FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

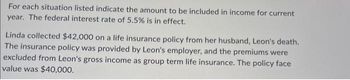

Transcribed Image Text:For each situation listed indicate the amount to be included in income for current

year. The federal interest rate of 5.5% is in effect.

Linda collected $42,000 on a life insurance policy from her husband, Leon's death.

The insurance policy was provided by Leon's employer, and the premiums were

excluded from Leon's gross income as group term life insurance. The policy face

value was $40,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- 39. Annie is covered by a $200,000 group-term life insurance policy of which her daughter is the sole beneficiary. Annie's employer pays the entire premium for the policy, for which the uniform premium table factor is $0.75 per $1,000 per month of coverage. How much, if any, of the cost of the group-term life insurance is included in Annie's gross income on an annual basis? a. $0. b. $450. c. $1,350. d. $1,800.arrow_forwardKevin is a 48-year-old nurse who earns an annual salary of $95,000. His employer provides group-term life insurance coverage equal to twice the annual salary for all employees. The annual amount of income for each $1,000 of taxable insurance coverage for an individual 48 years old is $1.80. How much gross income must Kevin report for this benefit? (Round answer to O decimal places, e.g. 125.) Income $arrow_forward7arrow_forward

- Mr. Gilbert is self-employed and makes annual contributions to a SEP plan. Ms. Gilbert's employer doesn't offer any type of qualified retirement plan. Each spouse contributes the maximum $6,000 to a traditional IRA. Required: a. Compute the AGI on their joint return if AGI before an IRA deduction is $144,000. b. Compute the AGI on their joint return if AGI before an IRA deduction is $210,100. Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required A Required B Compute the AGI on their joint return if AGI before an IRA deduction is $210,100. $198,100 AGIarrow_forwardOn April 30, Ava, age 42, received a distribution from her qualified plan of $150,000. She had an adjusted basis in the plan for $500,000 and the fair market value of the account as of April 30 was $625,000. Calculate the taxable amount of the distribution and any applicable penalty. $30,000 taxable; $3,000 tax penalty $30,000 taxable; $0 tax penalty $120,000 taxable; $12,000 tax penalty $150,000 taxable; $15,000 tax penaltyarrow_forwardFor calendar year 2023, Giana was a self-employed consultant with no employees. She had $80,000 of net profit from consulting and paid $7,000 in medical insurance premiums on her policy covering 2023. How much of these premiums may Giana deduct as a deduction for AGI? As an itemized deduction? If an amount is zero, enter "0". Self-employed persons can deduct fill in the blank 1 % of their medical insurance premiums as a deduction for AGI in 2023. Thus, Giana may deduct $fill in the blank 2 as a deduction AGI and she may deduct $fill in the blank 4 as an itemized deduction (subject to the AGI floor).arrow_forward

- Please explain every step. Thank youarrow_forwardIn 2019, Margaret and John Murphy (both over age 65) are married taxpayers who file a joint tax return with AGI of $26,100. During the year they incurred the following expenses: Medical insurance premiums $1,300 Premiums on an insurance policy that pays $100 per day for each day Margaret is hospitalized 400 Medical care lodging (two people, one night) 65 Hospital bills 2,100 Doctor bills 850 Dentist bills 200 Prescription drugs and medicines 340 Psychiatric care 350 In addition, they drove 80 miles for medical transportation, and their insurance company reimbursed them $800 for the above expenses. On the following segment of Schedule A of Form 1040, calculate the Murphy’s medical expense deduction.arrow_forwardChris 45 and Alison 46 are marries and they will file a joint return . During the year they earned 82500 wages. They also jad investment income consisting of 200 interest income from a savng account 350 interest income from a certificate of deposit held with another bank 250 interest income from a us treasury 500 tax exempt interest income from municipal bond and 1700 in ordinart dividends from a mutual fund what amout will cris and allison report for taxable interest in their 1040arrow_forward

- Aa.63. Ms. Ray is age 46 and single. This year, Mr. Ray's retirement savings included a $2,630 employer contribution to a qualified profit-sharing plan account, and a contribution by Ms. Ray to a traditional IRA. Mr. Ray contributed the maximum allowed. Required: Compute Ms. Ray's IRA deduction if current year income includes $71,320 salary.arrow_forwardAt the end of the first pay period of the year, Sofia earned $5,700 of salary. Withholdings from Sofia’s salary include FICA Social Security taxes at the rate of 6.2%, FICA Medicare taxes at the rate of 1.45%, $534 of federal income taxes, $194 of medical insurance deductions, and $44 of life insurance deductions. Compute Sofia’s net pay for this first pay period. (Round your intermediate and final answers to 2 decimal places.)arrow_forwardAssume your client, Jenni, age 50, takes a distribution of her Roth IRA assets six tax years after she funded her account. Which of the following distributions will be income tax free and free from the 10% early withdrawal penalty? A) A distribution due to a disability B) A distribution for medical expenses exceeding 7.5% of her adjusted gross income C) Distributions in the form of substantially equal periodic payments to her D) Distributions for health care insurance payments if she becomes unemployedarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education