FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Please don't provide answer in image format thank you

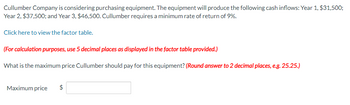

Transcribed Image Text:Cullumber Company is considering purchasing equipment. The equipment will produce the following cash inflows: Year 1, $31,500;

Year 2, $37,500; and Year 3, $46,500. Cullumber requires a minimum rate of return of 9%.

Click here to view the factor table.

(For calculation purposes, use 5 decimal places as displayed in the factor table provided.)

What is the maximum price Cullumber should pay for this equipment? (Round answer to 2 decimal places, e.g. 25.25.)

Maximum price $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Can you explain what I might be missing throughly please? I have it correct but it claims that it's not complete. What am I missing?arrow_forwardCh1 Question 2: A long-text entry will be truncated if the cell to the right is in use. Answer: A. True B. False Question 1: Which of these is true about using Undo? Answer: A. It can only be used in certain circumstances. B. Previous actions can be undone in any order. C. The Redo command must be used before the Undo command is available. D. The user must be aware of those commands that cannot be undone, as Excel will not provide any indication of these.arrow_forwardanswer ed is coming back incorrect please helparrow_forward

- Table Tools FIN4006D_Business_Maths_2147 [Compatibility Mode] - Microsoft Word (Product Activation Failed)- File Home Insert Page Layout References Mailings Review View PDFelement Design Layout X Cut Aal A Find - - A A Aa ッニ,三示 刻 T Arial 11 AaBbCcC AaBbCcI AaBbCcC AaBbCcC AaBbCcC AABBCCC AaB AaBbCc ab A Copy "ac Replace в I U Change | Styles - Paste - abe x, x A - 1 Body Text I Heading 1 1 List Paragr. I No Spacing 1 Normal 1 Table Para. 1 Title Heading 2 e Select - Format Painter Clipboard Font Paragraph Styles Editing (LOs: 1,2,3) Question 4 A company is thinking in investing in one of two potential new products for sale. The projections are as follows: Year Revenue/cost £ (Product A) Revenue/cost £ (Product B) (45,000) outlay 7,200 7,200 13,200 25,200 (45,000) outlay 3,600 7,600 15,600 19,000 1 2 3 4 a) Calculate the payback period for both products b) Calculate NPV of both products assuming a discount rate of 7% c) Which product should be chosen and why? d) Calculate the IRR for…arrow_forwardNot a previously submitted question. Thank youarrow_forwardPlease do not give solution in image format thankuarrow_forward

- Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardPlease do not give solution in image format thankuarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education