FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:1

5

points

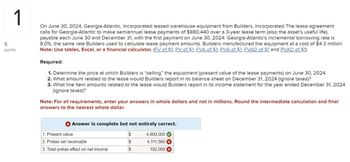

On June 30, 2024, Georgia-Atlantic, Incorporated leased warehouse equipment from Builders, Incorporated The lease agreement

calls for Georgia-Atlantic to make semiannual lease payments of $880,440 over a 3-year lease term (also the asset's useful life),

payable each June 30 and December 31, with the first payment on June 30, 2024. Georgia-Atlantic's incremental borrowing rate is

8.0%, the same rate Builders used to calculate lease payment amounts. Builders manufactured the equipment at a cost of $4.3 million.

Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1)

Required:

1. Determine the price at which Builders is "selling" the equipment (present value of the lease payments) on June 30, 2024.

2. What amount related to the lease would Builders report in its balance sheet on December 31, 2024 (ignore taxes)?

3. What line item amounts related to the lease would Builders report in its income statement for the year ended December 31, 2024

(ignore taxes)?

Note: For all requirements, enter your answers in whole dollars and not in millions. Round the intermediate calculation and final

answers to the nearest whole dollar.

Answer is complete but not entirely correct.

1. Present value

$

4,800,000

2. Pretax net receivable

$

4,111,560

3. Total pretax effect on net income

$

192,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 3 images

Knowledge Booster

Similar questions

- Problem 21-03 (Part Level Submission) Oriole Steel Company, as lessee, signed a lease agreement for equipment for 5 years, beginning December 31, 2020. Annual rental payments of $45,000 are to be made at the beginning of each lease year (December 31). The interest rate used by the lessor in setting the payment schedule is 7%; Oriole’s incremental borrowing rate is 9%. Oriole is unaware of the rate being used by the lessor. At the end of the lease, Oriole has the option to buy the equipment for $5,000, considerably below its estimated fair value at that time. The equipment has an estimated useful life of 7 years, with no salvage value. Oriole uses the straight-line method of depreciation on similar owned equipment.Click here to view factor tables. (a) Prepare the journal entries, that Oriole should record on December 31, 2020. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry…arrow_forwarddo not gicve solution in imagearrow_forwardReyarrow_forward

- 23. Partially correct answer icon Your answer is partially correct. Tamarisk Corporation enters into a 7-year lease of equipment on December 31, 2019, which requires 7 annual payments of $38,200 each, beginning December 31, 2019. In addition, Tamarisk guarantees the lessor a residual value of $18,500 at the end of the lease. However, Tamarisk believes it is probable that the expected residual value at the end of the lease term will be $8,500. The equipment has a useful life of 7 years. Assume that for Lost Ark Company, the lessor, collectibility of lease payments is probable and the carrying amount of the equipment is $170,000.Prepare Lost Ark’s 2019 and 2020 journal entries, assuming the implicit rate of the lease is 11% and this is known to Tamarisk. (Credit account titles are automatically indented when amount is entered. Do not indent manually. For calculation purposes, use 5 decimal places as displayed in the factor table provided and round final answers to 0 decimal…arrow_forwardSagararrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education