FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

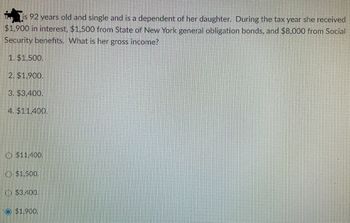

Transcribed Image Text:is 92 years old and single and is a dependent of her daughter. During the tax year she received

$1,900 in interest, $1,500 from State of New York general obligation bonds, and $8,000 from Social

Security benefits. What is her gross income?

1. $1,500.

2. $1,900.

3. $3,400.

4. $11,400.

$11,400.

$1,500.

$3,400.

Ⓒ$1,900.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Lane is single and has two dependent children. Financial records show the following items in the current year: Gift from a friend Dividends received on stock $12,000 $1,200 $1,000 $35,000 $6,000 $12,000 Price won in state lottery Salary from employer Child support received from ex-spouse Alimony received from ex-spouse How much is Lane's adjusted gross income for the current year? a. $47,000. b. $48,200. c. $49,200. d. $67,200.arrow_forwardAlpesharrow_forwardSusan is single and had the following tax information for the current tax year: Pension income: $58,800 Social Security benefit: 18,700 Tax-exempt interest: 3,750 How much of her SSB must Susan include in her taxable income? (Round answer to O decimal places, e.g. 5,125.) Taxable SSBs $arrow_forward

- Amy earns an income of 50,000 this year as an employee of rooster enterprises. She pays the following amounts during the year: Contribution to Traditional IRA : 5000 PreTax Cuts and Jobs Act Alimony she paid to her ex husband: 10,000 Medical expenses: 6000 What is Amy's Adjusted Gross Income? (AGI) a. 29000 b. 34000 c. 35000 d. 39000arrow_forward18. Rex and Dena are married and have two children, Michelle (age seven) and Nancy (age five). During 2022, Rex earned a salary of $27,500, received interest income of $300, and filed a joint income tax return with Dena. Dena had $0 gross income. Their earned income credit for the year is: a.$0. b.$5,840. c.$5,903. d.$6,164.arrow_forwardSocial Security is paid in with after-tax dollars but may be subject to tax if annual income exceeds a base amount. A single taxpayer’s base is $25,000. Married taxpayers filing jointly have a base of $32,000. Married taxpayers filing separately have a base of zero. Suppose Eric is retiring this year at age 67. The following table shows his data. Part-time salary $30,500 Annual savings account interest $300 Annual dividends $2,750 Annual interest on Dallas municipal bonds $1,550 Based on the income calculated, Eric will have % of his Social Security benefits taxed.arrow_forward

- D George and Katherine Green are married with $146,000 in gross income from their jobs at the University of Wyoming. During the year they had $4,300 in adjustments. They had $23,000 in eligible 7.5% medical expenses and $14,000 in other itemized deductions. They have 2 eligible child. They had $10,000 worth of taxes withheld throughout the year. 0 Question 1 What is the Green household's Adjusted Gross Income? O $145,100 O $126.000 O $120,500 O $141.700 Question 2 How much are the Green household's itemized deductions? O $22,000 O $17,000 O $10,900 O $26,372.50 Question 3 What is the Green household's taxable income? O $93,827.50 O $115,327.50 O $103,400.00 O $97,605.50arrow_forwardCarol is age 65 and single. She has no earned income but does make about $10,000 a year from interest and dividends. Which of the following statements is true? She may make a $7,000 contribution to a Roth IRA this year. She may make a traditional IRA or a Roth IRA contribution this year. She may make a $7,000 contribution to a traditional IRA this year. O She may not make a traditional IRA or Roth IRA contribution this year.arrow_forwardPaige had $100,000 of income from wages and $3,650 of taxable interest. Paige also made contributions of $2,300 to a tax-deferred retirement account. Paige has 4 dependents and files as head of household.What is Paige's total income?What is Paige's adjusted gross income?For Paige's filing status, the standard deduction is $18,000. What is Paige's taxable income?arrow_forward

- Julie is the beneficiary of a discretionary trust. She is 16 years old. Last year, she received a $3,000 distribution from the trust. Julie had no other sources of income for the year. Who is liable for tax on Julie's trust income? a. Her parents b. Julie c. No one d. Trustee of the trustarrow_forwardAndrew and Eunice are married filing jointly with AGI of $48,000. They contributed $1,800 to a qualified retirement plan. How much is their retirement savings contributions credit? Multiple Choice $1,800. $900. $180. $0.arrow_forwardFrom the following information, determine Marcie’s gross income for tax purposes. Salary $40,000 Interest (checking account) 50 Cash received as birthday gift 900 Dividends (mutual funds) 500 Inheritance received upon father’s death 22,000 Cash received from insurance for accident claim settlement 3,200 Cash dividend from stock 750arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education