Fundamentals Of Financial Management, Concise Edition (mindtap Course List)

10th Edition

ISBN: 9781337902571

Author: Eugene F. Brigham, Joel F. Houston

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Please correct answer and don't used hand raiting

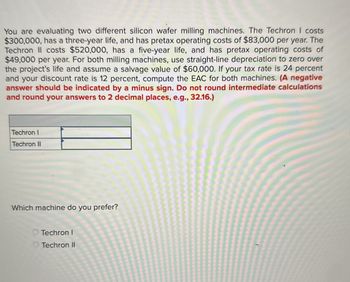

Transcribed Image Text:You are evaluating two different silicon wafer milling machines. The Techron I costs

$300,000, has a three-year life, and has pretax operating costs of $83,000 per year. The

Techron II costs $520,000, has a five-year life, and has pretax operating costs of

$49,000 per year. For both milling machines, use straight-line depreciation to zero over

the project's life and assume a salvage value of $60,000. If your tax rate is 24 percent

and your discount rate is 12 percent, compute the EAC for both machines. (A negative

answer should be indicated by a minus sign. Do not round intermediate calculations

and round your answers to 2 decimal places, e.g., 32.16.)

Techron I

Techron II

Which machine do you prefer?

Techron I

Techron II

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- You are evaluating two different silicon wafer milling machines. The Techron I costs $300,000, has a 3-year life, and has pretax operating costs of $83,000 per year. The Techron II costs $520,000, has a 5-year life, and has pretax operating costs of $49,000 per year. For both milling machines, use straight-line depreciation to zero over the project’s life and assume a salvage value of $60,000. If your tax rate is 24 percent and your discount rate is 12 percent, compute the EAC for both machines. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.)arrow_forwardYou are evaluating two different silicon wafer milling machines. The Techron I costs $249,000, has a 3-year life, and has pretax operating costs of $66,000 per year. The Techron II costs $435,000, has a 5-year life, and has pretax operating costs of $39,000 per year. For both milling machines, use straight-line depreciation to zero over the project's life and assume a salvage value of $43,000. If your tax rate is 22 percent and your discount rate is 11 percent, compute the EAC for both machines. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Techron I Techron II Which machine do you prefer? O Techron II O Techron Iarrow_forwardYou are evaluating two different silicon wafer milling machines. The Techron I costs $300,000, has a three-year life, and has pretax operating costs of $83,000 per year. The Techron Il costs $520,000, has a five-year life, and has pretax operating costs of $49,000 per year. For both milling machines, use straight-line depreciation to zero over the project's life and assume a salvage value of $60,000. If you tax rate is 24 percent and your discount rate is 12 percent, compute the EAC for both machines. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Techron I Techron IIarrow_forward

- You are evaluating two different silicon wafer milling machines. The Techron I costs $195,000, has a three-year life, and has pretax operating costs of $32,000 per year. The Techron II costs $295,000, has a five-year life, and has pretax operating costs of $19,000 per year. For both milling machines, use straight-line depreciation to zero over the project’s life and assume a salvage value of $20,000. If your tax rate is 35 percent and your discount rate is 14 percent, compute the EAC for both machines. Which do you prefer? Why?arrow_forwardYou are evaluating two different silicon wafer milling machines. The Techron I costs $216,000, has a three - year life, and has pretax operating costs of $55, 000 per year. The Techron II costs $380,000, has a five-year life, and has pretax operating costs of $28, 000 per year. For both milling machines, use straight - line depreciation to zero over the project's life and assume a salvage value of $32, 000. If your tax rate is 23 percent and your discount rate is 10 percent, compute the EAC for both machines. Note: Your answer should be a negative value and indicated by a minus sign. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.arrow_forwardYou are evaluating two different silicon wafer milling machines. The Techron I costs $216,000, has a three-year life, and has pretax operating costs of $55,000 per year. The Techron II costs $380,000, has a five-year life, and has pretax operating costs of $28,000 per year. For both milling machines, use straight-line depreciation to zero over the project’s life and assume a salvage value of $32,000. If your tax rate is 23 percent and your discount rate is 10 percent, compute the EAC for both machines Which machine should you choose? Techron II or Techron Iarrow_forward

- You are evaluating two different silicon wafer milling machines. The Techron I costs $303,000, has a 3-year life, and has pretax operating costs of $84,000 per year. The Techron Il costs $525,000, has a 5-year life, and has pretax operating costs of $57,000 per year. For both milling machines, use straight-line depreciation to zero over the project's life and assume a salvage value of $61,000. If your tax rate is 25 percent and your discount rate is 13 percent, compute the EAC for both machines. (A negative answer should be Indicated by a minus sign. Do not round Intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Techron I Techron II Which machine do you prefer? Techron I Techron IIarrow_forwardYou are evaluating two different silicon wafer milling machines. The Techron I costs $270,000, has a three - year life, and has pretax operating costs of $73, 000 per year. The Techron II costs $470,000, has a five-year life, and has pretax operating costs of $46, 000 per year. For both milling machines, use straight - line depreciation to zero over the project's life and assume a salvage value of $50,000. If your tax rate is 25 percent and your discount rate is 9 percent, compute the EAC for both machines.arrow_forwardYou are evaluating two different silicon wafer milling machines. The Techron I costs $249,000, has a three- year life, and has pretax operating costs of $66,000 per year. The Techron II costs $435,000, has a five-year life, and has pretax operating costs of $39,000 per year. For both milling machines, use straight-line depreciation to zero over the project's life and assume a salvage value of $43,000. If your tax rate is 22 percent and your discount rate is 11 percent, compute the EAC for both machines. Answerarrow_forward

- You are evaluating two different silicon wafer milling machines. The Techron I costs $288,000, has a three-year life, and has pretax operating costs of $79,000 per year. The Techron II costs $500,000, has a five-year life, and has pretax operating costs of $46,000 per year. For both milling machines, use straight-line depreciation to zero over the project’s life and assume a salvage value of $56,000. If your tax rate is 25 percent and your discount rate is 12 percent, compute the EAC for both machines. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Which machine do you prefer? Techron II Techron Iarrow_forwardYou are evaluating two different silicon wafer milling machines. The Techron I costs $252,000, has a three-year life, and has pretax operating costs of $67,000 per year. The Techron Il costs $440,000, has a five-year life, and has pretax operating costs of $40,000 per year. For both milling machines, use straight-line depreciation to zero over the project's life and assume a salvage value of $44,000. If your tax rate is 24 percent and your discount rate is 9 percent, compute the EAC for both machines. Note: Your answer should be a negative value and indicated by a minus sign. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16. Techron I Techron II $ -304,725.75 Which machine should you choose? O Techron I O Techron IIarrow_forwardYou are evaluating two different silicon wafer milling machines. The Techron I costs $279,000, has a three-year life, and has pretax operating costs of $76,000 per year. The Techron Il costs $485,000, has a five-year life, and has pretax operating costs of $43,000 per year. For both milling machines, use straight-line depreciation to zero over the project's life and assume a salvage value of $53,000. If your tax rate is 22 percent and your discount rate is 13 percent, compute the EAC for both machines. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Answer is complete but not entirely correct. Techron I $ -156,983.00 x Techron II S -150,093.00arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Fundamentals Of Financial Management, Concise Edi...

Finance

ISBN:9781337902571

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT