Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

Please correct answer and don't use hand rating and don't use Ai solution

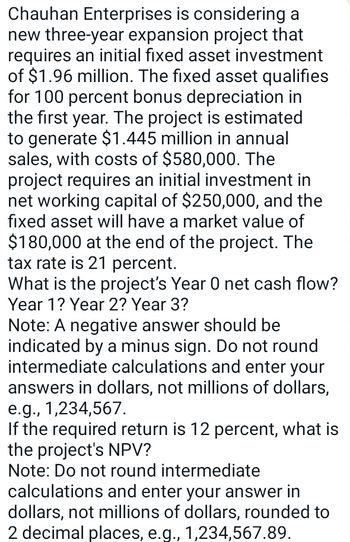

Transcribed Image Text:Chauhan Enterprises is considering a

new three-year expansion project that

requires an initial fixed asset investment

of $1.96 million. The fixed asset qualifies

for 100 percent bonus depreciation in

the first year. The project is estimated

to generate $1.445 million in annual

sales, with costs of $580,000. The

project requires an initial investment in

net working capital of $250,000, and the

fixed asset will have a market value of

$180,000 at the end of the project. The

tax rate is 21 percent.

What is the project's Year 0 net cash flow?

Year 1? Year 2? Year 3?

Note: A negative answer should be

indicated by a minus sign. Do not round

intermediate calculations and enter your

answers in dollars, not millions of dollars,

e.g., 1,234,567.

If the required return is 12 percent, what is

the project's NPV?

Note: Do not round intermediate

calculations and enter your answer in

dollars, not millions of dollars, rounded to

2 decimal places, e.g., 1,234,567.89.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Jasmine Manufacturing is considering a project that will require an initial investment of $52,000 and is expected to generate future cash flows of $10,000 for years 1 through 3, $8,000 for years 4 and 5, and $2,000 for years 6 through 10. What is the payback period for this project?arrow_forwardThe Pinkerton Publishing Company is considering two mutually exclusive expansion plans. Plan A calls for the expenditure of 50 million on a large-scale, integrated plant that will provide an expected cash flow stream of 8 million per year for 20 years. Plan B calls for the expenditure of 15 million to build a somewhat less efficient, more labor-intensive plant that has an expected cash flow stream of 3.4 million per year for 20 years. The firms cost of capital is 10%. a. Calculate each projects NPV and IRR. b. Set up a Project by showing the cash flows that will exist if the firm goes with the large plant rather than the smaller plant. What are the NPV and the IRR for this Project ? c. Graph the NPV profiles for Plan A, Plan B, and Project .arrow_forwardStaten Corporation is considering two mutually exclusive projects. Both require an initial outlay of 150,000 and will operate for five years. The cash flows associated with these projects are as follows: Statens required rate of return is 10%. Using the net present value method and the present value table provided in Appendix A, which of the following actions would you recommend to Staten? a. Accept Project X and reject Project Y. b. Accept Project Y and reject Project X. c. Accept Projects X and Y. d. Reject Projects X and Y.arrow_forward

- Markoff Products is considering two competing projects, but only one will be selected. Project A requires an initial investment of $42,000 and is expected to generate future cash flows of $6,000 for each of the next 50 years. Project B requires an initial investment of $210,000 and will generate $30,000 for each of the next 10 years. If Markoff requires a payback of 8 years or less, which project should it select based on payback periods?arrow_forwardProject S has a cost of $10,000 and is expected to produce benefits (cash flows) of $3,000 per year for 5 years. Project L costs $25,000 and is expected to produce cash flows of $7,400 per year for 5 years. Calculate the two projects’ NPVs, IRRs, MIRRs, and PIs, assuming a cost of capital of 12%. Which project would be selected, assuming they are mutually exclusive, using each ranking method? Which should actually be selected?arrow_forwardWansley Lumber is considering the purchase of a paper company, which would require an initial investment of $300 million. Wansley estimates that the paper company would provide net cash flows of $40 million at the end of each of the next 20 years. The cost of capital for the paper company is 13%. Should Wansley purchase the paper company? Wansley realizes that the cash flows in Years 1 to 20 might be $30 million per year or $50 million per year, with a 50% probability of each outcome. Because of the nature of the purchase contract, Wansley can sell the company 2 years after purchase (at Year 2 in this case) for $280 million if it no longer wants to own it. Given this additional information, does decision-tree analysis indicate that it makes sense to purchase the paper company? Again, assume that all cash flows are discounted at 13%. Wansley can wait for 1 year and find out whether the cash flows will be $30 million per year or $50 million per year before deciding to purchase the company. Because of the nature of the purchase contract, if it waits to purchase, Wansley can no longer sell the company 2 years after purchase. Given this additional information, does decision-tree analysis indicate that it makes sense to purchase the paper company? If so, when? Again, assume that all cash flows are discounted at 13%.arrow_forward

- Bhaarrow_forwardNikularrow_forwardQuad Enterprises is considering a new three-year expansion project that requires an initial fixed asset investment of $2.32 million. The fixed asset falls into the three-year MACRS class (MACRS schedule). The project is estimated to generate $1.735 million in annual sales, with costs of $650,000. The project requires an initial investment in net working capital of $250,000, and the fixed asset will have a market value of $180,000 at the end of the project. The tax rate is 21 percent. a. What is the project’s Year 0 net cash flow? Year 1? Year 2? Year 3? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answers in dollars, not millions of dollars, rounded to 2 decimal places, e.g., 1,234,567.89.) b. If the required return is 12 percent, what is the project's NPV? (Do not round intermediate calculations and enter your answers in dollars, not millions of dollars, rounded to 2 decimal places, e.g., 1,234,567.89.)arrow_forward

- Bhadibenarrow_forwardQuad Enterprises is considering a new three-year expansion project that requires an initial fixed asset investment of $2.31 million. The fixed asset qualifies for 100 percent bonus depreciation in the first year. The project is estimated to generate $1,725,000 in annual sales, with costs of $632,000. The project requires an initial investment in net working capital of $280,000, and the fixed asset will have a market value of $225,000 at the end of the project. a. If the tax rate is 23 percent, what is the project’s Year 0 net cash flow? Year 1? Year 2? Year 3? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answers in dollars, not millions of dollars, e.g., 1,234,567.) b. If the required return is 11 percent, what is the project's NPV? (Do not round intermediate calculations and enter your answers in dollars, not millions of dollars, rounded to two decimal places, e.g., 1,234,567.89.)arrow_forwardEsfandairi Enterprises is considering a new three-year expansion project that requires an initial fixed asset investment of $2.37 million. The fixed asset qualifies for 100 percent bonus depreciation in the first year. The project is estimated to generate $1,765,000 in annual sales, with costs of $664,000. The project requires an initial investment in net working capital of $360,000, and the fixed asset will have a market value of $345,000 at the end of the project. a. If the tax rate is 21 percent, what is the project's Year 0 net cash flow? Year 1? Year 2? Year 3? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answers in dollars, not millions of dollars, e.g., 1,234,567.) b. If the required return is 11 percent, what is the project's NPV? (Do not round intermediate calculations and enter your answers in dollars, not millions of dollars, rounded to two decimal places, e.g., 1,234,567.89.) a. Year 0 cash flow a. Year 1 cash…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning  Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,