FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

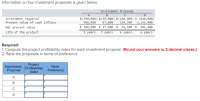

Transcribed Image Text:Information on four investment proposals is given below:

Investment Proposal

A

В

Investment required

Present value of cash inflows

$ (360,000) $(50,000) $(140,000) $ (840,000)

214, 300

$ 146,900 $ 17,600 $ 74,300 $ 281,400

7 years

506,900

67,600

1,121,400

Net present value

Life of the project

5 years

6 years

б уears

Required:

1. Compute the project profitability index for each investment proposal. (Round your answers to 2 decimal places.)

2. Rank the proposals in terms of preference.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- All information is providedarrow_forwardConsider two investments A and B with the following sequences of cash flows: Net Cash Flow n Project A Project B 0 -$120,000 -$100,000 1 20,000 15,000 2 20,000 15,000 3 120,000 130,000 (a) Compute the IRR for each investment. (b) At MARR = 15%, determine the acceptability of each project. (c) If A and B are mutually exclusive projects, which project would you select, based on the rate of return on incremental investment?arrow_forwardInformation on four investment proposals is given below. Investment required Present value of cash inflows Net present value Life of the project Required: 1 Compute the profitability index for each investment proposal. Note: Round your answers to 2 decimal places. 2. Rank the proposals in terms of preference Investment Profitability Proposal Index A B C D S (150,000) 211,800 $61,500 Rank Preference 5 years Investment Proposal $(80,000) 110,400 $ 30,400 7 years $ (160,000) 241,600 $ 81,600 6 years D $ (910,000) 1.214,500 $ 304,500 6 yearsarrow_forward

- a. Calculate the net present value of the following project for discount rates of o, 50, and 100%: Co -6,750 b. What is the IRR of the project? Cash Flows ($) C₁ +4,500 C₂ +18,000arrow_forwardnformation on four investment proposals is given below: Investment Proposal A B C D Investment required $ (900,000) $ (170,000) $ (90,000) $ (1,430,000) Present value of cash inflows 1,263,600 233,400 136,500 1,908,300 Net present value $ 363,600 $ 63,400 $ 46,500 $ 478,300 Life of the project 5 years 7 years 6 years 6 years Required: 1. Compute the profitability index for each investment proposal. (Round your answers to 2 decimal places.) 2. Rank the proposals in terms of preference.arrow_forwardValuation Problem Calculate NPV and IRR for the following investment. Initial investment = $1,000,000 machine, the project term is 6 years, ncf yr 1 = 387,160 ncf yr 2 = 459,460 ncf yr 3 = 465,322 ncf yr 4 = 481,725 ncf yr 5 = 506,617 ncf yr 6 = 269.200 and the discount rate is 12%.arrow_forward

- Find internal rate of return of a project with an initial cost of $43,000, expected net cash inflows of $9,550 per year for 8 years, and a cost of capital of 10.50%.Round your answer to two decimal places. For example, if your answer is $345.667 round as 345.67 and if your answer is .05718 or 5.718% round as 5.72. Group of answer choices 15.05% 14.60% 14.90% 16.24% 17.73%arrow_forwardExercise 24-10 (Algo) Net present value, unequal cash flows, and profitability Index LO P3 Following is information on two alternative investment projects being conside return from its investments. (PV of $1, FV of $1. PVA of $1, and FVA of $1) Note: Use appropriate factor(s) from the tables provided. y Tiger Company. The company requires a 4% Initial investment Project X1 $ (130,000) Project X2 $ (220,000) Net cash flows in: Year 1 Year 2 Year 3 50,000 97,500 60,500 87,500 85,500 77,500 a. Compute each project's net present value. b. Compute each project's profitability index. c. If the company can choose only one project, which should it choose on the basis of profitability index? Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required A Required B Required C Compute each project's net present value. Note: Round your final answers to the nearest dollar. Net Cash Flowe Present Value of 1 at 4% Present Value of Net Cash…arrow_forwardes Assume an investment has cash flows of -$105,000, $140,000, $200,000, and $485,000 for Years 0 to 3, respectively. What is the NPV if the required return is 13.5 percent? Should the project be accepted or rejected? Multiple Choice $501,656; reject $533,466; accept $505,307; rejectarrow_forward

- "Consider the following two mutually-exclusive altematives: Project Alternatives n Project A1 Cash Flows Project A2 Cash Flows 0-514,000 1+$4,000 - $17,000 $21,000 2- 54,000 3-$12,000 If MARR=15% and assuming indefinite required service and repeatability, use the incremental NPV and IRR analyses in parts (a) and (b) of the problem, respectively, to choose the project in part (c). Please note that project alternatives A7 and A2 have different lives, namely three years for A1 and one year for A2. The alternatives should be compared over the same period, so project A2 will have to be repeated twice." axThe Net Present Value of the incremental investment is: YbrThe rternal Rate of Retun of the incremental investment is: (oWe shoulo choose project alternative: Note: Please enrer your onswvers to two decimal places. If using the interest factor method, apply the value of the factor os presented in the table or spreocsheet (with all four decimal places).arrow_forwardYou are considering investing in a project with an initial outlay of $50,000 and the following year end net cash flows; Yr1: $17,000, Yr2: $17,000, Yr3: $12,000, Yr4: $12,000, Yr5: $9,000. Calculate the project’s IRR Group of answer choices 14% 13% 12% 11%arrow_forwardMutually exclusive projects and NPV you have been assigned the task of evaluating two mutually exclusive projects with the following projected cash flows. year. Project A (cash flow) Project B 0 $(102,000) $(102,000) 1 31,000 0 2 31,000 0 3 31,000 0 4 31,000 0 5 31,000 240,000 if the appropriate discount rate on these is 11 percent, which would be chosen and why? the NPV of project A is $arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education