FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

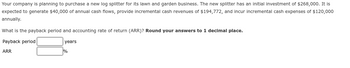

Transcribed Image Text:Your company is planning to purchase a new log splitter for its lawn and garden business. The new splitter has an initial investment of $268,000. It is

expected to generate $40,000 of annual cash flows, provide incremental cash revenues of $194,772, and incur incremental cash expenses of $120,000

annually.

What is the payback period and accounting rate of return (ARR)? Round your answers to 1 decimal place.

Payback period

years.

ARR

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- Suppose an investor is interested in purchasing the following income producing property at a current market price of $ 1,490,000. The prospective buyer has estimated the expected cash flows over the next five years to be as follows: Year 1 = $88,000, Year 2 = $90,662, Year 3 = $91,923, Year 4 = $95,778, Year 5 = $97,000. Assuming that the required rate of return is 15% and the estimated proceeds from selling the property at the end of year five is $1,860,000, what is the NPV of the project? What is the IRR of the project?arrow_forwardSolve the following three independent scenarios: A grocery store is considering the purchase of a new refrigeration unit with an initial investment of $412,000, and the store expects a return of $100,000 in year one, $72,000 in years two and three, $65,000 in years four and five, and $38,000 in year six and beyond, what is the payback period? Payback period years. Round your Payback Period (PB) answer to two decimal places (i.e. 12.34). An auto repair company needs a new machine that will check for defective sensors. The machine has an initial investment of $224,000. Incremental revenues, including cost savings, are $120,000, and incremental expenses, including depreciation, are $50,000. There is no salvage value. What is the accounting rate of return (ARR)? Accounting Rate of Return (ARR) = Round your ARR answer, in percentage format, to two decimal places (i.e. 12.34%).arrow_forwardMunabhaiarrow_forward

- Home Security Systems is analyzing the purchase of manufacturing equipment that will cost $56,000. The annual cash inflows for the next three years will be: Year 1 2 3 Cash Flow $ 28,000 26,000 21,000 Use Appendix B and Appendix D for an approximate answer but calculate your final answer using the financial calculator method. a. Determine the internal rate of return. Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places. Internal rate of return %arrow_forwardIncognito Company is contemplating the purchase of a machine that provides it with cash savings of $93,000 per year for five years. Interest is 11%. Assume the cash savings.occur at the end of each year. Required: Calculate the present value of the cash savings. Note: Use tables, Excel, or a financial calculator. Round your final answer to the nearest whole dollar. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Present valuearrow_forwardCan someone please help me to solve the following question showing all work and formulas neatly. And please show the cash flow diagram as well. PLEASE ANS THANK YOU!!!!!arrow_forward

- Rogers Inc.is considering investing $320,000 in hardware and software to develop a business-to-business (B2B) portal. The company expects the portal to save $40,000 each year for seven years of its useful life. Please figure out the payback period. b) AND its accounting rate returnarrow_forwardWhat is the present value of a savings account that is expected to pay $1,250 of cash inflow at the end of year 1, $0 cash inflow at the end of year 2 and $1,050 cash inflow at the end of 3rd year given the rate of return 10% in the first and second year and 12% in the third year? Please Show the workarrow_forwardAssume a company is going to make an investment of $450,000 in a machine and the following are the cash flows that two different products would bring in years one through four. Option A, Product A Option B, Product B $185,000 $155,000 190,000 185,000 65,000 55,000 20,000 65,000 A. Calculate the payback period of each product. Round your answers to 2 decimal places. Option A, Product A fill in the blank years Option B, Product B fill in the blank yearsarrow_forward

- Crane Company is considering an investment that will return a lump sum of $930,000 6 years from now. Click here to view the factor table. What amount should Crane Company pay for this investment to earn an 9% return? (For calculation purposes, use 5 decimal places as displayed in the factor table provided. Round answer to 2 decimal places, e.g. 25.25.) Crane Company should pay $arrow_forwardA project has estimated annual net cash flows of $52,700. It is estimated to cost $590,240. Determine the cash payback period. Round your answer to one decimal place.fill in the blank 1 yearsarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education