Survey of Accounting (Accounting I)

8th Edition

ISBN: 9781305961883

Author: Carl Warren

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Please answer do fast and correct calculation of these general accounting question

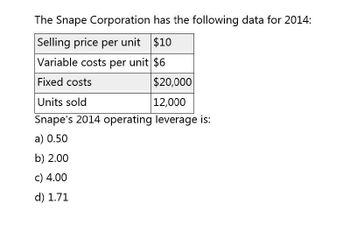

Transcribed Image Text:The Snape Corporation has the following data for 2014:

Selling price per unit $10

Variable costs per unit $6

Fixed costs

Units sold

$20,000

12,000

Snape's 2014 operating leverage is:

a) 0.50

b) 2.00

c) 4.00

d) 1.71

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Snape's operating leverage is?arrow_forwardThe Snape Corporation has the following data for 2014: Selling price per unit $10 Variable costs per unit $6 Fixed costs Units sold $20,000 12,000 Snape's 2014 operating leverage is: a) 0.50 b) 2.00 c) 4.00 d) 1.71arrow_forwardcorrect options is accountingarrow_forward

- The X Corp income statement resembles the following after 35,000 units were sold in 2020. Sales = $420,000 / $12 per unit Variable = $192,500 / $5.5 per unit Contribution Margin = $227,500 / $6.5 per unit Fixed Expense $110,000 Net Op Income $117,500 A. What is X Corp. breakeven point in units and dollars? B. What is X Corp. margin of safety in %, units, and dollars?arrow_forwardPlease Solve this Questionarrow_forwardWaht is the correct option? General accounting questionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College