Managerial Accounting

15th Edition

ISBN: 9781337912020

Author: Carl Warren, Ph.d. Cma William B. Tayler

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Question

Using the p/e multiples approach solve this question

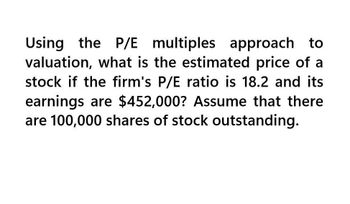

Transcribed Image Text:Using the P/E multiples approach to

valuation, what is the estimated price of a

stock if the firm's P/E ratio is 18.2 and its

earnings are $452,000? Assume that there

are 100,000 shares of stock outstanding.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Using the P/E multiples approach to valuation, What is the estimated price of a stock if the firm’s P/E ratio is 18.2 and it’s earnings are $452,000? Assume that there are 100,000 shares of stock outstanding.arrow_forwardAssume that you are a consultant to Broske Inc., and you have been provided with the following data: D1 = $0.67 P0 = $27.50; g = 8.00% (constant). Float on new issues is 5% of market price. What is the cost of issuing common stock?arrow_forwardThe stock of North American Dandruff Company is currently selling at $50 per share. The firm pays a dividend of $2.50 per share. a. What is the dividend yield? b. If the firm has a payout rate of 50 percent, what is the firms P/E ratio? If the components of the price/earnings ratio are inverted, the resulting percentage is referred to as which of the following? a. Book value per share. b. Dividend yield ratio. e. Capitalization rate. d. Multiple. Vivi Corporation had a net income of $401,000 in 2015. The company's Common Stock account balance all year long was $267,000 ($10 par stock). The market price per share as of December 31, 2015, was $33.50. Calculate the price-earnings ratio for 2015.arrow_forward

- North Side Corp’s dividends for year 1, year 2, year 3, and expected share price for year 3 are: D1=$1.95, D2=$2.10, D3=$2.18, and P3=$95 respectively. What is the company’s current share price given the required return of 8 percent?arrow_forwardProvide answerarrow_forwardplease see attatched filearrow_forward

- Provide correct answerarrow_forwardUsing the equity asset valuation model (CAPM) equation, determine the required return for the shares of the following companies, if the market return is 7.50% (Rm = 7.50%) and the risk-free asset return is 1.25% (RF = 1.25%). You must show all counts. Stock Beta SKT 0.65 COST 0.90 SU 1.42 AMZN 1.57 V 0.94arrow_forwardAssume that a firm can issue preferred stock that has a $70 par value and pays a 15.0% annual dividend each year. The firm's investment bankers believe that investors will be willing to pay $84.00 per share and that flotation costs will be equal to $8.45 per share. Given this information, determine the difference between the investor's required rate of return, and the firm's cost of preferred stock. O 1.969%. O 1.398% O 1.683% O 2.541% O 2.224%arrow_forward

- The stock of Pills Berry Company is currently selling at $60 per share. The firm pays a dividend of $2.25 per share. a. What is the annual dividend yield? (Do not round intermediate calculations. Input your answer as a percent rounded to 2 decimal places.) Dividend yield b. If the firm has a payout rate of 50 percent, what is the firm's P/E ratio? (Do not round intermediate calculations and round your answer to 2 decimal places.) P/E ratio times < Prev 5 of 10 Next SERIESarrow_forwardPlease answer question belowarrow_forwardThe market capitalization rate on the stock of Aberdeen Wholesale Company is 14%. Its expected ROE is 15%, and its expected EPS is $6. If the firm's plowback ratio is 60%. Calculate its P/E ratio.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning