FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

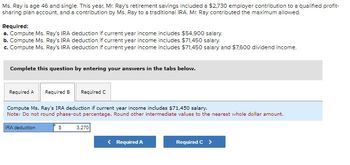

Transcribed Image Text:Ms. Ray is age 46 and single. This year, Mr. Ray's retirement savings included a $2,730 employer contribution to a qualified profit-

sharing plan account, and a contribution by Ms. Ray to a traditional IRA. Mr. Ray contributed the maximum allowed.

Required:

a. Compute Ms. Ray's IRA deduction if current year income includes $54,900 salary.

b. Compute Ms. Ray's IRA deduction if current year income includes $71,450 salary.

c. Compute Ms. Ray's IRA deduction if current year income includes $71,450 salary and $7,600 dividend income.

Complete this question by entering your answers in the tabs below.

Required A Required B Required C

Compute Ms. Ray's IRA deduction if current year income includes $71,450 salary.

Note: Do not round phase-out percentage. Round other intermediate values to the nearest whole dollar amount.

IRA deduction

$

3.270

< Required A

Required C >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 6 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Melvin, a self-employed dentist paid $4,476 for his health insurance premiums throughout the year and is net profit was 143,216. he became eligible under his spouse's plan on August 1st. the amount of Melvin may report a self-employment health insurance deduction on his tax return is whatarrow_forwardam.107.arrow_forwardDetermine the retirement savings contributions credit in each of the following independent cases. Use Table 9-2. a. A married couple filing jointly with modified AGI of $37,500 and an IRA contribution of $1,600. b. A married couple filing jointly with modified AGI of $58,000 and an IRA contribution of $1,500. c. A head of household taxpayer with modified AGI of $33,000 and Roth IRA contribution of $2,000. d. A single taxpayer with modified AGI of $12,000 and an IRA contribution of $2,300. Retirement Savings Contributions Creditarrow_forward

- Bennett is a single individual and received a salary of $28,000 before he retired in October of this year. After he retired, he received Social Security benefits of $4,000 during the year. Read the requirements. Requirement a. What amount, if any, of the Social Security benefits are taxable for the year? Begin by computing the provisional income. Only select items that are applicable to Bennett.(Leave unused cells blank, do not select a label or enter a zero.) Adjusted gross income (excluding Social Security benefits) $28,000 Plus: 50% of Social Security benefits 2,000 Provisional income $30,000 The taxable portion of the Social Security benefits is . Requirements a. What amount, if any, of the Social Security benefits are taxable for the year? b. Would the answer be different if Bennett also had $1,500 of tax-exempt interest? c. What if he had had $6,400of…arrow_forwardRita is a self-employed taxpayer who turns 39 years old at the end of the year (2022). In 2022, her net Schedule C income was $304,000. This was her only source of income. This year, Rita is considering setting up a retirement plan. What is the maximum amount Rita may contribute to the self-employed plan in each of the following situations? Note: Round your intermediate calculations and final answers to the nearest whole dollar amount. Problem 13-85 Part b (Algo) b. She sets up an individual 401(k).arrow_forwardMr. Gilbert is self-employed and makes annual contributions to a Keogh plan. Mrs. Gilbert's employer doesn't offer any type of qualified retirement plan. Each spouse contributes $3,100 to a traditional IRA. Required: Compute the AGI on their joint return if AGI before an IRA deduction is $154,000. Compute the AGI on their joint return if AGI before an IRA deduction is $204,600arrow_forward

- Reggie is a self-employed taxpayer who turns 59 years old at the end of the year (2021). In 2021, his net Schedule C income was $300,000. This was his only source of income. This year, Reggie is considering setting up a retirement plan. What is the maximum amount he may contribute to the self-employed plan in each of the following situations? (Round your intermediate calculations to the nearest whole dollar amount.) a. He sets up a SEP IRA. b. He sets up an individual 401(k).arrow_forwardKevin is a 48-year-old nurse who earns an annual salary of $95,000. His employer provides group-term life insurance coverage equal to twice the annual salary for all employees. The annual amount of income for each $1,000 of taxable insurance coverage for an individual 48 years old is $1.80. How much gross income must Kevin report for this benefit? (Round answer to O decimal places, e.g. 125.) Income $arrow_forwardMr. Gilbert is self-employed and makes annual contributions to a SEP plan. Ms. Gilbert's employer doesn't offer any type of qualified retirement plan. Each spouse contributes the maximum $6,000 to a traditional IRA. Required: a. Compute the AGI on their joint return if AGI before an IRA deduction is $144,000. b. Compute the AGI on their joint return if AGI before an IRA deduction is $210,100. Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required A Required B Compute the AGI on their joint return if AGI before an IRA deduction is $210,100. $198,100 AGIarrow_forward

- Rita is a self-employed taxpayer who turns 39 years old at the end of the year (2023). In 2023, her net Schedule C income was $314,000. This was her only source of income. This year, Rita is considering setting up a retirement plan. What is the maximum amount Rita may contribute to the self-employed plan in each of the following situations? Note: Round your intermediate calculations and final answers to the nearest whole dollar amount. Problem 13-85 Part a (Algo) a. She sets up a SEP IRA. Maximum contributionarrow_forwardFor each taxpayer, compute the maximum contribution to the retirement plan. a. Lewis, a self-employed individual, has net earned income of $50,000 in 2019. If Lewis has no employees, calculate the maximum contribution to a SEP plan that he may deduct from his adjusted gross income. b. During 2019, Linda, age 32, has a salary of $40,000. She participates in a Section 401(k) plan and chooses to defer 25 percent of her compensation. What is the maximum amount Linda can contribute to the Section 401(k) plan on a tax-deferred basis? If Linda's salary was $125,000, instead of $40,000, what is the maximum amount that she could contribute to the Section 401(k) plan on a tax-deferred basis?arrow_forwardFor each situation listed indicate the amount to be included in income for current year. The federal interest rate of 5.5% is in effect. Linda collected $42,000 on a life insurance policy from her husband, Leon's death. The insurance policy was provided by Leon's employer, and the premiums were excluded from Leon's gross income as group term life insurance. The policy face value was $40,000.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education