FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Need answer the accounting question

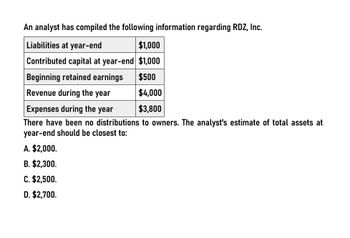

Transcribed Image Text:An analyst has compiled the following information regarding RDZ, Inc.

Liabilities at year-end

$1,000

Contributed capital at year-end $1,000

Beginning retained earnings

$500

Revenue during the year

$4,000

Expenses during the year

$3,800

There have been no distributions to owners. The analyst's estimate of total assets at

year-end should be closest to:

A. $2,000.

B. $2,300.

C. $2,500.

D. $2,700.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Calculate the following for Co. XYZ: c. Average collection period (365 days) d. Times interest earned Assets: Cash and marketable securities $400,000Accounts receivable 1,415,000Inventories 1,847,500Prepaid expenses 24,000Total current assets $3,686,500Fixed assets 2,800,000Less: accumulated depreciation 1,087,500Net fixed assets $1,712,500Total assets $5,399,000Liabilities: Accounts payable $600,000Notes payable 875,000Accrued taxes Total current liabilities $1,567,000Long-term debt 900,000Owner's equity Total liabilities and owner's equity Co. XYZ Income Statement: Net sales (all credit) $6,375,000Less: Cost of goods sold 4,375,000Selling and administrative expense 1,000,500Depreciation expense 135,000Interest expense Earnings before taxes $765,000Income taxes Net income Common stock dividends $230,000Change in retained earningsarrow_forwardWhat is the inaccuracy under the RR column?arrow_forwardplease answer do not image.arrow_forward

- Pritchett Company reported the following year-end data: Cash Short-term investments Accounts receivable (current) Inventory Prepaid (current) assets Total current 1iabilities $ 20, 100 8, 500 13,400 24, 000 6,800 28, 000 Compute the (a) current ratio and ( acid-test ratio. Complete this question by entering your answers in the tabs below. Currlat Ratio Acid Test Ratio Compute the current ratio. Current Ratio Current Ratio Numerator: Denominator: Current assets Current liabilities Current ratio 72.800 %24 28,000 2.6 to 1 %3 Acid Test Ratio>arrow_forwardCompute the expected recovery per peso of unsecured claimsarrow_forwardComplete the following table by putting the proper amount in each column: Assume that $100,000 was invested in each of the following classifications and the market value at the end of the year was $95,000. (For the Current Long term column indicate which classification is correct assuming there are no current maturities on long-term investments) Investment Type Carrying Value Current (C) or Long Term (LT) Adjustment To Income Adjustment to Other Comp Inc Debt Investment Trading Available-For-Sale Held-to-Maturity Equity Investment < 20% Ownership >21%,<50% Ownershiparrow_forward

- ans 7,arrow_forwardSelected current year company information follows: Net income. Net sales Total liabilities, beginning-year Total liabilities, end-of-year Total stockholders' equity, beginning-year Total stockholders' equity, end-of-year The total asset turnover is: (Do not round Intermediate calculations.) $ 16,753 720,855 91,932 111, 201 206,935 133,851arrow_forwardwo years. EXERCISE 15-2 Financial Ratios for Assessing Liquidity LO15-2 ending December 31 appear below. The company did not issue any new common stock during the payable was 12%, the income tax rate was 40%, and the dividend per share of common stock was this year was $18. All of the company’s sales are on account. year Deceof 800,000 shares of common stock were outstanding, The interest rate on the bond year. $0.75 last year and $0.40 this year. The market value of the company's common stock at the end of Weller Corporation Comparative Balance Sheet (dollars in thousands) This Year Last Year Assets Current assets: Cash .... $ 1,280 $ 1,560 Accounts receivable, net 12,300 9,100 Inventory .... 9,700 8,200 Prepaid expenses 1,800 2,100 Total current assets 25,080 20,960 Property and equipment: Land ..... 6,000 6,000 Buildings and equipment, net .. 19,200 19,000 epeA Total property and equipment ... 25,200 25,000 Total assets $50,280 $45,960 Liabilities and Stockholders' Equity Current…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education