Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

I want to correct answer general accounting question

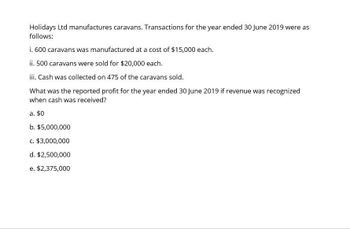

Transcribed Image Text:Holidays Ltd manufactures caravans. Transactions for the year ended 30 June 2019 were as

follows:

i. 600 caravans was manufactured at a cost of $15,000 each.

ii. 500 caravans were sold for $20,000 each.

iii. Cash was collected on 475 of the caravans sold.

What was the reported profit for the year ended 30 June 2019 if revenue was recognized

when cash was received?

a. $0

b. $5,000,000

c. $3,000,000

d. $2,500,000

e. $2,375,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Shelcal, Inc. provides the following data for the year 2019: Net Sales Revenue, $437,690; Cost of Goods Sold, $255,000. O The gross profit as a percentage of net sales is (Round your answer to two decimal places.) OA) 37.96% OB) 39.80% OC) 60.20% OD) 40.8%arrow_forwardCompute the compony gross profit percentage for 2019.arrow_forwardPresented below is information for Ayayai Company for the month of March 2020. Cost of goods sold $212,100 Rent expense $30,100 Freight-out 6,010 Sales discounts 7,010 Insurance expense 5,100 Sales returns and allowances 12,010 Salaries and wages expense 55,100 Sales revenue 385,000 Compute the gross profit rate. (Round answer to 2 decimal places, e.g. 25.20%.) Gross profit rate Enter the gross profit rate in percentages %arrow_forward

- Accurate Value Hardware began in 2019 with a credit balance of $47,000 in the allowance for sales returns account. Sales and cash collections from customers during the year were $663,000 and $615,000, respectively. Accurate Value estimates that 7.2% of all sales will be returned. In 2019, customers returned merchandise for a credit of $36,000 to their accounts. Accurate Value's 2019 income statement would report net sales of__.arrow_forwardCompany X reports $200,000 in sales of Widgets in 2019. The Costs of Goods sold for these Widgets is $90,000. All other operating expenses (SG&A, R&D, Depreciation, Other, etc.) are $50,000. Which of the following is the correct representation of the profitability ratios: Gross Profit Margin 45%, Operating Margin 30%. Gross Profit Margin 55%, Operating Margin 30%. Gross Profit Margin 45%, Operating Margin 20%. Gross Profit Margin 55%, Operating Margin 20%.arrow_forwardNet Sales of ___.arrow_forward

- Get balance sheet as of december 2021 and income statement for the yeararrow_forwardPlease provide answer as per possible fastarrow_forwardTauros Company’s usual sales terms are net 60 days, FOB Shipping point. Sales, net of returns and allowances, totaled P2,300,000 for the year ended December 31, 2022, before year-end adjustments. Additional data are as follows: · On December 27, 2022, Taurus authorized a customer to return, for full credit, goods shipped and billed at P50,000 on December 15, 2022. The returned goods were received by Taurus on January 4, 2023, and a P50,000 credit memo was issued and recorded on the same date. · Goods with an invoice amount of P80,000 were billed and recorded on January 3, 2023. The goods were shipped on December 30, 2022. · Goods with an invoice amount of P100,000 were billed and recorded on December 30, 2022. The goods were shipped on January 3, 2023. The adjusted net sales for 2022 should be? a. 2,300,000b. 2,250,000c. 2,230,000d. 2,070,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College