Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

None

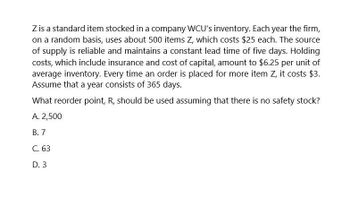

Transcribed Image Text:Z is a standard item stocked in a company WCU's inventory. Each year the firm,

on a random basis, uses about 500 items Z, which costs $25 each. The source

of supply is reliable and maintains a constant lead time of five days. Holding

costs, which include insurance and cost of capital, amount to $6.25 per unit of

average inventory. Every time an order is placed for more item Z, it costs $3.

Assume that a year consists of 365 days.

What reorder point, R, should be used assuming that there is no safety stock?

A. 2,500

B. 7

C. 63

D. 3

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- ?!arrow_forwardZ is a standard item stocked in a company WCU's inventory. Each year the firm, on a random basis, uses about 500 items Z, which costs $25 each. The source of supply is reliable and maintains a constant lead time of five days. Holding costs, which include insurance and cost of capital, amount to $6.25 per unit of average inventory. Every time an order is placed for more item Z, it costs $3. Assume that a year consists of 365 days. What is the economic order quantity? A. 3 B. 46 C. 63 D. 22 solve this financial accounting problemarrow_forwardZ is a standard item stocked in a company WCU's inventory. Each year the firm, on a random basis, uses about 500 items Z, which costs $25 each. The source of supply is reliable and maintains a constant lead time of five days. Holding costs, which include insurance and cost of capital, amount to $6.25 per unit of average inventory. Every time an order is placed for more item Z, it costs $3. Assume that a year consists of 365 days. What is the economic order quantity? A. 3 B. 46 C. 63 D. 22 need answerarrow_forward

- What is the economic order quantityarrow_forwardA CARDBOARD BOX FACTORY pays its suppliers 40 days after making the purchase and receiving the goods. The average collection period is 45 days, i.e. its customers settle their debt with the company in that time; and the average inventory age is based on the inventory turnover which is 10 times a year. The company spends about $1.23 million in operating cycle investments. With this data we need to calculate: The operating cycle.The cash conversion cycle.The cash turnover.The minimum cash balance.You plan to make modifications to your policies so that you can decrease your PPC by 10 days, and decrease your EPI by 2 times (before converting it to days). Negotiations with your supplier have been unsuccessful and the payment term has been reduced by 10 days. With these data you have to calculate: Re-calculate the Operating Cycle, the SCC, RC and SMC introducing the proposed changes.Calculate the opportunity cost that the changes will cause, if the company's interest rate is 8%.arrow_forwardCan you explain the process for solving this financial accounting question accurately?arrow_forward

- A local bakery sells 12,000 loaves of sourdough bread each year. The loaves are ordered from an outside supplier, and it takes 4 days for each shipment of loaves to arrive. Ordering costs are estimated at $18 per order. Carrying costs are $6 per loaf per year. Assume that the bakery is open 300 days a year. What is the maximum inventory of loaves held in a given ordering cycle? a. 180.02 b. 362.07 c. 268.33 d. 152.98arrow_forwardA local bakery sells 12,000 loaves of sourdough bread each year. The loaves are ordered from an outside supplier, and it takes 4 days for each shipment of loaves to arrive. Ordering costs are estimated at $18 per order. Carrying costs are $6 per loaf per year. Assume that the bakery is open 300 days a year. What is the maximum inventory of loaves held in a given ordering cycle? Solutionarrow_forwardWhat is the maximum inventory of croissants held in a given ordering cycle of this financial accounting question?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning