Managerial Accounting

15th Edition

ISBN: 9781337912020

Author: Carl Warren, Ph.d. Cma William B. Tayler

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Question

Please correct answer and don't used hand raiting

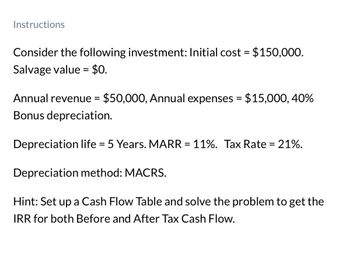

Transcribed Image Text:Instructions

Consider the following investment: Initial cost = $150,000.

Salvage value = $0.

Annual revenue = $50,000, Annual expenses = $15,000, 40%

Bonus depreciation.

Depreciation life = 5 Years. MARR = 11%. Tax Rate = 21%.

Depreciation method: MACRS.

Hint: Set up a Cash Flow Table and solve the problem to get the

IRR for both Before and After Tax Cash Flow.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Give correct operating cash flowarrow_forwardDo not use aiarrow_forwardDogwood Company is considering a capital investment in machinery: (Click the icon to view the data.) 8. Calculate the payback. 9. Calculate the ARR. Round the percentage to two decimal places. 10. Based on your answers to the above questions, should Dogwood invest in the machinery? 8. Calculate the payback. Amount invested Expected annual net cash inflow Payback 1,500,000 24 500,000 3 years 9. Calculate the ARR. Round the percentage to two decimal places. Average annual operating income Average amount invested ARR Data Table Initial investment $ 1,500,000 Residual value 350,000 Expected annual net cash inflows 500,000 Expected useful life 4 years Required rate of return 15%arrow_forward

- In your first job with TBL Inc. your task is to consider a new project whose data are shown below. What is the project's Year 1 cash flow? The annual operating cash flows of the project can be calculated as follows: OCF = {[Sales - Operating Costs]*(1-Tax Rate)} + (Depreciation * Tax Rate) Sales revenues $225,250 Depreciation $78,847 Other operating costs $92,000 Tax rate 18%arrow_forwardOpereting cash flow?arrow_forwardAs assistant to the CFO of Boulder Inc., you must estimate the Year 1 cash flow for a project with the following data. What is the Year 1 cash flow? Do not round the intermediate calculations and round the final answer to the nearest whole number. Sales revenues$11,800Depreciation$4,000Other operating costs$6,000Tax rate35.0% a.$4,756 b.$5,170 c.$6,359 d.$5,377 e.$4,033arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,