FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:secret-

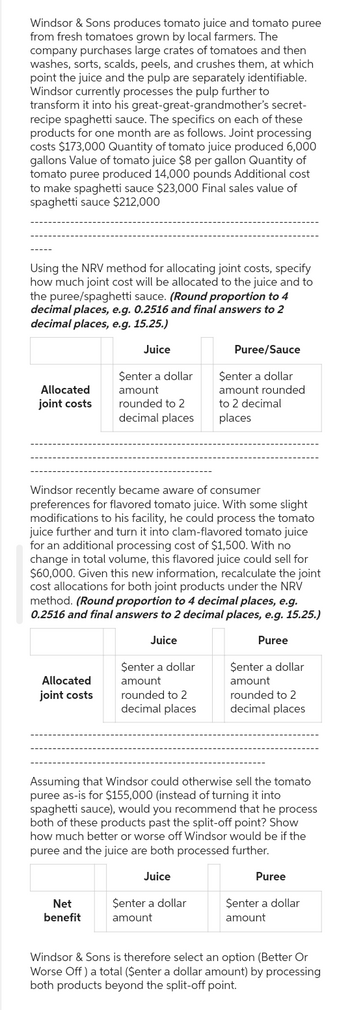

Windsor & Sons produces tomato juice and tomato puree

from fresh tomatoes grown by local farmers. The

company purchases large crates of tomatoes and then

washes, sorts, scalds, peels, and crushes them, at which

point the juice and the pulp are separately identifiable.

Windsor currently processes the pulp further to

transform it into his great-great-grandmother's

recipe spaghetti sauce. The specifics on each of these

products for one month are as follows. Joint processing

costs $173,000 Quantity of tomato juice produced 6,000

gallons Value of tomato juice $8 per gallon Quantity of

tomato puree produced 14,000 pounds Additional cost

to make spaghetti sauce $23,000 Final sales value of

spaghetti sauce $212,000

Using the NRV method for allocating joint costs, specify

how much joint cost will be allocated to the juice and to

the puree/spaghetti sauce. (Round proportion to 4

decimal places, e.g. 0.2516 and final answers to 2

decimal places, e.g. 15.25.)

Juice

Allocated

joint costs

Allocated

joint costs

$enter a dollar

amount

rounded to 2

decimal places

Windsor recently became aware of consumer

preferences for flavored tomato juice. With some slight

modifications to his facility, he could process the tomato

juice further and turn it into clam-flavored tomato juice

for an additional processing cost of $1,500. With no

change in total volume, this flavored juice could sell for

$60,000. Given this new information, recalculate the joint

cost allocations for both joint products under the NRV

method. (Round proportion to 4 decimal places, e.g.

0.2516 and final answers to 2 decimal places, e.g. 15.25.)

Juice

Puree

Net

benefit

$enter a dollar

amount

rounded to 2

decimal places

Puree/Sauce

$enter a dollar

amount rounded

to 2 decimal

places

Senter a dollar

amount

Assuming that Windsor could otherwise sell the tomato

puree as-is for $155,000 (instead of turning it into

spaghetti sauce), would you recommend that he process

both of these products past the split-off point? Show

how much better or worse off Windsor would be if the

puree and the juice are both processed further.

Juice

$enter a dollar

amount

rounded to 2

decimal places

Puree

Senter a dollar

amount

Windsor & Sons is therefore select an option (Better Or

Worse Off) a total ($enter a dollar amount) by processing

both products beyond the split-off point.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Which one of the following is not an assumption of CVP analysis? The behavior of costs and revenues are linear within the relevant range. Sales mix remains constant. All units produced are sold. All costs are variable costs.arrow_forwardYou have been asked to decide about one of two mutually exclusive alternatives (A & B). The following table gives the initial costs, annual savings in labor costs, and the expected life of two pieces of equipment. Plot PW vs. i for each equipment on the same graph and identify the AAIRR from the graph (i for the intersection). Then, highlight the corresponding value of i in yellow in your spreadsheet. High-cost Equipment (A) Low-cost Equipment (B) Initial Cost $137,910 $100,000 Savings in Labor Costs $42,000 / year $32,000 / year Life 5 years 5 yearsarrow_forwardAwla Ltd. sells two products as follows: Product A Product B Units sold 2,625 3,500 Selling price per unit $400 $350 Variable costs per unit $160 $210 The company has the following fixed costs: Product A, $590,000, Product B, $883,200, and common fixed costs of $293,200.arrow_forward

- Hi, I also need help finding the highest acceptable transfer price and the lowest acceptable transfer price. Thanksarrow_forwardAllocating a transaction price to multiple performance obligations includes which of the following steps: O Complete each performance obligation before recognizing any revenue from the contract. O All of these choices are correct. O Consolidate the components of the contract to two performance obligations because a contract should not have more than two performance obligations. O Allocate the transaction price based on relative fair values.The best measure of fair value is what the good or service could be sold for on a standalone basis (standalone selling price).arrow_forwardSelect Among the choices, this transfer prices basis is considered as the most inferior one: a. variable cost transfer pice b. full cost transfer price c. negotiatied transfer price d. external market transfer price e. dual transfer pricearrow_forward

- Q. 8 Which following costs need to be considered for both make or buy options? O. Fixed overhead O. Variable overhead O. Rental revenue Q. 9 What is the per unit cost to purchase from the vendor? Round to the nearest penny. Q. 10 Based on your analysis, the CreativeStationary Co. should make the product in-house or buy them from the vender? O. Make O. Buy Do (Q8,9,10 plz)arrow_forwardREQUIRED Use the information provided below to answer the following questions: 3.1. Calculate the Payback period for the HMC. 3.2. Calculate the Net Present Value for both the HMC and VMC. 3.3. Calculate the Internal Rate of Return (IRR) for the HMC and VMC. 3.4. Which configuration of the CNC machining centres should SMT purchase, if any? Motivate your answer by referring to the answers obtained in questions 3.3 and 3.4. INFORMATION Southern Manufacturing Tools Limited (SMT) is considering the purchase of a Computer Numerical Control (CNC) machining centre for its operations. Two configurations of the CNC machining centres are available: horizontal CNC machining centre (HMC) and vertical CNC machining centre (VMC). Both the HMC and VMC will require an initial investment of R10 000 000, will have a useful life of 7 years and a residual value of R1 500 000. SMT uses the straight-line method of depreciation. The expected net cash inflows of the VMC are expected to be R2 100 000…arrow_forwardIn which scenario would an adjusted sales value be used to assign costs? a. If abnormal losses occur during production of joint products b. If a joint product is to be processed further after the point of separation c. If one of the joint products has negligible market value d. If joint products are separately identifiable before split-off pointarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education