College Accounting (Book Only): A Career Approach

12th Edition

ISBN: 9781305084087

Author: Cathy J. Scott

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

please provide answer

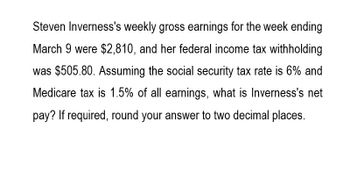

Transcribed Image Text:Steven Inverness's weekly gross earnings for the week ending

March 9 were $2,810, and her federal income tax withholding

was $505.80. Assuming the social security tax rate is 6% and

Medicare tax is 1.5% of all earnings, what is Inverness's net

pay? If required, round your answer to two decimal places.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Steven McFarland's weekly gross earnings for the week ending March 9 were $1,180, and her federal income tax withholding was $212.40. Assuming the social security tax rate is 6% and Medicare tax is 1.5% of all earnings, what is McFarland's net pay? If required, round your answer to two decimal places.arrow_forwardKenneth McFarland's weekly gross earnings for the week ending March 9 were $2,170, and her federal income tax withholding was $390.60. Assuming the social security tax rate is 6% and Mcdicarc tax is 1.5% of all carnings, what is McFarland's net pay? If required, round your answer to two decimal places.arrow_forwardColin Friedman's weekly gross earnings for the week ending March 9 were $710, and her federal income tax withholding was $142.00. Assuming the social security tax rate is 6% and Medicare tax is 1.5% of all earnings, what is Friedman's net pay? If required, round your answer to two decimal places.$arrow_forward

- Steven Washington's weekly gross earnings for the week ending March 9 were $1,490, and her federal income tax withholding was $268.20. Assuming the social security tax rate is 6% and Medicare tax is 1.5% of all earnings, what is Washington's net pay? If required, round your answer to two decimal places.________________arrow_forward.arrow_forwardBaker Green's weekly gross earnings for the week ending December 7 were $3,200, and her federal income tax withholding was $384. Assuming the social security rate is 6.0%, the Medicare rate is 1.5%, and all earnings are subject to FICA taxes, what is Green's net pay? Round your answer to the nearest whole dollar. ?arrow_forward

- Lindsey Vater’s weekly gross earnings for the week ended March 9 were $3,940, and her federal income tax withholding was $709.20. Assuming the social security tax rate is 6% and Medicare tax is 1.5% of all earnings, what is Lindsey's net pay? For interim computations, carry amounts out to two decimal places. Round your final answer to two decimal places.fill in the blank 1 of 1$arrow_forwardBaker Green's weekly gross earnings for the week ending December 7 were $1,800, and her federal income tax withholding was $216. Prior to this week Green had earned $98,000 for the year. Assuming the social security rate is 6.0% and Medicare is 1.5%, what is Green's net pay? Round your answer to the nearest whole dollar.$___________arrow_forwardMarsha Mellow's weekly gross earning for the week ended May 23 were $1,250 and her federal income tax withholding was $204.95. Assuming the social security rate is 6.2% and Medicare if 1.45%, what is Mellow's net pay?arrow_forward

- Calculate FICA Taxes. Please answer question correctly. All calculations should be rounded to two decimal places at each calculation.arrow_forwardCalculate Social Security taxes, Medicare Taxes, and FIT for Jordon Barrett. He earns a monthly salary of $11,500. He is single and claims 1 deduction. Before this payroll, Barrett’s cumulative earnings were $128,080. (Social Security maximum is 6.2% on $128,400 and Medicare is 1.45%.) Calculate FIT by the percentage method. Round your answers to two decimal places. FIT: Social Security Taxes: Medicare taxes:arrow_forwardTodd Hackworth’s weekly gross earnings for the week ending December 18 were $2,000, and his federal income tax withholding was $396.19. Prior to this week, Hackworth had earned $98,500 for the year. Assuming the social security rate is 6% on the first$100,000 of annual earnings and Medicare is 1.5% of all earnings, what is Hackworth’s net pay?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub