EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

Do fast answer of this general accounting question

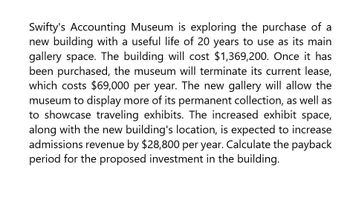

Transcribed Image Text:Swifty's Accounting Museum is exploring the purchase of a

new building with a useful life of 20 years to use as its main

gallery space. The building will cost $1,369,200. Once it has

been purchased, the museum will terminate its current lease,

which costs $69,000 per year. The new gallery will allow the

museum to display more of its permanent collection, as well as

to showcase traveling exhibits. The increased exhibit space,

along with the new building's location, is expected to increase

admissions revenue by $28,800 per year. Calculate the payback

period for the proposed investment in the building.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Riverbed's Accounting Museum is exploring the purchase of a new building with a useful life of 15 years to use as its main gallery space. The building will cost $1,098,000. Once it has been purchased, the museum will terminate its current lease, which costs $65,700 per year. The new gallery will allow the museum to display more of its permanent collection, as well as to showcase traveling exhibits. The increased exhibit space, along with the new building's location, is expected to increase admissions revenue by $25,800 per year. Calculate the payback period for the proposed investment in the building. Assume that all cash flows occur evenly throughout the year. Payback period yearsarrow_forwardSwifty’s Accounting Museum is exploring the purchase of a new building with a useful life of 20 years to use as its main gallery space. The building will cost $1,369,200. Once it has been purchased, the museum will terminate its current lease, which costs $69,000 per year. The new gallery will allow the museum to display more of its permanent collection, as well as to showcase traveling exhibits. The increased exhibit space, along with the new building’s location, is expected to increase admissions revenue by $28,800 per year.Calculate the payback period for the proposed investment in the building. Assume that all cash flows occur evenly throughout the year. (Round answer to 0 decimal places, e.g. 5,275.) Payback period years Click if you would like to Show Work for this question:arrow_forwardCullumber, Inc. is considering the purchase of a warehouse directly across the street from its manufacturing plant. Cullumber currently warehouses its inventory in a public warehouse across town. Rent on the warehouse and delivering and picking up inventory cost Cullumber $50880 per year. The building will cost Cullumber $477000. Cullumber will depreciate the building for 20 years. At the end of 20 years, the building will have a $132500 salvage value. Cullumber's required rate of return is 12%. Click here to view the factor table. Using the present value tables, the building's net present value is (round to the nearest dollar) O $1017600. O $46077. O $393783. O $-83217.arrow_forward

- Blossom, Inc. is considering the purchase of a warehouse directly across the street from its manufacturing plant. Blossom currently warehouses its inventory in a public warehouse across town. Rent on the warehouse and delivering and picking up inventory cost Blossom $48960 per year. The building will cost Blossom $459000. Blossom will depreciate the building for 20 years. At the end of 20 years, the building will have a $127500 salvage value. Blossom’s required rate of return is 11%. suggest whether he should buy warehousearrow_forwardOgren Corporation is considering purchasing a new spectrometer for the firm's R&D department. The purchase price is $70,000 and it would cost another $15,000 to install it. The spectrometer which falls into the MACRS 3-year property class (Year 1-33.33%, Year 2 - 44.44%, Year 3 - 14.82%, and Year 4 - 7.41%) is projected to be sold after three years for $30,000. Use of this equipment would result in an increased net working capital of $4,000 over the life of the machine. The spectrometer would have no effect on revenues, but it is expected to save the firm $35,000 per vear in before-tax operating costs, mainly labor. The firm's tax rate is 40%, and the required rate of return on the project is 11%. What is the after-tax salvage value for the spectrometer?arrow_forwardOgren Corporation is considering purchasing a new spectrometer for the firm’s R&D department. The purchase price is $70,000 and it would cost another $15,000 to install it. The spectrometer which falls into the MACRS 3-year property class (Year 1 - 33.33%, Year 2 - 44.44%, Year 3 - 14.82%, and Year 4 - 7.41%) is projected to be sold after three years for $30,000. Use of this equipment would result in an increased net working capital of $4,000 over the life of the machine. The spectrometer would have no effect on revenues, but it is expected to save the firm $35,000 per year in before-tax operating costs, mainly labor. The firm’s tax rate is 40%, and the required rate of return on the project is 11%. What amount should be used as the initial cash flow for this project? Why?arrow_forward

- Ogren Corporation is considering purchasing a new spectrometer for the firm's R&D department. The purchase price is $70,000 and it would cost another $15,000 to install it. The spectrometer which falls into the MACRS 3-year property class (Year 1-33.33%, Year 2 - 44.44%, Year 3 - 14.82%, and Year 4 - 7.41%) is projected to be sold after three years for $30,000. Use of this equipment would result in an increased net working capital of $4,000 over the life of the machine. The spectrometer would have no effect on revenues, but it is expected to save the firm $35,000 per year in before-tax operating costs, mainly labor. The firm's tax rate is 40%, and the required rate of return on the project is 11%. What amount should be used as the initial cash flow for this project? Why? Short Answer Toolbar navigationarrow_forwardOgren Corporation is considering purchasing a new spectrometer for the firm's R&D department. The purchase price is $70,000 and it would cost another $15,000 to install it. The spectrometer which falls into the MACRS 3-year property class (Year 1- 33.33%, Year 2- 44.44%, Year 3 - 14.82%, and Year 4 - 7.41%) is projected to be sold after three years for $30,000. Use of this equipment would result in an increased net working capital of $4,000 over the life of the machine. The spectrometer would have no effect on revenues, but it is expected to save the firm $35,000 per year in before-tax operating costs, mainly labor. The firm's tax rate is 40%, and the required rate of return on the project is 11%. What is the NPV of the project? Should the firm accept or reject this project?arrow_forwardThe Parkview Hospital is considering the purchase of a new autoclave. This equipment will cost $150,000. This asset will be depreciated using an MACRS (GDS) recovery period of three years. Use this information to solve, The BV at the end of the second year is (a) $27,771 (b) $41,667 (c) $116,675 (d) $33,325arrow_forward

- Larson Manufacturing is considering purchasing a new injection-molding machine for $250,000to expand its production capacity. It will cost anadditional $20,000 to do the site preparation. Withthe new injection-molding machine installed, Larson Manufacturing expects to increase its revenueby $90,000. The machine will be used for five years,with an expected salvage value of $75,000. At aninterest rate of 12%, would the purchase of the injection-molding machine be justified?arrow_forwardNguyen, Inc., is considering the purchase of a new computer system (ICX) for $130,000. The system will require an additional $30,000 for installation. If the new computer is purchased, it will replace an old system that has been fully depreciated. The new system will be depreciated under the MACRS rules applicable to 7-year class assets. If the ICX is purchased, the old system will be sold for $20,000. The ICX system, which has a useful life of 10 years, is expected to increase revenues by $32,000 per year over its useful life. Operating costs are expected to decrease by $2,000 per year over the life of the system. The firm is taxed at a 40 percent marginal rate.a. What net investment is required to acquire the ICX system and replace the old system?b. Compute the annual net cash flows associated with the purchase of the ICX system.arrow_forwardTinney & Smyth Inc. is considering the purchase of a new batch polymer-bonding machine for producing Crazy Rubber, a new children's toy. The machine will increase EBITDA by $215,000 per year for the next two years. The machine's purchase price is $260,000 and the salvage value at the end of two years is $46,800. The machine is classified as 3-year property with MACRS depreciation rates for the first two years of 33.33% and 44.45%. What is the tax on sale associated with selling the machine after two years? Use a tax rate of 35%. Round to the nearest dollar. Check Answerarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning