments. The estimated income from operations and SHOW MI NO net cash flows from each investment are as follows: tart TIMPLATE Front-End Loader Greenhouse Income from Operations Net Cash Flow Income from Operations Net Cash Flow Year $ 40,000 35,000 22,000 18,000 $ 26,250 $25.000 20.000 7,000 3,000 $11,250 11,250 11,250 26,250 26,250 26,250 4 11,250 11,250 $56,250 26,250 $131,250 1,250 16,250 $131,250 Total $56.250 Each project requires an investment of $75,000. Straight-line depreciation will be used, and no residual value is expected. The committee has selected a rate of 12% for purposes of the net present value analysis. Instructions 1. Compute the following: A. The average rate of return for each investment. Answer B. The net present value for each investment. Use the present…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education