FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

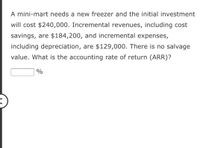

Transcribed Image Text:A mini-mart needs a new freezer and the initial investment

will cost $240,000. Incremental revenues, including cost

savings, are $184,200, and incremental expenses,

including depreciation, are $129,000. There is no salvage

value. What is the accounting rate of return (ARR)?

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A project has the following cash flows: Year Cash Flow 0 $ 37,000 1 -18,000 227,000 What is the IRR for this project? (Round the final answer to 2 decimal places.) IRR % What is the NPV of this project, if the required return is 11% ? ( Negative answer should be indicated by a minus sign. Do not round intermediate calculations. Round the final answer to 2 decimal places. Omit $ sign in your response.) NPV $ What is the NPV of the project if the required return is 0% ? ( Negative answer should be indicated by a minus sign. Omit $ sign in your response.) NPV $ What is the NPV of the project if the required return is 22 % ? (Do not round intermediate calculations. Round the final answer to 2 decimal places. Omit $ sign in your response.) NPV $arrow_forwardPlease do not provide solution in image format and give proper explanation.arrow_forwardPlease read instructions and answer each question show work.arrow_forward

- Cecil company is considering the of a new machine. The machine cost $227,500 and will generate a yearly cash inflow of $35,000. what is the payback period? Requirement: what is the payback period?arrow_forward(a) New manufacturing equipment costs $225,000, salvage value is $25,000, and average annual earnings of $20,000 after taxes is expected. Find the average annual rate of return. If the earnings are doubled, then what is the rate?(b) Investment for new equipment is $100,000, and the salvage value is $10,000. Average yearly earnings from this equipment are $15,000 after taxes. What is the non-time-value-ofmoney return? When is the payback?arrow_forwardThis question is based on the following in formation: An investment is Machinery costing P 250,000 with a 4-year life and no salvage value is expected to produce the following net income after taxes of 30%: End of year 1 P 17,000 2 22,000 3 25,000 4 26,000 How much is the annual tax shield?How much is the annual tax shield?A. P 17,580B. P 17,850C. P 18,570D. P 18,750What is the ROI (using the cash income)? A. 6.3%B. 9%C. 31.3%D. 34%arrow_forward

- Use the following information for the Quick Study below. (Algo) [The following information applies to the questions displayed below.] Following is information on an investment in a manufacturing machine. The machine has zero salvage value. The company requires a 6% return from its investments. Initial investment Net cash flows: Year 1 Year 2 Year 3 Year 1 Year 2 Year 3 QS 24-19 (Algo) Net present value with unequal cash flows LO P3 Compute this machine's net present value. (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided. Round all present value factors to 4 decimal places. Round present value amounts to the nearest dollar.) Totals Initial investment Net present value Net Cash Flow $ $ $ (240,000) 195,000 90,000 103,000 388,000 195,000 90,000 103,000 Present Value Factor Present Value of Net Cash Flows $ $ 0 0arrow_forwardYou are analyzing a project and have developed the following estimates. The depreciation is $47,900 a year and the tax rate is 21 percent. What is the worst-case operating cash flow? Unit sales Sales price per unit Variable cost per unit Fixed costs -$2,545 $11,145 $88,855 $27,556 O $63,937 Base-Case Lower Bound Upper Bound 9,800 12,800 $34 $24 $ 9,200 11,300 $ 39 $25 $ 9,700 $44 $26 $ 10,200arrow_forward(Ignore income taxes in this problem.) Your Company uses a discount rate of 10%. The company has an opportunity to buy a machine now for $38,000 that will yield cash inflows of $10,000 per year for each of the next five years. The machine would have no salvage value. The net present value of this machine to the nearest whole dollar is: If the NPV is negative, enter your number with a – in front. Otherwise, just enter the number.arrow_forward

- 1. what amount should be used as the initial cash flow for this project and why?? 2. What is the after-tax salvage value for the spectrometer? 3. What is the MPV of the project? Should the firm accept or reject this project?arrow_forwardGarden-Grow Products is considering a new investment whose data are shown below. The equipment would be depreciated on a straight-line basis over the project's 3-year life, would have a zero salvage value, and would require some additional working capital that would be recovered at the end of the project's life. Revenues and other operating costs are expected to be constant over the project's life. What is the project's NPV? (Hint: Cash flows are constant in Years 1 to 3.) Project cost of capital (r) Net investment in fixed assets (basis) Required new working capital Straight-line deprec. rate Sales revenues, each year Operating costs (excl. deprec.), each year Tax rate a. $31,573 b. $30,069 c. $36,550 d. $34,809 e. $33,152 10.0% $75,000 $15,000 33.333% $75,000 $25,000 25.0%arrow_forwardRaghubhaiarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education