FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

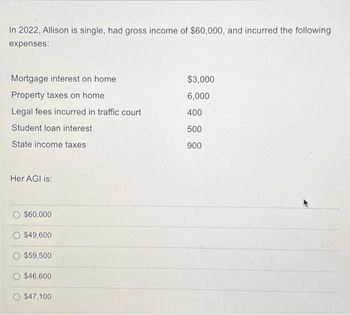

Transcribed Image Text:In 2022, Allison is single, had gross income of $60,000, and incurred the following

expenses:

Mortgage interest on home

Property taxes on home

Legal fees incurred in traffic court

Student loan interest

State income taxes

Her AGI is:

$60,000

$49,600

$59,500

$46,600

$47,100

$3,000

6,000

400

500

900

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Mario, a single taxpayer with two dependent children, has the following items of income and expense during 2020: Gross receipts from business $144,000 Business expenses 180,000 Net capital gain 22,000 Interest income 3,000 Itemized deductions (state taxes, residence interest, and contributions) 24,000 a. Determine Mario's taxable income or loss for 2020. Adjusted gross income Less: itemized deductions Less: Deduction for qualified business income Loss b. Indicate which items are adjustments to taxable income or loss when computing an NOL. Business receipts Business Expenses Net capital gain Interest income Itemized deductions c. Determine Mario's NOL for 2020. Mario's NOL is ?arrow_forwardDuring the year, Maxine pays the following amounts related to her residence: Mortgage interest $8,000 Real estate taxes 4,000 Painting of exterior 2,000 Utilities 3,400 New roof 10,000 She also paid the following for her daughter's house: Real estate taxes (owned and used by daughter) $1,500 a. Which expenses are deductible by Maxine if she is eligible to itemize her deductions? b. Calculate the total dollar amount. c. Are the deductions "For" or "From" AGI?arrow_forwardIn 2019, Margaret and John Murphy (both over age 65) are married taxpayers who file a joint tax return with AGI of $26,100. During the year they incurred the following expenses: Medical insurance premiums $1,300 Premiums on an insurance policy that pays $100 per day for each day Margaret is hospitalized 400 Medical care lodging (two people, one night) 65 Hospital bills 2,100 Doctor bills 850 Dentist bills 200 Prescription drugs and medicines 340 Psychiatric care 350 In addition, they drove 80 miles for medical transportation, and their insurance company reimbursed them $800 for the above expenses. On the following segment of Schedule A of Form 1040, calculate the Murphy’s medical expense deduction.arrow_forward

- Hardevarrow_forwardErica has the following: Salary = $30,000; RPP contribution = $2,000; mortgage interest = $1,000; Union dues = $800; Basic Personal Amount = $11,635. Her federal income tax rate = 15%. What amount of federal income tax does Erica owe? A) $2,335 B) $4,200 C) $2,259 D) $2,829arrow_forwardMenard is single and has the following income and expenses Form W-2 wages Interest income received from savings account Mortgage interest on primary residence (acquisition debt of $350,000) Investment interest expense Personal credit card interest Car loan interest on SUV Late fees on mortgage $76,500 $4,000 ($27,000) Answer: (6,000) ($2,600) ($1,200) ($50) Menard plans to itemize this year. What is his total allowable deduction for interest expense on his Schedule A?arrow_forward

- The Tax Formula for Individuals, A Brief Overview of Capital Gains and Losses (LO 1.3, 1.9) In 2020, Manon earns wages of $54,000. She also has dividend income of $2,800. Manon is single and has no dependents. During the year, Manon sold silver coins held as an investment for a $7,000 loss. Table for the standard deduction Filing Status Standard Deduction Single $12,400 Married, filing jointly 24,800 Married, filing separately 12,400 Head of household 18,650 Qualifying widow(er) 24,800 Calculate the following amounts for Manon: a. Adjusted gross income $fill in the blank b. Standard deduction $fill in the blank c. Taxable income $fill in the blankarrow_forward1.Charles, who is single and age 61, had AGI of $400,000 during 2020. He incurred the following expenses and losses during the year. Medical expenses before AGI floor$28,500State and local income taxes15,200Real estate taxes4,400Home mortgage interest5,400Charitable contributions14,800Unreimbursed employee expenses8,900Gambling losses (Charles had $7,400 of gambling income)9,800Compute Charles's total itemized deductions for the year. 2.For the following exchanges, indicate which qualify as like-kind property.a.lnventory of a sporting goods store in Charleston for land in Savannah.b.lnvestment land in Virginia Beach for office building in Williamsburg.c.Used automobile used in a business for a new automobile to be used in the business.d.Investment land in Paris for investment land in San Francisco.e.Shares of Texaco stock for shares of Exxon Mobil stock.arrow_forwardM 1 Mindy is single with AGI of $250,000. Mindy made the following payments in 2020: 2 Medical expenses 5,000 3 State income tax withholdings 7,500 4 State sales tax payments 1,500 5 Real estate taxes 6,000 6 Interest on qualified home mortgage 12,000 7 Charitable contribution XYZ Corporation stock 8 Mindy purchased her home in 2020 and the original mortgage on the home has a principal balance of $800,000. 9 Mindy purchased XYZ stock for $2,000 in 2017 and the stock had a fair market value of $3,000 when she made the donation to a public charity in 2020. 10 Calculate the amount of Mindy's2020 itemized deductions. 8 points 11 A calculations must be shownarrow_forward

- During 2023, Anmol Frank had the following transactions: Alimony received (divorce occured in 2017) Interest income on IBM bonds She borrowed money to buy a new car Value of BMW received as a gift from aunt Federal income tax withholding payments The taxpayer's AGI is: a. $74,000. b. $76,000. c. $79,000. d.) $81,000. e. $90,000.arrow_forwardMr. Babu Kamil is a married person and have a net income of $85,000 in 2021. His spouse has a net income of $4500 and she has no mental or physical infirmity. Calculate the spousal amount to be claimed in Line 30300 $13808 – 4500 = $9,308 Calculate the spousal credit (how much credit Mr. Babu gets from this amount). $9308*15% = $1396.20arrow_forwardVikrambhaiarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education