Managerial Accounting

15th Edition

ISBN: 9781337912020

Author: Carl Warren, Ph.d. Cma William B. Tayler

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Question

D

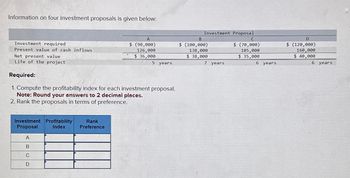

Transcribed Image Text:Information on four investment proposals is given below:

Investment Proposal

C

$ (70,000)

105,000

$ 35,000

6 years

D

$ (120,000)

160,000

$ 40,000

6 years

A

B

Investment required

Net present value.

Present value of cash inflows

$ (90,000)

126,000

$ 36,000

$ (100,000)

138,000

$ 38,000

Life of the project

5 years

7 years

Required:

1. Compute the profitability index for each investment proposal.

Note: Round your answers to 2 decimal places.

2. Rank the proposals in terms of preference.

Investment Profitability

Proposal

Index

Rank

Preference

A

B

C

D

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Information on four investment proposals is given below: Investment Proposal A В Investment required Present value of cash inflows $ (360,000) $(50,000) $(140,000) $ (840,000) 214, 300 $ 146,900 $ 17,600 $ 74,300 $ 281,400 7 years 506,900 67,600 1,121,400 Net present value Life of the project 5 years 6 years б уears Required: 1. Compute the project profitability index for each investment proposal. (Round your answers to 2 decimal places.) 2. Rank the proposals in terms of preference.arrow_forwardPlease help! Thank youarrow_forwardnformation on four investment proposals is given below: Investment Proposal A B C D Investment required $ (94,000 ) $ (104,000 ) $ (74,000 ) $ (126,000 ) Present value of cash inflows 141,000 153,920 100,640 194,040 Net present value $ 47,000 $ 49,920 $ 26,640 $ 68,040 Life of the project 5 years 7 years 6 years 6 years Required: 1. Compute the project profitability index for each investment proposal. (Round your answers to 2 decimal places.) 2. Rank the proposals in terms of preference. Investment Proposal Project Profitability Index Rank Preference A ____________ Second B ____________ Third C ____________ Fourth D ____________ Firstarrow_forward

- Information on four investment proposals is given below: Investment Proposal A B C D Investment required $ (330,000) $ (40,000) $ (190,000) $ (2,380,000) Present value of cash inflows 480,000 56,500 286,700 3,178,500 Net present value $ 150,000 $ 16,500 $ 96,700 $ 798,500 Life of the project 5 years 7 years 6 years 6 years Required: 1. Compute the profitability index for each investment proposal. (Round your answers to 2 decimal places.) 2. Rank the proposals in terms of preference.arrow_forwardInformation on four investment proposals is provided below: Investment Proposal A B C D Investment required $ (45,000 ) $ (50,000 ) $ (35,000 ) $ (60,000 ) Present value of cash inflows 65,000 45,000 53,000 80,000 Net present value $ 20,000 $ (5,000 ) $ 18,000 $ 20,000 Life of the project 5 years 7 years 6 years 8 years Required: 1. Compute the profitability index for each investment proposal. (Round your answers to 2 decimal places.) 2. Rank the proposals in terms of preference. multiple choice D C B A B C A D C A D B A B C Darrow_forwardnformation on four investment proposals is given below: Investment Proposal A B C D Investment required $ (900,000) $ (170,000) $ (90,000) $ (1,430,000) Present value of cash inflows 1,263,600 233,400 136,500 1,908,300 Net present value $ 363,600 $ 63,400 $ 46,500 $ 478,300 Life of the project 5 years 7 years 6 years 6 years Required: 1. Compute the profitability index for each investment proposal. (Round your answers to 2 decimal places.) 2. Rank the proposals in terms of preference.arrow_forward

- All information is providedarrow_forwardiarrow_forwardInformation on four investment proposals is given below: Investment required Present value of cash inflows Net present value Life of the project Investment Profitability Index Proposal A B с D A $ (60,000) 88,000 $ 28,000 5 years Required: 1. Compute the profitability index for each investment proposal. (Round your answers to 2 decimal places.) 2. Rank the proposals in terms of preference. Rank Preference Investment Proposal с $ (40,000) 64,200 $ 24, 200 B $ (70,000) 97,300 $ 27,300 7 years 6 years D $ (990,000) 1,318,700 $ 328,700 6arrow_forward

- Vinubhaiarrow_forwardSubject- accountarrow_forwardThe management of Riker Inc. is exploring five different investment opportunities. Information on the five projects under study follow Project Number Investment required Present value of cash inflows at a 10% discount rate Net present value Life of the project Project 1 2 3 4 5 Profitability Index 1 2 3 $(390,000) $(330,000) $(350,000) 478,490 396,950 $ 88,490 $ 66,950 6 years 3 years First preference Second preference 433,190 $ (83,190) 5 years The company's required rate of return is 10%; thus, a 10% discount rate has been used in the preceding present value computations. Limited funds are available for investment, and so the company cannot accept all of the available projects. Third preference Fourth preference Fifth preference 4 $(330,000) Required: 1. Compute the profitability Index for each investment project. (Round your answers to 2 decimal places.) 300, 100 $ 29,900 12 years 5 $(480,000) 562,860 $82,860 6 years 2. Rank the five projects according to preference, in terms of (a)…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning