College Accounting (Book Only): A Career Approach

13th Edition

ISBN: 9781337280570

Author: Scott, Cathy J.

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Question

Answer in step by step with explanation.

Don't use

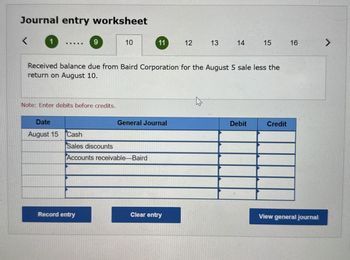

Transcribed Image Text:Journal entry worksheet

<

9

10

11

12

13

14

15

16

Received balance due from Baird Corporation for the August 5 sale less the

return on August 10.

Note: Enter debits before credits.

General Journal

Debit

Credit

Date

August 15

Cash

Sales discounts

Accounts receivable-Baird

Record entry

Clear entry

View general journal

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- A summary of Klugman Company's December 31, 2021. accounts receivable aging schedule is presented below along with the: estimáted percent uncollectible for each age group: Age Group 0-69 days 61-98 days 01 123 days Dver 128 days Amount $55,000 19,500 2,500 1, 000 0.5 1.0 10.0 50.0 The allowance fer uncollectible accounts had a balance of $1,350 on January 1, 20211. During the year, bad debts of $700 were. written of: Required: Prepare all joumal entries for 2021 with respect to bad debts and the aflowance for uncollectible accounts. (f no entry is required fain a transaction/event, select "No journat entry requirEG" in the first account fielld.) w transaCtion ist Journal entry worksheet Record the entry to write-off specific accounts.arrow_forwardOn January 1, 2024, Rick's Pawn Shop leased a truck from Corey Motors for a six-year period with an option to extend the lease for three years. • Rick's had no significant economic incentive as of the beginning of the lease to exercise the three-year extension option. Annual lease payments are $12,000 due on December 31 of each year, calculated by the lessor using a 7% discount rate. . The expected useful life of the asset is nine years, and its fair value is $90,000. . Assume that at the beginning of the third year, January 1, 2026, Rick's had made significant improvements to the truck whose cost could be recovered only if it exercises the extension option, creating an expectation that extension of the lease was "reasonably certain." The relevant interest rate at that time was 8%. Note: Use tables, Excel, or a financial calculator. (FV of $1. PV of $1. FVA of $1. PVA of $1. EVAD of $1 and PVAD of $1) Required: 1. Prepare the journal entry, if any, on January 1 and on December 31 of…arrow_forwardInstructions Journalize the following merchandise transactions. Refer to the chart of accounts for the exact wording of the account itles. CNOW journals do not use ines for jounal explanations. Every Nne on a journal page is used for debit or aredit ents. CNOW journals will automaticaly indent a credit entry when a credit amount s entered. 1 Sold merchandise on account, $94,800 with terms 2/10, n30. The sost.ot the merchandise nold was Mar. $56,900. Received payment les the discount. 13 Issued a $500 oredit memo for damaged merchandise. The customer agreed to keep the merchandisearrow_forward

- Please Make All Relevant Journal Entries Related To Above Transactionsarrow_forwardUNCOLLECTIBLE ACCOUNTSALLOWANCE METHOD Pyle Nurseries used the allowance method to record the following transactions, adjusting entries, and closing entries during the year ended December 31, 20--. REQUIRED 1. Open the three selected general ledger accounts. 2. Enter the transactions and the adjusting and closing entries in a general journal (page 6). After each entry, post to the appropriate selected accounts. 3. Determine the net realizable value as of December 31.arrow_forwardUNCOLLECTIBLE ACCOUNTSALLOWANCE METHOD Lewis Warehouse used the allowance method to record the following transactions, adjusting entries, and closing entries during the year ended December 31, 20--: Selected accounts and beginning balances on January 1, 20--, are as follows: REQUIRED 1. Open the three selected general ledger accounts. 2. Enter the transactions and the adjusting and closing entries in a general journal (page 6). After each entry, post to the appropriate selected accounts. 3. Determine the net realizable value as of December 31, 20--.arrow_forward

- JOURNALIZING SALES RETURNS AND ALLOWANCES Enter the following transactions starting on page 60 of a general journal and post them to the appropriate general ledger and accounts receivable ledger accounts. Use account numbers as shown in the chapter. Beginning balance in Accounts Receivable is 3,900. Beginning balances in selected customer accounts are Adams, 850; Greene, 428; and Phillips, 1,018.arrow_forwardneed help finding the net payment and credit towards account still due invoice amount= $538.42 date of invoice= April 23 Date of payment= May 14 credit terms= 3/10,1/15, n/30 E.O.M Net price= ?arrow_forwardPrepare the entries for transaction below and indicate what journal it is 21 august issued a $600 credit memo to ultracity co. For an allowance on good sold on august 19, 2020arrow_forward

- Journal entry worksheet < 3 4 Record the cost of the sale, $17,400. Note: Enter debits before credits. Transaction General Journal Debit Credit 1-barrow_forwardJournal entry worksheet r 1 2 3 4 5 The goods cost Troy $22,445. Record Troy's entry for this transaction. Note: Enter debits before credits. Date May 11 General Journal Debit Credit Accounts receivable 7 Record entry Clear entry View general journalarrow_forwardJournalizing Purchases Returns and Allowances and Posting to General Ledger and Accounts Payable Ledger Transactions for July and the beginning balances for selected general ledger and accounts payable ledger accounts are shown. July 7 Returned merchandise to Starcraft Industries, $750. 15 Returned merchandise to XYZ, Inc., $530. 27 Returned merchandise to Datamagic, $820. General Ledger Account No. Account Balance July 1, 20-- 202 Accounts Payable $10,640 501.1 Purchases Returns and Allowances Accounts Payable Ledger Name Balance July 1, 20-- Datamagic $2,680 Starcraft Industries 4,310 XYZ, Inc. 3,650 Required: Using page 3 of a general journal and the general ledger accounts and accounts payable ledger accounts, journalize and post the transactions. GENERAL JOURNAL PAGE 3 DATE DESCRIPTION POST. REF. DEBIT CREDIT 20-- Jul. 7 Jul. 15 Jul. 27 GENERAL LEDGER ACCOUNT Accounts Payable ACCOUNT NO. 202 BALANCE DATE ITEM POST. REF. DEBIT CREDIT DEBIT CREDIT 20-- Jul. 1 Balance 10,640.00arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning