Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

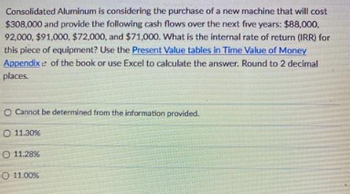

Transcribed Image Text:Consolidated Aluminum is considering the purchase of a new machine that will cost

$308,000 and provide the following cash flows over the next five years: $88,000,

92,000, $91,000, $72,000, and $71,000. What is the internal rate of return (IRR) for

this piece of equipment? Use the Present Value tables in Time Value of Money

Appendix e of the book or use Excel to calculate the answer. Round to 2 decimal

places.

O Cannot be determined from the information provided.

O 11.30%

O 11.28%

O 11.00%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Haresh valaarrow_forwardSolve for the missing information pertaining to each investment proposal. Using the tables in Exhibit 26–3 determine the present value of the following cash flows, discounted at an annual rate of 15 percent. $40,000 to be received 20 years from today. $24,000 to be received annually for 10 years. $16,000 to be received annually for five years, with an additional $20,000 salvage value expected at the end of the fifth year. $30,000 to be received annually for the first three years, followed by $20,000 received annually for the next two years (total of five years in which cash is received)arrow_forwardFoster Company wants to buy a special automated machine to replace an existing manual system. The initial outlay (cost) is $3,500,000. The new machine will last 5 years with no expected salvage value. The expected annual cash flows are as follows: Year Cash Inflow Cash Outflow 0 $ - $ 3,500,000.00 1 $ 3,900,000.00 $ 3,000,000.00 2 $ 3,900,000.00 $ 3,000,000.00 3 $ 3,900,000.00 $ 3,000,000.00 4 $ 3,900,000.00 $ 3,000,000.00 5 $ 3,900,000.00 $ 3,000,000.00 Foster has a cost of capital equal to 10%. 1. Calculate the payback period. Payback period: yearsarrow_forward

- Kanye Company is evaluating the purchase of a rebuilt spot-welding machine to be used in the manufacture of a new product. The machine will cost $166,000, has an estimated useful life of 7 years, a salvage value of zero, and will increase net annual cash flows by $32,982. Click here to view the factor table. What is its approximate internal rate of return? (Round answer to O decimal place, e.g. 13%.) Internal rate of return %arrow_forwardDomesticarrow_forwardA firm is considering an investment in new equipment that has the following information. Purchase Cost: $132,793 Salvage Value in five years time: $18,337 Useful life is 5 years and depreciation is determined using the straightline method. Expected increased annual cash flows are $52,651 What is the payback period in years? Calculate to 2 decimal placesarrow_forward

- The production department is proposing the purchase of an automatic insertion machine. It has identified 3 machines, each with an estimated life of 10 years. Which machine offers the best internal rate of return? Annual net cash flows Average investment Machine A only Machine B only Machine C only O Machines A and B Machine A $ 50,000 250,000 Machine B $ 40,000 300,000 Machine $ 75,000 500,000arrow_forwardA firm buys a new piece of equipment for $28,808, and will receive a cash flow of $3,700 per year for fourteen years. What is the IRR? (Use a Financial calculator to arrive at the answers. Round the final answer to the nearest whole percent.) IRR %arrow_forwardGodoarrow_forward

- please answer without copy paste and with steps , explanation , computation, formula for each and every steps/numbers answer in text formarrow_forwardCentral Mass Ambulance Service can purchase a new ambulance for $200,000 that will provide an annual net cash flow of $50,000 per year for five years. The salvage value of the ambulance will be $25,000. Assume the ambulance is sold at the end of year 5. Calculate the NPV of the ambulance if the required rate of return is 9%. (Round your answer to the nearest $1.) A) $(10,731) B) $10,731 C) $(5,517) D) $5,517arrow_forwardThe production department is proposing the purchase ONE automatic insertion machine. It has identified three machines (A, B and C). Each machine has an estimated useful life of 10 years. minimum desired rate of return of 10%. The accountant has identified the following data: Machine A Machine B Machine C Present value of future cash flows computed using 10% rate of return $305,000 $295,000 $300,500 Amount of initial investment 300,000 300,000 300,000 Based on net present value method, which machine do you recommend?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education