FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

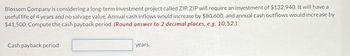

Transcribed Image Text:Blossom Company is considering a long-term investment project called ZIP. ZIP will require an investment of $132,940. It will have a

useful life of 4 years and no salvage value. Annual cash inflows would increase by $80,600, and annual cash outflows would increase by

$41,500. Compute the cash payback period. (Round answer to 2 decimal places, e.g. 10.52.)

Cash payback period

years.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Emerald Enterprises is developing a new product at the cost of $ 50,000. The new product is expected to increase the cash flow for the next five years as follows: $ 10000, $ 15000, $ 15000, $ 20000 and $ 20000. Find the payback period. (Note: Roundup the fractional values; that is if the payback period is 6.23 years, enter 7 years as payback period) 4 years 5 years 3 years 2 yearsarrow_forwardBig Steve's, a maker of swizzle sticks, is considering the purchase of a new plastic stamping machine. This investment requires an initial outlay of $130,000 and will generate cash inflows of $37,000 per year for 7 years. If the discount rate is 17%, what is the project's IRR? (Round to two decimal places.) O A.17.00% OB. 20.94% O C. 32.52% OD. 37.33% MacBook Airarrow_forwardThe cash flow of an energy management opportunity is estimated as follows: Initial cost:$12,000 Energy saving:$2,700/year for 12 years Maintenance cost:$1,200/year for 12 years Salvage value:$2,500@the end of 12 years If the interest rate is 10%, 1) What is the simple payback period (SPP) (in years)? (a)5.2 (b)4.2 (c)4.6 (d)8.02) With an annual discount rate is 10%, what is the discounted payback period (in years)? (a)9.5 b) 15.1 (c)8.1 (d) 16.9 (e) 6.53)With an annual discount rate is 10%, what is the benefit-cost ratio (BCR)? (Hint: Benefit = Annual saving-Maintenance; Cost= Initial investment - Salvage)(a) 1.04(b) 0.80(c) 1.25(d) 1.12(e) 1.43arrow_forward

- Novak Company is contemplating an investment costing $168,810. The investment will have a life of 8 years with no salvage value and will produce annual cash flows of $30,500. Click here to view PV tables. What is the approximate internal rate of return associated with this investment? (Use the above table.) (Round answer to O decimal places, e.g. 15%) Internal rate of return. %6arrow_forwardNOVA Company is considering a long-term investment project called STUDY. STUDY will require an investment of $125,190. It will have a useful life of 4 years and no salvage value. Annual cash inflows would increase by $79,000, and annual cash outflows would increase by $40,000. Compute the cash payback period. O 3.21 years O 1.23 years O 1.58 years O 4 yearsarrow_forwardBunnings Ltd is considering to invest in one of the two following projects to buy a new equipment. Each equipment will last 5 years and have no salvage value at the end. The company’s required rate of return for all investment projects is 8%. The cash flows of the projects are provided below. Equipment 1 Equipment 2 Cost $186000 $195000 Future Cash Flow Year 1 86000 97000 Year 2 93000 84000 Year 3 83000 86000 Year 4 75000 75000 Year 5 55000 63000 Required:a) Identify which option of equipment should the company accept based on Profitability Index? b) Identify which option of equipment should the company accept based on discounted pay back method if the payback criterion is maximum 2 years?arrow_forward

- Nikularrow_forwardPlease help mearrow_forwardA project that costs $2,300 to install will provide annual cash flows of $730 for each of the next 5 years. a. Calculate the NPV if the opportunity cost of capital is 12%? (Do not round intermediate calculations. Round your answer to 2 decimal places.) NPV b. Is this project worth pursuing? Yes O No c. What is the project's internal rate of return IRR? (Do not round intermediate calculations. Round your answer to 2 decimal places.) %24arrow_forward

- Ross enterprises is considering a 3 year project with the following cash flows: Time 0: spend $4800 Time 1: collect $2200Time 2: collect $3600 Time 3: collect $1400 Ross's discount rate is 7.0%. What is the NPV of the project? (Do not roundintermediate calculations. Round the final answers to 2 decimal places. Omit $ sign in your response.).arrow_forwardGiant Machinery Ltd is considering to invest in one of the two following Projects to buy a new equipment. Each project will last 5 years and have no salvage value at the end. The company’s required rate of return for all investment projects is 9%. The cash flows of the projects are provided below. Project 1Cost $175,000 Project 2 Cost $185,000 Future Cash Flows For Project 1 Year 1 Year 2 Year 3 Year 4 Year 5 is 76,000 83,000 67,000 65,000 55,000 respectively. For Project 2 it is 87,000 78,000 69,000 65,000 57,000 for Year 1 Year 2 Year 3 Year 4 Year 5 resp. Required: a) Identify which project should the company accept based on NPV method. (Note: Please round up the result of each calculation of PV to 2 decimal places only for simplification) b) Identify which project should the company accept based on simple pay back method if the payback criteria is maximum 2 years. c) Which project Giant Machinery should choose if two methods are in conflictarrow_forwardNikularrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education