Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

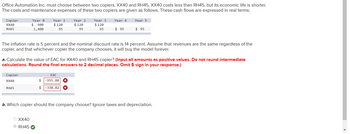

Transcribed Image Text:Office Automation Inc. must choose between two copiers, XX40 and RH45. XX40 costs less than RH45, but its economic life is shorter.

The costs and maintenance expenses of these two copiers are given as follows. These cash flows are expressed in real terms:

Copier

XX40

RH45

Year 0

$ 900

1,400

Year 1

$ 120

95

Year 2

$ 120

95

Year 3

Year 4

Year 5

$ 120

95

$ 95

$ 95

The inflation rate is 5 percent and the nominal discount rate is 14 percent. Assume that revenues are the same regardless of the

copier, and that whichever copier the company chooses, it will buy the model forever.

a. Calculate the value of EAC for XX40 and RH45 copier? (Input all amounts as positive values. Do not round intermediate

calculations. Round the final answers to 2 decimal places. Omit $ sign in your response.)

Copier

XX40

EAC

$ -955.08 ⭑

RH45

$

-338.82

b. Which copier should the company choose? Ignore taxes and depreciation.

XX40

RH45

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Don't give answer in image formatarrow_forwardKindly don't try to provide the answer from Chegg as they are incorrect (thoroughly checked). If it is possible to be solved in excel, then please do that.arrow_forwardSkatez n' co. is considering building a new plant. Gustav Jenkins, the company's marketing manager, is a supporter of the new plant. Charles Barles, the company's CFO is not sure they need a new plant. Currently, they purchase their skateboard blanks from china. The following figures were estimated for the new plant: cost of plant $6,000,000 Annual cash inflow $7,000,000 annual cash outflow $6,540,000 Estimated useful life of plant 15 years Salvage value of plant $3,000,000 Discount rate 11% Jenkins belives that this understates the value of the plant, claiming sales will be $400,000 higher than claimed, with insurance and warranty claim savings of $60,000 per year. He also believes the project is safter than above, at an 8% discount rate. What is the net present value of the project based on original projections? What if Jenkins estimated the $60,000 savings correctly, but the discount rate remains at 11%?arrow_forward

- Your firm spends $498,000 per year in regular maintenance of its equipment. Due to the economic downturn, the firm considers forgoing these maintenance expenses for the next 3 years. If it does so, it expects it will need to spend $2.1 million in year 4 replacing failed equipment. a. What is the IRR of the decision to forgo maintenance of the equipment? b. Does the IRR rule work for this decision? c. For what costs of capital (COC) is forgoing maintenance a good decision? a. What is the IRR of the decision to forgo maintenance of the equipment? The IRR of the decision is%. (Round to two decimal places.)arrow_forwardPart B: QI Proposal Quantum International (QI) would manufacture, sell and distribute the valves. QI has a long history of success in manufacturing high performance valves. However, Piscataway does not expect them to be as successful in marketing as FPS resulting in lower payments from customers as shown below. In the QI proposal, Piscataway would only have operating cash outflows related to administrative expenses as shown below. Year Cash In-Flow (Payments from Customers) Total Cash Outflow Explain your choice. 1 $3,255 $315 Piscataway would make a payment to QI of QI would receive an annual fee of These payments are not included in the Total Cash Flow above. (i) What required rate of return should Pisctataway use to evaluate the QI proposal? (iii) Should Piscataway choose FPS or QI? 2 $6,610 $580 15% (ii) What would be Piscataway's net operating cash flow if they choose QI? 3 $11,005 $935 $10,000 in Year 0 60% of payments to customers to compensate them for manufacturing and…arrow_forwardAssume a company is going to make an investment of $470,000 in a machine and the following are the cash flows that two different products would bring in years one through four. Option A, Option B, Product A Product B $195,000 $145,000 195,000 175,000 65,000 60,000 25,000 100,000 A. Calculate the payback period of each product. Round your answers to 2 decimal places. Option A, Product A years years Option B, Product B B. Which of the two options would you choose based on the payback method? Ch 11 HW assignment take framearrow_forward

- Don't copy and answer on your own. I will ratearrow_forward(Ignore income taxes in this problem.) Your Company has a telephone system that is in poor condition. The system must be either overhauled or replaced with a new system. The following data have been gathered concerning these two alternatives: Present System Proposed New System Purchase cost when new $100,000 $110,000 Accumulated depreciation 90,000 Overhaul cost needed now 80,000 Working capital required 50,000 Annual cash operating costs 30,000 20,000 Salvage value now of old system 10,000 Salvage value in 8 years 2,000 15,000 Your Company uses a 12% discount rate and the total cost approach to capital budgeting analysis. Both alternatives are expected to have a useful life of eight years. What is the net present value of the new system alternative? Enter your answer without dollar signs. If the NPV is negative enter with a minus sign in front.arrow_forward6. The multiplier effect Consider a hypothetical economy where there are no taxes and no foreign trade, and households spend $0.75 of each additional dollar they earn and save the remaining $0.25. The marginal propensity to consume (MPC) for this economy is 0.75 ; the marginal propensity to save (MPS) for this economy is 0.25 ; and the multiplier for this economy is 4 Suppose investment spending in this economy increases by $100 billion. The increase in investment will lead to an increase in income, generating an increase in consumption that increases income yet again, and so on. Fill in the following table to show the impact of the change in investment spending on the first two rounds of consumption spending and, eventually, on total output and income. Hint: Be sure to enter a negative sign in front of the number if there is a decrease in consumption. Change in Investment Spending = $100 billion First Change in Consumption = billion Second Change in Consumption = 24 billion Total…arrow_forward

- Note: don't use chat gpt.arrow_forwardUse the following information for the Quick Study below. (Algo) [The following information applies to the questions displayed below.] Following is information on an investment in a manufacturing machine. The machine has zero salvage value. The company requires a 6% return from its investments. Initial investment Net cash flows: Year 1 Year 2 Year 3 Year 1 Year 2 Year 3 QS 24-19 (Algo) Net present value with unequal cash flows LO P3 Compute this machine's net present value. (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided. Round all present value factors to 4 decimal places. Round present value amounts to the nearest dollar.) Totals Initial investment Net present value Net Cash Flow $ $ $ (240,000) 195,000 90,000 103,000 388,000 195,000 90,000 103,000 Present Value Factor Present Value of Net Cash Flows $ $ 0 0arrow_forwardA company needs a 33 tonnage refrigeration system. Knowing that a 20 tonnage similar refrigeration system only cost $100,000 15 years ago when the approximate cost index was 150, and that the cost index now is 370. The cost-capacity factor for a refrigeration system is 0.53. 1) estimate the required cost for the 33 tonnage refrigeration system in current year. 2) If borrowing the amount of required money is from a bank in current year and the bank interested rate is 6% per year, find the equivalent value (FW) as a single payment payed back to the bank in 15 years.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education