Auditing: A Risk Based-Approach (MindTap Course List)

11th Edition

ISBN: 9781337619455

Author: Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Provide correct answer general accounting

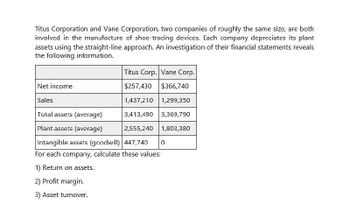

Transcribed Image Text:Titus Corporation and Vane Corporation, two companies of roughly the same size, are both

involved in the manufacture of shoe-tracing devices. Each company depreciates its plant

assets using the straight-line approach. An investigation of their financial statements reveals

the following information.

Titus Corp. Vane Corp.

$366,740

Net income

$257,430

Sales

1,437,210 1,299,350

Total assets (average)

3,413,490 3,369,790

Plant assets (average)

2,555,240 1,803,380

0

Intangible assets (goodwill) 447,740

For each company, calculate these values:

1) Return on assets.

2) Profit margin.

3) Asset turnover.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Indigo Corporation and Blue Corporation, two companies of roughly the same size, are both involved in the manufacture of shoe-tracing devices. Each company depreciates its plant assets using the straight-line approach. An investigation of their financial statements reveals the information shown below. For each company, calculate these values: 1) Return on assets 2) Profit margin 3) Asset turnoverarrow_forwardCrane Mart and Cullumber Shop are two companies of roughly the same size both running a chain of convenience stores. Each company depreciates its plant assets using the straight-line method. An investigation of their financial statements reveals the following information: CraneMart CullumberShop Net income $ 164,052 $ 166,020 Sales revenue 1,121,400 1,386,000 Total assets (average) 5,468,400 6,917,400 Plant assets (average) 2,079,000 2,394,000 For each company, calculate: (Round answers to 2 decimal places, e.g. 52.75.) CraneMart CullumberShop A. Return on assets B. Asset turnoverarrow_forwardRequired Information [The following information applies to the questions displayed below] In the current year, Randa Merchandising Incorporated sold its interest in a chain of wholesale outlets, taking the company completely out of the wholesaling business. The company still operates its retail outlets. A listing of the major sections of an income statement follows. 1. Net sales 2. Gain on state's condemnation of company property 3. Cost of goods sold 4. Income tax expense 5. Depreciation expense 6. Gain on sale of wholesale business segment, net of tax 7. Loss from operating wholesale business segment, net of tax 8. Loss of assets from meteor strike Item Prepare the December 31 year-end income statement. Note: Loss amounts should be Indicated with a minus sign. Net sales Expenses: Total operating expenses Discontinued segment: Other unusual and/or infrequent gains (losses) Debit $ 1,990,000 292,000 312,000 RANDA MERCHANDISING, INCORPORATED Income Statement For Year Ended December 31…arrow_forward

- In the current year, Randa Merchandising Incorporated sold its interest in a chain of wholesale outlets, taking the company completely out of the wholesaling business. The company still operates its retail outlets. A listing of the major sections of an income statement follows. Item 1. 2. 3. 4. 5. 6. 7. 8. 1. Net sales 2. Gain on state's condemnation of company property 3. Cost of goods sold 4. Income tax expense 5. Depreciation expense 6. Gain on sale of wholesale business segment, net of tax 7. Loss from operating wholesale business segment, net of tax 8. Loss of assets from meteor strike Exercise 13-17A (Algo) Income statement categories LO A2 Debit Section $ 1,888,000 277,000 296,000 566,000 817,000 Credit $ 3,700,000 293,000 Indicate where each of the following income-related items for this company appears on its current year income statement by selecting the appropriate section in the drop down beside each item. 989,000 Item Net sales Gain on state's condemnation of company…arrow_forwardRequired Information [The following information applies to the questions displayed below.] In the current year, Randa Merchandising Incorporated sold Its Interest in a chain of wholesale outlets, taking the company completely out of the wholesaling business. The company still operates its retail outlets. A listing of the major sections of an Income statement follows. Item 1. Net sales 2. Gain on state's condemnation of company property 3. Cost of goods sold 4. Income tax expense 5. Depreciation expense 6. Gain on sale of wholesale business segment, net of tax 7. Loss from operating wholesale business segment, net of tax 8. Loss of assets from meteor strike Net sales Expenses: RANDA MERCHANDISING, INCORPORATED Income Statement For Year Ended December 31 Total operating expenses Other unusual and/or infrequent gains (losses) Discontinued segment: Debit $ 1,735,000 254,000 272,000 Prepare the December 31 year-end Income statement. (Loss amounts should be indicated with a minus sign.)…arrow_forwardRequired Information [The following Information applies to the questions displayed below.] In the current year, Randa Merchandising Incorporated sold its interest in a chain of wholesale outlets, taking the company completely out of the wholesaling business. The company still operates its retail outlets. A listing of the major sections of an Income statement follows. Item 1. Net sales 2. Gain on state's condemnation of company property 3. Cost of goods sold 4. Income tax expense 5. Depreciation expense 6. Gain on sale of wholesale business segment, net of tax 7. Loss from operating wholesale business segment, net of tax 8. Loss of assets from meteor strike Prepare the December 31 year-end Income statement. Note: Loss amounts should be Indicated with a minus sign. Net sales Expenses: RANDA MERCHANDISING, INCORPORATED Income Statement For Year Ended December 31 Total operating expenses Other unusual and/or infrequent gains (losses) Discontinued segment: Debit Credit $ 4,000,000 317,000 $…arrow_forward

- Required information [The following information applies to the questions displayed below.] In the current year, Randa Merchandising Incorporated sold its interest in a chain of wholesale outlets, taking the company completely out of the wholesaling business. The company still operates its retail outlets. A listing of the major sections of an income statement follows. Item 1. Net sales 2. Gain on state's condemnation of company property 3. Cost of goods sold 4. Income tax expense 5. Depreciation expense 6. Gain on sale of wholesale business segment, net of tax 7. Loss from operating wholesale business segment, net of tax 8. Loss of assets from meteor strike Prepare the December 31 year-end income statement. Note: Loss amounts should be indicated with a minus sign. RANDA MERCHANDISING, INCORPORATED Income Statement For Year Ended December 31 Net sales Expenses: Total operating expenses Other unusual and/or infrequent gains (losses) Discontinued segment. Debit Credit $ 4,400,000 349,000 $…arrow_forwardRequired information Use the following information for the Exercies below. (Static) [The following information applies to the questions displayed below.] In the current year, Randa Merchandising Incorporated sold its interest in a chain of wholesale outlets, taking the company completely out of the wholesaling business. The company still operates its retail outlets. A listing of the major sections of an income statement follows. Item 1. Net sales 2. Gain on state's condemnation of company property 3. Cost of goods sold 4. Income tax expense 5. Depreciation expense 6. Gain on sale of wholesale business segment, net of tax 7. Loss from operating wholesale business segment, net of tax 8. Loss of assets from meteor strike Exercise 17-18A (Static) Income statement presentation LO A2 Prepare the December 31 year-end income statement. Note: Loss amounts should be indicated with a minus sign. Net sales Expenses: RANDA MERCHANDISING, INCORPORATED Income Statement For Year Ended December 31…arrow_forwardPlease help me with correct answer thankuarrow_forward

- In the current year, Randa Merchandising Incorporated sold its interest in a chain of wholesale outlets, taking the company completely out of the wholesaling business. The company still operates its retail outlets. A listing of the major sections of an income statement follows. Item Debit Credit 1. Net sales $ 4,700,000 2. Gain on state's condemnation of company property 373,000 3. Cost of goods sold $ 2,399,000 4. Income tax expense 352,000 5. Depreciation expense 376,000 6. Gain on sale of wholesale business segment, net of tax 1,256,000 7. Loss from operating wholesale business segment, net of tax 720,000 8. Loss of assets from meteor strike 1,037,000 Prepare the December 31 year-end income statement. (Loss amounts should be indicated with a minus sign.)arrow_forwardIn the current year, Randa Merchandising Incorporated sold its interest in a chain of wholesale outlets, taking the company completely out of the wholesaling business. The company still operates its retail outlets. A listing of the major sections of an income statement follows. 1. Net sales 2. Gain on state's condemnation of company property 3. Cost of goods sold 4. Income tax expense 5. Depreciation expense 6. Gain on sale of wholesale business segment, net of tax 7. Loss from operating wholesale business segment, net of tax 8. Loss of assets from meteor strike Exercise 17-18A (Algo) Income statement presentation LO A2 Net sales Expenses: Item Total operating expenses Other unusual and/or infrequent gains (losses) Discontinued segment: RANDA MERCHANDISING, INCORPORATED Income Statement For Year Ended December 31 Prepare the December 31 year-end income statement. (Loss amounts should be indicated with a minus sign.) Debit $ $ 1,684,000 247,000 264,000 505,000 728,000 0 0 0 0 Credit $…arrow_forwardIn the current year, Randa Merchandising, Inc., sold its interest in a chain of wholesale outlets, taking the company completely out of the wholesaling business. The company still operates its retail outlets. Item 1. Net sales 2. Gain on state's condemnation of company property 3. Cost of goods sold 4. Income tax expense 5. Depreciation expense 6. Gain on sale of wholesale business segment, net of tax 7. Loss from operating wholesale business segment, net of tax 8. Loss of assets from meteor strike Debit $1,474,897 227,000 232,500 474,000 636,000 Credit $2,890,000 257,000 795,000 Prepare the December 31 year-end income statement. (Loss amounts should be indicated with a minus sign.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...

Accounting

ISBN:9781337619455

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Cengage Learning