Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Required: Evaluate the performance of RBL Paving Company using the below ratios. Define each ratio, perform the calculation, and provide an explanation of the result.

a. Return on equity

b.Total assets turnover

c. Return on assets

d. Current ratio

e. Receivables turnover

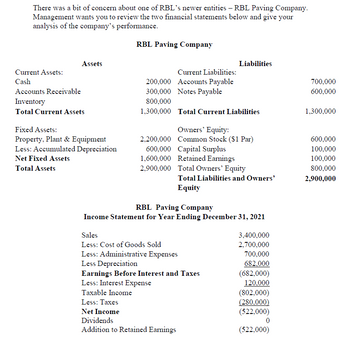

Transcribed Image Text:There was a bit of concern about one of RBL's newer entities - RBL Paving Company.

Management wants you to review the two financial statements below and give your

analysis of the company's performance.

RBL Paving Company

Current Assets:

Cash

Assets

Accounts Receivable

Inventory

Total Current Assets

Fixed Assets:

Property, Plant & Equipment

Less: Accumulated Depreciation

Net Fixed Assets

Total Assets

Current Liabilities:

Accounts Payable

200,000

300,000 Notes Payable

800,000

1,300,000 Total Current Liabilities

2,200,000

600,000 Capital Surplus

1,600,000 Retained Earnings

2,900,000

Liabilities

Owners' Equity:

Common Stock ($1 Par)

Dividends

Addition to Retained Earnings

Total Owners' Equity

Total Liabilities and Owners'

Equity

RBL Paving Company

Income Statement for Year Ending December 31, 2021

Sales

Less: Cost of Goods Sold

Less: Administrative Expenses

Less Depreciation

Earnings Before Interest and Taxes

Less: Interest Expense

Taxable Income

Less: Taxes

Net Income

3,400,000

2,700,000

700,000

682,000

(682,000)

120,000

(802,000)

(280.000)

(522,000)

0

(522,000)

700,000

600,000

1,300,000

600,000

100,000

100,000

800,000

2,900,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 6 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Which of the following ratios best measures the profitability of a company? a) Return on equity b) Gross margin c) Current ratio d) Net operating asset turnoverarrow_forwardAnswer the following question a. Return on equityb. Total assets turnoverc. Return on assetsd. Current ratioe. Receivables turnoverarrow_forwardIncome statmentBalance sheetNo statmentarrow_forward

- Metropolitan Water Utilities purchases surface water from Elephant Butte Irrigation District at a cost of $100,000 per month in the months of February through September. Instead of paying monthly, the utility makes a single payment of $800,000 at the end of each calendar year for the water it used. The delayed payment essentially represents a subsidy by Elephant Butte Irrigation District to the water utility. At an interest rate of 0.25% per month, what is the amount of the subsidy?arrow_forwardBusiness ratios of financial statements are generally categorized as one of the following areas, EXCEPT Select one: a. Leverage b. Profitability c. Net Present Value d. Liquidity e. Efficiency (or Activity)arrow_forwardWhich of the following ratios is used to analyze a company's liquidity? a. Inventory turnover ratio b. Earnings per share c. Return on assets ratio d. Asset turnover ratioarrow_forward

- Which of the following ratios would a lender find most useful in monitoring a borrower's ability to make loan payments? () PE ratio Return on assets Total asset turnover Inventory turnover () Cash coverage ratio Previous Page Next Page Page 6arrow_forward12. Which two ratios multiplied by each other equal Return on Total Assets? (A) Profit Margin (B) Return on Equity (C) Current Ratio (D) Price Earnings Ratio (E) Total Asset Turnoverarrow_forward5. Know the calculations for all of the following ratios (see ratio sheet that can be used on the exam) and know the category (listed in Question 4) they fall in: Formula Category/Use Ratio Working Capital Current Assets - Current Liabilities Net credit sales/Average Accounts Receivable Turnover accounts receivable Asset Turnover Net sales/Average total assets Net income/Average total stockholders' equity Total liabilities/Total stockholders equity Net income/Net sales Return on Equity (ROE) Debt to equity Return on Sales (ROS) (also known as Net Margin Current Assets/Current Liabilities Cost of goods sold/Average inventory Quick assets/Current Current Ratio Inventory Turnover Quick Ratio liabilities Dividend Yield Dividends per share/Market price per share Net earnings available for common stock/Number of outstanding common shares Net income/Average total Earnings per Share (EPS) Return on Investment (ROI) assets Price Earnings Ratio (P/E) Market price per share/Earnings per share…arrow_forward

- _______ ratios are used to measure the speed in which various assets are converted into sales or cash. A Debt (aka Leverage) B Efficiency (aka working capital) C Profitability C Coveragearrow_forwardCurrent assets DIVIDED BY current liabilities is the Current Ratio Net Worth Ratio Working Capitalarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education