Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

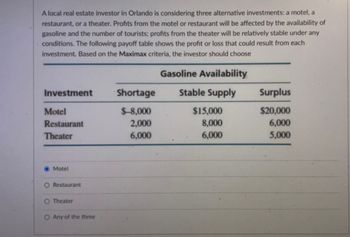

Transcribed Image Text:A local real estate investor in Orlando is considering three alternative investments: a motel, a

restaurant, or a theater. Profits from the motel or restaurant will be affected by the availability of

gasoline and the number of tourists; profits from the theater will be relatively stable under any

conditions. The following payoff table shows the profit or loss that could result from each

investment. Based on the Maximax criteria, the investor should choose

Investment

Motel

Restaurant

Theater

Motel

Restaurant

O Theater

O Any of the three

Shortage

$-8,000

2,000

6,000

Gasoline Availability

Stable Supply

$15,000

8,000

6,000

Surplus

$20,000

6,000

5,000

Transcribed Image Text:For the Orlando real estate investment problem, assume the probabilities for the gasoline shortage,

stable supply and surplus are .5, .3 and .2, then compute the expected opportunity loss of choosing

motel, it is (type number only, no decimals, no dollar sign)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The buyer of a piece of real estate is often given the option of buying down the loan. This option gives the buyer a choice of loan terms in which various combinations of interest rates and discount points are offered. The choice of how many points and what rate is optimal is often a matter of how long the buyer intends to keep the property. Darrell Frye is planning to buy an office building at a cost of $982,000. He must pay 10% down and has a choice of financing terms. He can select from a 9% 30-year loan and pay 4 discount points, a 9.25% 30-year loan and pay 3 discount points, or a 9.5% 30-year loan and pay 2 discount points. Darrell expects to hold the building for three years and then sell it. Except for the three rate and discount point combinations, all other costs of purchasing and selling are fixed and identical. (Round your answers to the nearest cent. Use this table, if necessary.) (a) What is the amount being financed? 2$ (b) If Darrell chooses the 4-point 9% loan, what…arrow_forwardThe buyer of a piece of real estate is often given the option of buying down the loan. This option gives the buyer a choice of loan terms in which various combinations of interest rates and discount points are offered. The choice of how many points and what rate is optimal is often a matter of how long the buyer intends to keep the property. Darrell Frye is planning to buy an office building at a cost of $982,000. He must pay 10% down and has a choice of financing terms. He can select from a 9% 30-year loan and pay 4 discount points, a 9.25% 30-year loan and pay 3 discount points, or a 9.5% 30-year loan and pay 2 discount points. Darrell expects to hold the building for three years and then sell it. Except for the three rate and discount point combinations, all other costs of purchasing and selling are fixed and identical. (Round your answers to the nearest cent. Use this table, if necessary.)arrow_forwardThe buyer of a piece of real estate is often given the option of buying down the loan. This option gives the buyer a choice of loan terms in which various combinations of interest rates and discount points are offered. The choice of how many points and what rate is optimal is often a matter of how long the buyer intends to keep the property. Darrell Frye is planning to buy an office building at a cost of $989,000. He must pay 10% down and has a choice of financing terms. He can select from a 9% 30-year loan and pay 4 discount points, a 9.25% 30-year loan and pay 3 discount points, or a 9.5% 30-year loan and pay 2 discount points. Darrell expects to hold the building for four years and then sell it. Except for the three rate and discount point combinations, all other costs of purchasing and selling are fixed and identical. (Round your answers to the nearest cent. Use this table, if necessary.) (a) What is the amount being financed? $ (b) If Darrell chooses the 4-point 9% loan,…arrow_forward

- Use the following information to answer questions 1 to 5. A development corporation purchased land that will be the site of a new luxury condominium complex. Management is considering a six month market research study designed to learn more about potential market acceptance of the condominium project. Management anticipates that, if conducted, the market research study will provide one of the following two results. 1. Favorable report (F): A significant number of the individuals contacted express interest in purchasing a condominium. 2. Unfavorable report (U): Very few of the individuals contacted express interest in purchasing a condo- minium. After deciding whether to conduct the market research study, they have the following two decision alternatives. d1 = a small complex with 30 condominiumsd2 = a medium complex with 60 condominiumsFollowing this, a chance event concerning the demand for the condominiums has two states of nature. s1 = strong demand for the condominiumss2 = weak…arrow_forwardMore real estate Consider the Albuquerque home sales from Exercise 29 again. The regression analysis gives the model Price = 47.82 + 0.061 Size. a) Explain what the slope of the line says about housing prices and house size. b) What price would you predict for a 3000-square-foot house in this market? c) A real estate agent shows a potential buyer a 1200-square- foot home, saying that the asking price is $6000 less than what one would expect to pay for a house of this size. What is the asking price, and what is the $6000 called?arrow_forwardThe buyer of a piece of real estate is often given the option of buying down the loan. This option gives the buyer a choice of loan terms in which various combinations of interest rates and discount points are offered. The choice of how many points and what rate is optimal is often a matter of how long the buyer intends to keep the property. Darrell Frye is planning to buy an office building at a cost of $983,000. He must pay 10% down and has a choice of financing terms. He can select from a 9% 30-year loan and pay 4 discount points, a 9.25% 30-year loan and pay 3 discount points, or a 9.5% 30-year loan and pay 2 discount points. Darrell expects to hold the building for four years and then sell it. Except for the three rate and discount point combinations, all other costs of purchasing and selling are fixed and identical. (Round your answers to the nearest cent. Use this table, if necessary.) (d): If Darrell chooses the 2-point 9.5% loan, what will be his total outlay in points…arrow_forward

- The buyer of a piece of real estate is often given the option of buying down the loan. This option gives the buyer a choice of loan terms in which various combinations of interest rates and discount points are offered. The choice of how many points and what rate is optimal is often a matter of how long the buyer intends to keep the property. Darrell Frye is planning to buy an office building at a cost of $986,000. He must pay 10% down and has a choice of financing terms. He can select from a 9% 30-year loan and pay 4 discount points, a 9.25% 30-year loan and pay 3 discount points, or a 9.5% 30-year loan and pay 2 discount points. Darrell expects to hold the building for three years and then sell it. Except for the three rate and discount point combinations, all other costs of purchasing and selling are fixed and identical. (Round your answers to the nearest cent. Use this table, if necessary.) I want to know how to find this out: If Darrell chooses the 4-point 9% loan, what will be his…arrow_forwardNet Present Value and Internal Rate of Return. Below are the projected revenues and expenses for a new clinical nurse specialist program being established by your healthcare organization. The nurses would provide education while patients are in the hospital and home visits are on a fee-for-service basis after patients have been discharged Should the hospital undertake the program if its required rate of return is 12%? Note: it must be assumed that the revenues and costs in this problem represent cash flows. Present value analysis is based on cash, not revenue or expenses. Provide a response to support the findings in the table listed below. Your response should be at least a half page long in addition to the table. Please include citations. Year One Year Two Year Three Year Four Total Revenue $100,000 $150,000 $200,000 $250,000 $700,000 Costs $150,000 $150,000 $150,000 $150,000 $600,000 $ <50,000> $0 $50,000 $100,000…arrow_forwardThe buyer of a piece of real estate is often given the option of buying down the loan. This option gives the buyer a choice of loan terms in which various combinations of interest rates and discount points are offered. The choice of how many points and what rate is optimal is often a matter of how long the buyer intends to keep the property. Darrell Frye is planning to buy an office building at a cost of $984,000. He must pay 10% down and has a choice of financing terms. He can select from a 9% 30-year loan and pay 4 discount points, a 9.25% 30-year loan and pay 3 discount points, or a 9.5% 30-year loan and pay 2 discount points. Darrell expects to hold the building for three years and then sell it. Except for the three rate and discount point combinations, all other costs of purchasing and selling are fixed and identical. (Round your answers to the nearest cent. Use this table, if necessary.) (a) What is the amount being financed? $ (b) If Darrell chooses the 4-point 9% loan, what…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education