CONCEPTS IN FED.TAX.,2020-W/ACCESS

20th Edition

ISBN: 9780357110362

Author: Murphy

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Question

General accounting

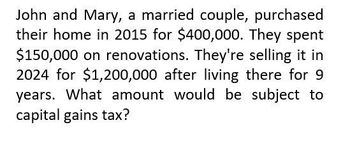

Transcribed Image Text:John and Mary, a married couple, purchased

their home in 2015 for $400,000. They spent

$150,000 on renovations. They're selling it in

2024 for $1,200,000 after living there for 9

years. What amount would be subject to

capital gains tax?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Chelsea, who is single, purchases land for investment purposes in 2014 at a cost of 22,000. In 2019, she sells the land for 38,000. Chelseas taxable income without considering the land sale is 100,000. What is the effect of the sale of the land on her taxable income, and what is her tax liability?arrow_forwardIn each of the following problems, identify the tax issue(s) posed by the facts presented. Determine the possible tax consequences of each issue that you identify. Thans grandmother dies and leaves him jewelry worth 40,000. In addition, he is the beneficiary of a 100,000 life insurance policy that his grandmother had bought before she retired.arrow_forwardLeroy and Amanda are married and have three dependent children. During the current year, they have the following income and expenses: Salaries 120,000 Interest income 45,000 Royalty income 27,000 Deductions for AGI 3,000 Deductions from AGI 9,000 a. What is Leroy and Amandas current year taxable income and income tax liability? b. Leroy and Amanda would like to lower their income tax. How much income tax will they save if they validly transfer 5,000 of the interest income to each of their children? Assume that the children have no other income and that they are entitled to a 1,050 standard deduction.arrow_forward

- Virginia and Richard are married taxpayers with adjusted gross income of $28,000 in 2019 If Virginia is able to make a $1,500 contribution to her IRA and Richard makes a $1,500 contribution to his IRA, what is the Saver's Credit Virginia and Richard will be eligible for? $0 $1,500 $2,000 $3,000 $4,000arrow_forwardOn June 30, 2019, Kelly sold property for 240,000 cash and a 960,000 note due on September 30, 2020. The note will also pay 6% interest, which is slightly higher than the Federal rate. Kellys cost of the property was 400,000. She is concerned that Congress may increase the tax rate that will apply when the note is collected. Kellys after-tax rate of return on investments is 6%. a. What can Kelly do to avoid the expected higher tax rate? b. Assuming that Kellys marginal combined Federal and state tax rate is 25% in 2019, how much would the tax rates need to increase to make the option identified in part (a) advisable?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you