EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

pm.54r

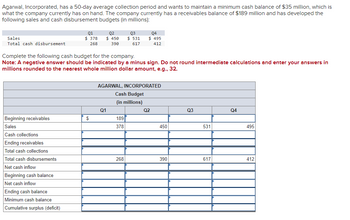

Transcribed Image Text:Agarwal, Incorporated, has a 50-day average collection period and wants to maintain a minimum cash balance of $35 million, which is

what the company currently has on hand. The company currently has a receivables balance of $189 million and has developed the

following sales and cash disbursement budgets (in millions):

Sales

Total cash disbursement

Q1

$ 378

Q2

$ 450

Q3

$ 531

Q4

$ 495

268

390

617

412

Complete the following cash budget for the company.

Note: A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answers in

millions rounded to the nearest whole million dollar amount, e.g., 32.

AGARWAL, INCORPORATED

Cash Budget

(in millions)

Q1

Beginning receivables

Sales

$

189

378

Cash collections

Ending receivables

Q2

450

Q3

531

Q4

495

Total cash collections

Total cash disbursements

268

390

617

412

Net cash inflow

Beginning cash balance

Net cash inflow

Ending cash balance

Minimum cash balance

Cumulative surplus (deficit)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Agarwal, Incorporated, has a 50-day average collection period and wants to maintain a minimum cash balance of $35 million, which is what the company currently has on hand. The company currently has a receivables balance of $192 million and has developed the following sales and cash disbursement budgets (in millions): Sales Q1 $ 405 Q2 $ 477 Q3 $ 558 Total cash disbursement 279 415 652 Q4 $ 522 434 ed Complete the following cash budget for the company. Note: A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answers in millions rounded to the nearest whole million dollar amount, e.g., 32. AGARWAL, INCORPORATED Cash Budget (in millions) Q1 Q2 Q3 Q4 Beginning receivables 192 225 $ 265 $ 310 Sales Cash collections 405 477 558 522 372 437 513 542 Ending receivables EA $ 225 265 $ 310 $ 290 Total cash collections $ 372 437 $ 513 $ 542 Total cash disbursements 279 415 652 434 Net cash inflow $ 93 $ 22 $ 139 × $ 108 Beginning cash…arrow_forwardAgarwal, Incorporated, has a 40-day average collection period and wants to maintain a minimum cash balance of $25 million, which is what the company currently has on hand. The company currently has a receivables balance of $188 million and has developed the following sales and cash disbursement budgets (in millions): Sales Total cash disbursement Q1 Q2 $ 369 $ 441 295 Q3 $ 522 389 617 Q4 $ 486 402 Complete the following cash budget for the company. Note: A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answers in millions rounded to the nearest whole million dollar amount, e.g., 32. AGARWAL, INCORPORATED Q1 Beginning receivables Sales Cash collections Ending receivables Cash Budget (in millions) 369 Q2 441 Q3 522 Q4 486 Total cash collections Total cash disbursements 295 389 617 402 Net cash inflow Beginning cash balance Net cash inflow Ending cash balance Minimum cash balance Cumulative surplus (deficit)arrow_forward2 Agarwal, Incorporated, has a 32-day average collection period and wants to maintain a minimum cash balance of $20 million, which is what the company currently has on hand. The company currently has a receivables balance of $245 million and has developed the following sales and cash disbursement budgets (in millions): Sales Total cash disbursement Beginning receivables Sales Cash collections Ending receivables Total cash collections Total cash disbursements Net cash inflow Beginning cash balance Net cash inflow 01 $ 400 332 Complete the following cash budget for the company. Note: A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answers to the nearest whole number, e.g., 32. Ending cash balance Minimum cash balance Cumulative surplus (deficit) 02 $502 443 Q1 03 $ 608 779 AGARWAL, INCORPORATED Cash Budget (in millions) 400 04 $ 568 471 332 Q2 502 443 Q3 608 779 Q4 568 471arrow_forward

- Hurzdan, Inc., has a 50-day average collection period and wants to maintain a minimum cash balance of $35 million, which is what the company currently has on hand. The company currently has a receivables balance of $189 million and has developed the following sales and cash disbursement budgets (in millions): Q2 Sales $450 Total cash disbursement 268 390 Beginning receivables Sales Cash collections Ending receivables Total cash collections Total cash disbursements Net cash inflow Beginning cash balance Net cash inflow Ending cash balance Minimum cash balance Cumulative surplus (deficit) Q1 $378 Complete the following cash budget for the company. (A negative answer should be Indicated by a minus sign. Do not round Intermediate calculations and enter your answers in millions rounded to the nearest whole million dollar amount, e.g., 32.) + Q3 Q4 $531 $495 412 617 Q1 HURZDAN, INC. Cash Budget (in millions) 378 268 Q2 450 390 Q3 531 617 Q4 495 412arrow_forwardmni.3arrow_forwardes Agarwal, Incorporated, has a 50-day average collection period and wants to maintain a minimum cash balance of $40 million, which is what the company currently has on hand. The company currently has a receivables balance of $198 million and has developed the following sales and cash disbursement budgets (in millions): Sales Total cash disbursement Beginning receivables Sales Cash collections Ending receivables Total cash collections Total cash disbursements Net cash inflow Beginning cash balance Net cash inflow Q1 $ 459 302 Ending cash balance Minimum cash balance Cumulative surplus (deficit) Q2 $531 466 Complete the following cash budget for the company. Note: A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answers in millions rounded to the nearest whole million dollar amount, e.g., 32. Q1 Q3 $ 612 720 AGARWAL, INCORPORATED Cash Budget (in millions) 459 Q4 $576 477 302 Q2 531 466 Q3 612 720 Q4 576 477arrow_forward

- Agarwal, Incorporated, has a 30-day average collection period and wants to maintain a minimum cash balance of $20 million, which is what the company currently has on hand. The company currently has a receivables balance of $187 million and has developed the following sales and cash disbursement budgets (in millions): Sales Total cash disbursement Beginning receivables Sales Cash collections Ending receivables Total cash collections Total cash disbursements Net cash inflow Beginning cash balance Net cash inflow Q1 $360 320 Ending cash balance Minimum cash balance Cumulative surplus (deficit) Q2 $ 432 388 Complete the following cash budget for the company. Note: A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answers in millions rounded to the nearest whole million dollar amount, e.g., 32. $ Q1 Q3 $513 617 AGARWAL, INCORPORATED Cash Budget (in millions) 187 360 Q4 $ 477 391 320 Q2 432 388 Q3 513 617 Q4 477 391arrow_forwardNikularrow_forwardAgarwal, Incorporated, has a 32-day average collection period and wants to maintain a minimum cash balance of $20 million, which is what the company currently has on hand. The company currently has a receivables balance of $245 million and has developed the following sales and cash disbursement budgets (in millions): Sales Total cash disbursement Beginning receivables Sales Cash collections Ending receivables Total cash collections Total cash disbursements Net cash inflow 01 $ 400 332 Beginning cash balance Net cash inflow Ending cash balance Minimum cash balance Cumulative surplus (deficit) 02 $ 502 443 Complete the following cash budget for the company. Note: A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answers to the nearest whole number, e.g., 32. Q1 Q3 $ 608 779 AGARWAL, INCORPORATED Cash Budget (in millions) 400 04 $ 568 471 332 Q2 502 443 Q3 608 779 Q4 568 471arrow_forward

- Agarwal, Incorporated, has a 40-day average collection period and wants to maintain a minimum cash balance of $30 million, which is what the company currently has on hand. The company currently has a receivables balance of $200 million and has developed the following sales and cash disbursement budgets (in millions): Q1 Q2 $ 477 $ 549 Total cash disbursement 349 Complete the following cash budget for the company. Note: A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answers in millions rounded to the nearest whole million dollar amount, e.g., 32. Sales 491 Q3 $ 630 754 Q4 $ 594 488arrow_forwardDo not give solution in imagearrow_forwardCash Management. A firm maintains a separateaccount for cash disbursements. Total disbursementsare $100,000 per month, spread evenly over the month.Administrative and transaction costs of transferringcash to the disbursement account are $10 per transfer.Marketable securities yield 1% per month. Determinethe size and number of transfers that will minimizethe cost of maintaining the special account. (LO4)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT