Managerial Accounting

15th Edition

ISBN: 9781337912020

Author: Carl Warren, Ph.d. Cma William B. Tayler

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Need help with this general accounting question

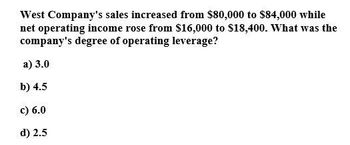

Transcribed Image Text:West Company's sales increased from $80,000 to $84,000 while

net operating income rose from $16,000 to $18,400. What was the

company's degree of operating leverage?

a) 3.0

b) 4.5

c) 6.0

d) 2.5

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Parker Company has provided the following data for the most recent year: net operating income, $33,000; fixed expense, $94,200; sales, $212,000; and CM ratio, 60%. What is the company's degree of operating leverage? A. 3.85 B. 1.35 C. 0.26 D. 0.60arrow_forwardWhat is its degree of operating leverage for this accounting question?arrow_forwardPlease provide this question solution general accountingarrow_forward

- I want to correct answer general accountingarrow_forwardSimple ROI and Residual Income Calculations. Consider the following data: 1.) DIVISION X Y Z Invested Capital P2,000,000 (1)1,300,000 P1,250,000 Income (2) 100,000 P182,000 P 150,000 Revenue P4,000,000 P3,640,000 (3) 3,750,000 Income Percentage of Revenue 2.5% (4) 5% (5) 4% Capital Turnover (6) 2 (7) 2.8 3 Rate of Return on Invested Capital (8) 5% 14% (9) 12% Required: 1. Which division is the best performer 2. Suppose each division is assessed an imputed interest rate of 20% on invested capital. Compute the residual income for each division.arrow_forwardI need answer of this question accountingarrow_forward

- Using the Van Accessible data from Table 5–4:a. Calculate the degree of operating leverage (DOL).b. Calculate the degree of financial leverage (DFL).c. Calculate the degree of combined leverage (DCL).d. Explain what DOL, DFL, and DCL mean.arrow_forwardNeed answer the accounting questionarrow_forwardcalculate sales margin for this accountarrow_forward

- Using the Van Accessible data from Table 5–4: Calculate the degree of operating leverage (DOL). Calculate the degree of financial leverage (DFL). Calculate the degree of combined leverage (DCL). Explain what DOL, DFL, and DCL mean.arrow_forwardThe following data relates to the XYZ Corporation and its X Division. X Division sales P 8,000,000 X Division operating income P 480,000 X Division total assets P 2,000,000 X Division current liabilities P 600,000 Corporate target rate of return 14% Corporate weighted average cost of capital 10% Corporate effective tax rate 30% What is the X Divisions Economic Value Added (EVA)?arrow_forwardPlease give me answer general accountingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub