Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

please help/@2 hw3&4

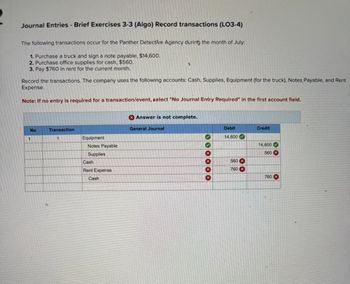

Transcribed Image Text:Journal Entries - Brief Exercises 3-3 (Algo) Record transactions (LO3-4)

The following transactions occur for the Panther Detective Agency during the month of July:

1. Purchase a truck and sign a note payable, $14,600.

2. Purchase office supplies for cash, $560.

3. Pay $760 in rent for the current month.

Record the transactions. The company uses the following accounts: Cash, Supplies, Equipment (for the truck), Notes, Payable, and Rent

Expense.

Note: If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.

No

Transaction

1

1

Equipment

Notes Payable

Supplies

Cash

Rent Expense

Cash

Answer is not complete.

General Journal

*

X X X X 10

Debit

Credit

14,600

14,600

560

560x

760 x

760 x

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Tasks 8-9. Application. Prepare the journal entries of the transaction below and post them to the necessary ledger books. Write your answer on a separate sheet of paper. Olson Sala Company completed the following sales transactions during the month of June 2015. All credit sales have terms of 3/10, n/30 and all invoices are dated as at the transaction date. June 1 Olson Sala invested Php 52,000 of his funds in the business. 1 Sold merchandise on account to R. Bituin, Php 32,000. Invoice no. 377 Sold merchandise on account to A. Perdales, Php 54,000. Invoice no. 378 3 4 Sold merchandise for cash, Php 46,000. 7. Received payment from R. Bltuin less discounts. Received payment from A. Perdales less discounts. 9. Required: 1. Record the transactions in the general journal. 2. Post to the accounts receivable ledger. 3. Prepare a schedule of accounts receivable.arrow_forwardThe transactions completed by Revere Courier Company during December, the first month of the fiscal year, were as follows: Dec. 1. Issued Check No. 610 for December rent, $4,200. Dec. 2. Issued Invoice No. 940 to Clifford Co., $1,740 Dec. 3. Received check for $4,800 from Ryan Co. in payment of account. Dec. 5. Purchased a vehicle on account from Platinum Motors, $37,300. Dec. 6. Purchased office equipment on account from Austin Computer Co., $4,500. Dec. 6. Issued Invoice No. 941 to Ernesto Co., $3,870. Dec. 9. Issued Check No. 611 for fuel expense, $600. Dec. 10. Received check from Sing Co. in payment of $4,040 invoice. Dec. 10. Issued Check No. 612 for $330 to Office To Go Inc. in payment of invoice. Dec. 10. Issued Invoice No. 942 to Joy Co., $1,970. Dec. 11. Issued Check No. 613 for $3,090 to Essential Supply Co. in payment of account. Dec. 11. Issued Check No. 614 for $500 to Porter Co. in payment of account. Dec. 12. Received…arrow_forwardProvide the journal entries needed.arrow_forward

- The transactions completed by Fleetfoot Courier Company during December, the first month of the fiscal year, were as follows: Dec. 1. Issued Check No. 610 for December rent, $5,260. 2. Issued Invoice No. 940 to Clifford Co., $2,180. 3. Received check for $6,010 from Ryan Co. in payment of account. 5. Purchased a vehicle on account from Platinum Motors, $46,700. 6. Purchased office equipment on account from Austin Computer Co., $5,630. 6. Issued Invoice No. 941 to Ernesto Co., $4,850. 9. Issued Check No. 611 for fuel expense, $750. 10. Received check from Sing Co. in payment of $5,060 invoice. Issued Check No. 612 for $410 to Office To Go Inc. in payment of 10. Invoice. 10. Issued Invoice No. 942 to Joy Co., $2,470. Issued Check No. 613 for $3,870 to Essential Supply Co. in payment of 11. account. 11. Issued Check No. 614 for $630 to Porter Co. in payment of account. Received check from Clifford Co. in payment of $2,180 invoice of 12. December 2. Issued Check No. 615 to Platinum Motors…arrow_forwardA company's Cash account shows a balance of $3,460 at the end of the month. Comparing the company's Cash account with the monthly bank statement reveals several additional cash transactions such as bank service fees ($50), an NSF check from a customer ($370), a customer's note receivable collected by the bank ($1,600), and interest earned ($130). Required: Record the necessary entry(ies) to adjust the company's balance for cash. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet Record the items that increase cash. 2 Note: Enter debits before credits. Transaction Record entry General Journal Clear entry Debit Credit View general Journalarrow_forwardRequirement 2:Prepare the journal entries for the above transactions. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)Requirement 1: a. Accounts Receivable had a balance of $1,320 at the beginning of the month and $990 at the end of the month. Credit sales totaled $13,200 during the month. Calculate the cash collected from customers during the month, assuming that all sales were made on account. b. The Supplies account had a balance of $594 at the beginning of the month and $803 at the end of the month. The cost of supplies used during the month was $2,574. Calculate the cost of supplies purchased during the month. c. Wages Payable had a balance of $451 at the beginning of the month. During the month, $4,180 of wages were paid to employees. Wages Expense accrued during the month totaled $4,510. Calculate the balance of Wages Payable at the end of the month. General Journal entriesarrow_forward

- Expert need your helparrow_forwardPrepare journal entries for the following transactions, using the accounts in the order listed: PLEASE NOTE: For similar accounting treatment (DR or CR), you are to record accounts in the order in which they are mentioned in the transactions. On June 1, Kellie Company had decided to initiate a petty cash fund in the amount of $1,200. DR CR On June 5, the petty cash fund needed replenishment, and the following are the receipts: Auto Expense $125, Supplies $368, Postage Expense $325, Repairs and Maintenance Expense $99, Miscellaneous Expense $259. The cash on hand at this time was $38. DR DR DR DR DR DR or CR? CR On June 14, the petty cash fund needed replenishment, and the following are the receipts: Auto Expense $425, Supplies $95, Postage Expense $240, Repairs and Maintenance Expense $299, Miscellaneous Expense $77. The cash on hand at this time was $80. DR DR DR DR DR DR or CR?…arrow_forwardHappy Tails Inc. has a September 1, 20Y4, accounts payable balance of 620, which consists of 320 due Labradore Inc. and 300 due Meow Mart Inc. Transactions related to purchases and cash payments completed by Happy Tails Inc. during the month of September 20Y4 are as follows: a. Prepare a purchases journal and a cash payments journal to record these transactions. The forms of the journals are similar to those used in the text. Place a check mark () in the Post. Ref. column to indicate when the accounts payable subsidiary ledger should be posted. Happy Tails Inc. uses the following accounts: b. Prepare a listing of accounts payable creditor balances on September 30, 20Y4. Verify that the total of the accounts payable creditor balances equals the balance of the accounts payable controlling account on September 30, 20Y4. c. Why does Happy Tails Inc. use a subsidiary ledger for accounts payable?arrow_forward

- Your company paid rent of $1,000 for the month with check number 1245. Which journal would the company use to record this? A. sales journal B. purchases journal C. cash receipts journal D. cash disbursements journal E. general journalarrow_forwardThe transactions completed by AM Express Company during March, the first month of the fiscal year, were as follows: Instructions 1. Enter the following account balances in the general ledger as of March 1: 2. Journalize the transactions for March, using the following journals similar to those illustrated in this chapter: single-column revenue journal (p. 35), cash receipts journal (p. 31), purchases journal (p. 37, with columns for Accounts Payable, Maintenance Supplies, Office Supplies, and Other Accounts), cash payments journal (p. 34), and twocolumn general journal (p. 1). Assume that the daily postings to the individual accounts in the accounts payable subsidiary ledger and the accounts receivable subsidiary ledger have been made. 3. Post the appropriate individual entries to the general ledger. 4. Total each of the columns of the special journals and post the appropriate totals to the general ledger; insert the account balances. 5. Prepare a trial balance.arrow_forwardDuring the month of October 20--, The Pink Petal flower shop engaged in the following transactions: Selected account balances as of October 1 were as follows: The Pink Petal also had the following subsidiary ledger balances as of October 1: REQUIRED 1. Record the transactions in a sales journal (page 7), cash receipts journal (page 10), purchases journal (page 6), cash payments journal (page 11), and general journal (page 5). Total, verify, and rule the columns where appropriate at the end of the month. 2. Post from the journals to the general ledger, accounts receivable ledger, and accounts payable ledger accounts. Use account numbers as shown in the chapter.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax CollegeCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning