FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Answer? ? General Accounting

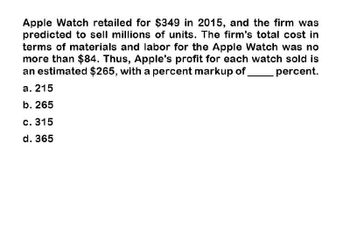

Transcribed Image Text:Apple Watch retailed for $349 in 2015, and the firm was

predicted to sell millions of units. The firm's total cost in

terms of materials and labor for the Apple Watch was no

more than $84. Thus, Apple's profit for each watch sold is

an estimated $265, with a percent markup of

a. 215

b. 265

percent.

c. 315

d. 365

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- In 2012, Grant Co. sold 160,000 units of its product at a selling price of $40. The variable cost per unit was $30, and Grant reported net income for the year of $200,000. What was the amount of Grant's fixed costs for the year?arrow_forwardIn March 2012, the second year of production, the cost of producing an iPad 2 fell to an estimated $249.41. What markup percentage would Apple need to use to maintain its $620.00 sales price? (Round answer to 1 decimal place, e.g. 25.2%.) The gross margin in the previous question was 59% Markup percentagarrow_forward.Kipling Company has sales of $1,500,000 for the first quarter of 2016. In making the sales, the company incurred the following costs and expenses. Variable Fixed Product costs $500,000 $550,000 Selling expenses 100,000 75,000 Administrative expenses 80,000 67,000 Instructions Calculate net income under CVP for 2016.arrow_forward

- Maple Enterprises sells a single product with a selling price of $94 and variable costs per unit of $32. The company’s monthly fixed expenses are $15,846. What dollar sales will Maple need in order to reach a target profit of $22,657? Round to the nearest whole dollar, no decimals.arrow_forwardIn 2018, Samantha's Bath and Body Shop had variable costs of $27,000, fixed costs of $18,000, and a net loss of $4,500.Samantha's 2018 break-even sales volume was a.$49,500. b.$37,500. c.$36,000. d.$54,000.arrow_forwardDuring 20Y5, Jackson Computer Supply produced income from operations of $95,000 from sales of 80,000 units at $2.50 each. The company's fixed costs totaled $22,000. If the company has a 4,000 increase in sales units in the upcoming year, what will income from operations be for 20Y6? Assume that fixed costs and the selling price and variable cost per unit will remain the same.arrow_forward

- Crane Corporation sells a single product for $40. Its management estimates the following revenues and costs for the year 2022: Net sales Direct materials Direct labour Manufacturing overhead-variable Manufacturing overhead-fixed (a) Monthly break-even in units Monthly break-even in dollars Assuming fixed costs and net sales are spread evenly throughout the year, determine Crane's monthly break-even point in units and dollars. (Round answers to O decimal places, e.g. 5,275.) eTextbook and Media Save for Later $410,000 73,800 49,200 Administrative expenses-variable 16,400 Administrative expenses-fixed 24,600 $ Selling expenses-variable Selling expenses-fixed $16,400 16,400 8,200 8,200 units Attempts: 0 of 3 used Submit Answer (b) The parts of this question must be completed in order. This part will be available when you complete the part above.arrow_forwardThe Titan Company provides you with the following information for the current year: Revenues = $2,000,000Cost of goods sold = $750,000 (2/3 of this amount varies with the number of units produced)S&A costs = $200,000 (1/2 of this amount is fixed)Selling price = $40 per unit The company sold 50,000 units of their product in the current year. The company expects unit sales of their product to increase 20% in the next year. Based on the information above, what would be the expected increase to profit before taxes in the coming year?arrow_forwardSunland Corporation sells a product for $175 per unit. The product's current sales are 41,900 units and its break-even sales are 34,155 units. What is the margin of safety in dollars?arrow_forward

- Legrand Company produces hand cream. In 2018, their financial information is as follows:Each jar sells for: $3.40Total variable cost (materials, labor, and overhead) per jar: $2.55Total fixed cost: $58,140Total jars sold in 2018: 81,6001. Calculate the break-even point in units for Legrand?arrow_forwardTumble company sells coats for $149.17 each. The variable costs per coat are $63.95 and the fixed costs per month are $46817. How many coats must be sold to make a profit of 5380 in a month? Round to the next whole numberarrow_forwardSunshine Company’s single product has a selling price of P25 per unit. Last year the company reported a profit of P20,000 and variable expenses totaling P180,000. The product has a 40% contribution ratio. Because of competition, Sunshine Company will be forced in the current year to reduce its selling price by P2 per unit. How many units must be sold in the current year to earn the same profit as was earned last year? (Hint: Prepare last year’s income statement, then, prepare the current year using the new price) 15,000 units 12,000 units 16,500 units 12,960 units Group of answer choices 1 2 3 4arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education