FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Instructions:

I. Resolve the ratios listed on table a for each year (2020 & 2021):

a. For each ratio includes the formula with math computes (2020 & 2021)

b. . Fill M&G Industries Ratio Analysis Table A. (2020 & 2021)

II. Perform the following Analysis:

a. Explain each ratio results for 2021 only.

b. Compare each ratio performance with the previous year results (compare 2021 results with 2020 results)

c. Compare each Ratio results for 2021 with their respective Industry average.

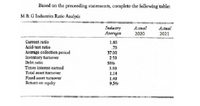

Transcribed Image Text:Based on the preceeding statements, complete the following table:

M & G Industries Ratio Analysis

Industry

Averagis

Acaua!

Actual

2020

2021

Current ratio

Acid-test ratio

Average collection period

Inventory turnover

Debt ratio

Times interest earmed

Total asset turnover

Fixed asset turnover

Return on equity

1.80

.70

37.00

2.50

58%

3.80

1.14

1.40

9.5%

Transcribed Image Text:Analysis of Financial Statements (Financial Ratios)

M & G Industries Balance Sheet

For December 31, 2020 and 2021

2020

2021

Cash

Accounts receivable

Inventories

Total current asseis

Land

$ 9,000

12,500

29,000

$ 50,500

20,000

500

16,000

45,500

$ 62,000

26,000

100,000

Buildings and equipment

Less: allowance for depreciation

Total fixed assets

Total assets

70,000

(28,000)

$ 62,000

$112,500

$ 10,500

17,000

$ 27,500

28,750

31,500

24,750

$112,500

(38,000)

$ 88,000

$150,000

$ 22,000

47,000

$ 69,000

22,950

31,500

26,550

$150,000

Accounts Payable

Short-term bank notes

Total current liabilities

Long-term debt

Common stock

Retained earnings

Total debt and equity

M&G Industries Income Statement

For the Years Ended December 31, 2020 and 2021

2020

2021

Sales (all credit)

Cost of goods sold

Gross profit

Operating expenses

Fixed cash operating expenses

Variable operating expenses

Depreciation

Total operating expenses

Earnings before interest and taxes

Interest expense

Earnings before taxes

Талеs

$125,000

75,000

50,000

$160,000

96,000

$ 64,000

$ 21,000

12,500

$ 21,000

16,000

4,500

$ 38,000

$ 12,000

3,000

$ 9,000

4,500

$ 4,500

10,000

$ 47,000

$ 17,000

6,100

$ 10,900

5,450

$ 5,450

Net income

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Locate the formula in the textbook and calculate the 2022 Profit Margin Ratio (Profitability). Fill in the numerator and denominator using the financial statements provided (no symbols or commas) and the answer should be in a XX.XX% format:arrow_forwardplease answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image)arrow_forward2) Ratios Based on the information given in picture #1, complete the following ratios for the last TWO years and indicate whether the trend is favorable or unfavorable. Note percentages and times should be to one decimal place (e.g. 14.8%; 5.8x) Liq./Solv. Ratios Current Yr. Prior Yr. Fav/Unfav. Current Ratio (X) {Total. Current Assets/ Total Current Liabilities} Quick Ratio (X) {Cash + Short term Investments + Current Receivables/ Current Liabilities} Day's Sales Uncollected (days) {Total Accounts Receivables / Sales x 365}arrow_forward

- Perform the following: a. horizontal analysis b. vertical analysis c. ratio analysis d. interpret the resultsarrow_forwardplease answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image)arrow_forwardThe financial statements of Dandy Distributors Ltd. are shown on the "Fcl. Stmts." page. 1 Based on Dandy's financial statements, calculate ratios for the year ended December 31, 2020. Assume all sales are on credit. Show your work. 2 From these ratios, analyze the financial performance of Dandy.arrow_forward

- please answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image)arrow_forwardPlease do not give solution in image format thankuarrow_forwardJason Hilton, M.D., reported the following unadjusted trial balance as of September 30, 2025: View the trial balance. Calculate the debt ratio for Jason Hilton, M.D. Select the debt ratio formula on the first line and then calculate the ratio. (Round the percentage to the nearest whole percent.) Average total assets Average total equity Average total liabilities Net income Total assets + Total equity Total liabilities = Debt ratio % Trial Balance Account Title Cash Jason Hilton, M.D. Unadjusted Trial Balance September 30, 2025 Accounts Receivable Supplies Land Building Office Equipment Accounts Payable Utilities Payable Unearned Revenue Notes Payable Common Stock Dividends Service Revenue Salaries Expense Utilities Expense Advertising Expense Total $ Debit Balance 39,000 7,300 2,900 28,000 100,000 25,000 56,000 23,400 800 300 282,700 $ Credit 2,400 1,100 8,666 95,000 130,000 45,534 282,700 I Xarrow_forward

- Required Prepare a vertical analysis of both the balance sheets and income statements for Year 4 and Year 3. Complete this question by entering your answers in the tabs below. Analysis Bal Sheet Analysis Inc Stmt Prepare a vertical analysis of an income statements for Year 4 and Year 3. (Percentages may not add exactly due to rounding. Round your answers to 2 decimal places. (i.e., .2345 should be entered as 23.45).) ALLENDALE COMPANY Vertical Analysis of Income Statements Year 4 Year 3 Amount % Total Amount % Total Revenues Sales (net) $ 230,000 100.00 % $ 210,000 100.00 % Other revenues 8,000 5,000 Total revenues 238,000 215,000 Expenses Cost of goods sold 120,000 103,000 Selling, general, and administrative expense 55,000 50,000 Interest expense 8,000 7,200 Income tax expense 23,000 22,000 Total expenses 206,000 182,200 Net income $ 32,000 % $ 32,800 %arrow_forwardCompute the following for Stanley Limited. Round your answers to two decimal places. All answers MUST be expressed in the unit as specified in the question, if any. Show your workings. (a) Gross Profit Rate (in %) (b) Current Ratio (c) Quick Ratio B Stanley Limited Statement of Financial Position 31 December 2021 ($ in million) Stanley Limited Income Statement For the year ended 31 December 2021 ($ in million) Question B5 (continued) (d) Accounts Receivable Turnover Rate (e) Return on Equity (%) (f) Debt Ratio (in %) (g) Price-Earnings Ratioarrow_forwardH2.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education