FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

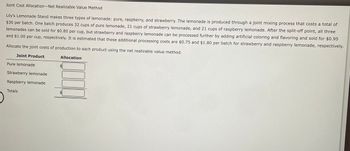

Transcribed Image Text:Joint Cost Allocation-Net Realizable Value Method

Lily's Lemonade Stand makes three types of lemonade: pure, raspberry, and strawberry. The lemonade is produced through a joint mixing process that costs a total of

$30 per batch. One batch produces 32 cups of pure lemonade, 21 cups of strawberry lemonade, and 21 cups of raspberry lemonade. After the split-off point, all three

lemonades can be sold for $0.80 per cup, but strawberry and raspberry lemonade can be processed further by adding artificial coloring and flavoring and sold for $0.95

and $1.00 per cup, respectively. It is estimated that these additional processing costs are $0.75 and $1.80 per batch for strawberry and raspberry lemonade, respectively.

Allocate the joint costs of production to each product using the net realizable value method.

Joint Product

Pure lemonade

Strawberry lemonade

Raspberry lemonade

Totals

Allocation

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Net realizable value method. Sweeney Comapny is one of the world’s leading corn refiners. It produces two joint products –corn syrup and corn starch- using a common production process. In July 2017, Sweeney reported the following production and selling-price information:arrow_forwardPowerTrain Sports Inc. manufactures and sells two styles of All Terrain Vehicles (ATVs), the Mountain Monster and Desert Dragon, from a single manufacturing facility. The manufacturing facility operates at 100% of capacity. The following per-unit information is available for the two products: 1 Mountain Monster Desert Dragon 2 Sales price $5,200.00 $5,300.00 3 Variable cost of goods sold 3,240.00 3,450.00 4 Manufacturing margin $1,960.00 $1,850.00 5 Variable selling expenses 712.00 1,108.00 6 Contribution margin $1,248.00 $742.00 7 Fixed expenses 470.00 320.00 8 Income from operations $778.00 $422.00 In addition, the following sales unit volume information for the period is as follows: Mountain Monster Desert Dragon Sales unit volume 4,800 4,650 Required: a. Prepare a contribution margin by product report. Calculate the contribution margin ratio for each.…arrow_forwardMichael Brown manufactures and sells homemade wine, and he wants to develop a standard cost per litre. The following are required for production of a 300-litre batch: 90.00 litres of grape concentrate at $1.40 per litre 40.50 kg of granulated sugar at $0.60 per kilogram 87.00 lemons at $0.60 each 72.00 yeast tablets at $0.25 each 69.00 nutrient tablets at $0.20 each 112.50 litres of water at $0.10 per litre Michael estimates that 4% of the grape concentrate is wasted, 10% of the sugar is lost, and 20% of the lemons cannot be used. Calculate the standard cost of the ingredients for one litre of wine. (Round intermediate calculations and final answer to 3 decimal places, e.g. 1.251.) Standard cost of the ingredients for one litre of wine $arrow_forward

- Scoring: Your score will be based on the number of correct matches. There is no penalty for incorrect or missing matches. Match each of the following costs of producing T-shirts with the appropriate classification. Clear All Ink used for screen printing Warehouse rent of $8,000 per month plus $0.50 per square foot of storage used Thread Electricity costs of $0.038 per kilowatt-hour Janitorial costs of $4,000 per month Fixed cost Variable cost Mixed costarrow_forwardNonearrow_forwardDetermining the Optimal Product Mix with One Constrained Resource and a Sales Constraint Casual Essentials, Inc. manufactures two types of team shirts, the Homerun and the Goalpost, with unit contribution margins of $5 and $15, respectively. Regardless of type, each team shirts must be fed through a stitching machine to affix the appropriate team logo. The firm leases seven machines that each provides 1,000 hours of machine time per year. Each Homerun shirt requires 6 minutes of machine time, and each Goalpost shirt requires 30 minutes of machine time. Assume that a maximum of 49,830 units of each team shirts can be sold. Required: If required, round your answers to the nearest whole number. 1. What is the contribution margin per hour of machine time for each type of team shirts? Contribution Margin Homerun $fill in the blank 1 Goalpost $fill in the blank 2 2. What is the optimal mix of team shirts? Optimal Mix Homerun fill in the blank 3 units Goalpost fill in…arrow_forward

- Sibling Furniture Company manufactures and sells oak tables and chairs. Price and cost data for the furniture follow: (Click the icon to view the price and cost data.) Sibling Furniture has three sales representatives: Ansley, Bryce, and Camara. Ansley sold 110 tables with 4 chairs each. Bryce sold 70 tables with 6 chairs each. Camara sold 100 tables with 8 chairs each Read the requirements. Data table Calculate the total contribution margin for each sales representative. Sales representative: Ansley Bryce Camara Net sales revenue Tables Variable costs Chairs 1,300 $ 780 130 90 18 Contribution margin 9 Now calculate the contribution margin ratio for each sales representative. (Round to two decimal places-the nearest hundred Contribution margin ratio 8:49 PM S 5/20/2022 ? * IDI 16 7 L A @ 2 W S W 3 JL E $ V 4 R F 75 % 5 T G 40 6 Y C- & I 7 hp U 8 J to 144 9 K Sales Price Variable manufacturing costs Sales commission (10%) Print 11 ) () TW A4 P $ Done ENG [ 4 D 1 backspacearrow_forwardDinesharrow_forwardJoint-cost allocation. SW Flour Company buys 1 input of standard flour and refines it using a special sifting process to 3 cups of baking flour and 9 cups of bread flour. In May 2017, SW bought 12,000 inputs of flour for $89,000. SW spent another $47,800 on the special sifting process. The baking flour can be sold for $3.60 per cup and the bread flour for $4.80 per cup. SW puts the baking flour through a second process so it is super fine. This costs an additional $1.00 per cup of baking flour and the process yields ½ cup of super-fine baking flour for every one cup of baking flour used. The super-fine baking flour sells for $9.60 per cup. SW Flour Company has decided that their bread flour may sell better if it was marketed for gourmet baking and sold with infused spices. This would involve additional cost for the spices of $0.80 per cup. Each cup could be sold for $5.50. Q.If SW uses the physical-measure method, what combination of products should SW sell to maximize profits?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education