Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

1

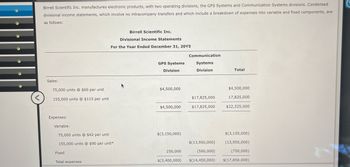

Transcribed Image Text:Birrell Scientific Inc. manufactures electronic products, with two operating divisions, the GPS Systems and Communication Systems divisions. Condensed

divisional income statements, which involve no intracompany transfers and which include a breakdown of expenses into variable and fixed components, are

as follows:

Birrell Scientific Inc.

Divisional Income Statements

For the Year Ended December 31, 20Y5

Communication

GPS Systems

Division

Systems

Division

Total

Sales:

75,000 units @ $60 per unit

$4,500,000

$4,500,000

<

155,000 units @ $115 per unit

$17,825,000

17,825,000

$4,500,000

$17,825,000

$22,325,000

Expenses:

Variable:

75,000 units @ $42 per unit

$(3,150,000)

$(3,150,000)

155,000 units @ $90 per unit*

$(13,950,000)

(13,950,000)

Fixed

250,000

(500,000)

(750,000)

Total expenses

$(3,400,000)

$(14,450,000)

$(17,850,000)

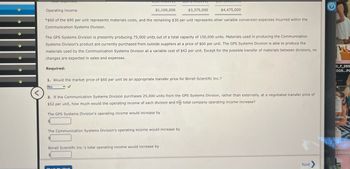

Transcribed Image Text:Operating income

$1,100,000

$3,375,000

$4,475,000

*$60 of the $90 per unit represents materials costs, and the remaining $30 per unit represents other variable conversion expenses incurred within the

Communication Systems Division.

The GPS Systems Division is presently producing 75,000 units out of a total capacity of 150,000 units. Materials used in producing the Communication

Systems Division's product are currently purchased from outside suppliers at a price of $60 per unit. The GPS Systems Division is able to produce the

materials used by the Communication Systems Division at a variable cost of $42 per unit. Except for the possible transfer of materials between divisions, no

changes are expected in sales and expenses.

Required:

1. Would the market price of $60 per unit be an appropriate transfer price for Birrell Scientific Inc.?

No

<

2. If the Communication Systems Division purchases 25,000 units from the GPS Systems Division, rather than externally, at a negotiated transfer price of

$52 per unit, how much would the operating income of each division and the total company operating income increase?

The GPS Systems Division's operating income would increase by

The Communication Systems Division's operating income would increase by

Birrell Scientific Inc.'s total operating income would increase by

Chaal Mode

Next

t>

0_F_265

DG5...PC

ndlin_Re

ne

ion for

3350.pdf

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Garcon Inc. manufactures electronic products, with two operating divisions, Consumer and Com- mercial. Condensed divisional income statements, which involve no intracompany transfers and which include a breakdown of expenses into variable and fixed components, are as follows: Garcon Inc. Divisional Income Statements For the Year Ended December 31, 20Y2 Consumer Division Commercial Division Total Sales: 14,400 units x $144 per unit $ 2,073,600 $ 2,073,600 21,600 units x $275 per unit $ 5,940,000 5,940,000 $ 2,073,600 $ 5,940,000 $ 8,013,600 Total sales Expenses: Variable: 14,400 units x $104 per unit $(1,497,600) S(1,497,600) 21,600 units x $193" per unit $(4,168,800) (4,168,800) Fixed (200,000) (520,000) (720,000) Total expenses $(1,697,600) $(4,688,800) $(6,386,400) $ 376,000 $ 1,251,200 $ 1,627,200 Operating income *5150 ot the $193 per unit represents materials costs, and the remaining 543 per unit represents other variable conversion expenses incurred within the Commercial…arrow_forwardExoplex Industries Inc. is a diversified aerospace company, including two operating divisions, Semiconductors and Navigational Systems. Condensed divisional income statements, which involve no intracompany transfers and include a breakdown of expenses into variable and fixed components, are as follows: Exoplex Industries Inc.Divisional Income StatementsFor the Year Ended December 31, 20Y8 SemiconductorsDivision NavigationalSystemsDivision Total Sales: 2,240 units × $396 per unit $887,040 $887,040 3,675 units × $590 per unit $2,168,250 2,168,250 Total sales $887,040 $2,168,250 $3,055,290 Expenses: Variable: 2,240 units × $232 per unit $(519,680) $(519,680) 3,675 units × $472* per unit $(1,734,600) (1,734,600) Fixed (220,000) (325,000) (545,000) Total expenses $(739,680) $(2,059,600) $(2,799,280) Operating income $147,360 $108,650…arrow_forwardNeelon Corporation has two divisions: Southern Division and Northern Division. The following data are for the most recent operating period: Sales Variable expenses Traceable fixed expenses Common fixed expense Total Company Southern Division $ 418,000 $ 193,000 $ 130,880 $ 79,130 $ 186,000 $ 77,000 $ 79,420 $ 36,670 Northern Division $ 225,000 $ 51,750 $ 109,000 $ 42,750 The common fixed expenses have been allocated to the divisions on the basis of sales. What is the company's overall net operating income if it operates at the break-even points for its two divisions? Multiple Choice $(79,420) $21,700 $(265,420) $0arrow_forward

- Neelon Corporation has two divisions: Southern Division and Northern Division. The following data are for the most recent operating period: Total Company Southern Division Northern Division Sales $ 301,300 $ 167,900 $ 133,400 Variable expenses $ 112,125 $ 58,765 $ 53,360 Traceable fixed expenses $ 169,600 $ 57,200 $ 112,400 Common fixed expense $ 60,260 $ 33,580 $ 26,680 The common fixed expenses have been allocated to the divisions on the basis of sales. The Northern Division’s break-even sales is closest to: (Round your intermediate calculations to 2 decimal places.)arrow_forwardGREEN COMPANY has two divisions: Del Sur Division and Del Norte Division. The following data are for the most recent operating period: Total Company Del Sur Division Del Norte DivisionSales P 418,000 P 193,000 P 225,000 Variable expenses P 130,880 P 79,130 P 51,750 Traceable fixed expenses P 186,000 P 77,000 P 109,000 Common fixed expense P 79,420 P 36,670 P 42,750 The bookkeeper allocated common fixed expenses to the divisions on the basis of sales. Required: a. What is the company's overall break-even sales? b. Determine the break-even point for Del Sur Division c. Determine the break-even point for Del Norte Division.arrow_forwardThe following data is for a company that produces a single product. selling price 24 193 Units in beginning inventory Units produced Units sold 3,090 2,910 variable costs per unit: Direct materials 53 Direct labor $ 24 59 Variable manufacturing overhead variable selling and administrative expense Fixed costs: 15 13 Fixed manufacturing overhead Fixed selling and administrative $ 89,610 $ $,730 Requlred: a. What Is the unit product cost for the month under varlable costing? b. What is the unit product cost for the month under absorption costing? c. Prepare a contribution format income statement for the month using varlable costing. d. Prepare an Income statement for the month using absorption costing. e. Reconcile the varlable costing and absorption costing net operating incomes for the month. Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D Required E Reconcile the variable costing and absorption costing net operating incomes…arrow_forward

- Clouthier Corporation has two divisions: Home Division and Commercial Division. The following report is for the most recent operating period: Total Company Home Division Commercial Division Sales $ 572, 000 $ 268, 000 $ 304, 000 Variable expenses $ 205, 790 $ 88, 360 $ 117, 430 Traceable fixed expenses $ 203, 000 $ 91, 000 $ 112, 000 The company's common fixed expenses total $62, 700. Required: What is the Home Division's break - even in sales dollars? What is the Commercial Division's break - even in sales dollars? What is the company's overall break - even in sales dollars? Note: Round intermediate calculations to three decimal places.arrow_forwardDacker Products is a division of a major corporation. The following data are for the most recent year of operations: Sales$ 37,880,000Net operating income$ 3,508,960Average operating assets$ 9,400,000The company's minimum required rate of return14% The division's residual income is closest to:arrow_forwardJemmott Corporation has two divisions: Western Division and Eastern Division. The following report is for the most recent operating period: Total Company Western Division Sales Variable expenses Contribution margin Traceable fixed expenses Segment margin Common fixed expenses Net operating income Eastern Division $ 406,000 $ 188,000 $ 218,000 111,880 63,920 47,960 294,120 124,080 170,040 191,000 85,000 106,000 103,120 39,080 64,040 69,020 31,960 37,060 $ 34,100 $ 7,120 $ 26,980 The common fixed expenses have been allocated to the divisions on the basis of sales. The company's overall break-even sales is closest to: Multiple Choice $94,243 $271,743 $264,685 $358,929arrow_forward

- The sales, income from operations, and invested assets for each division of Grosbeak Company are as follows: Sales Income fromOperations InvestedAssets Division E $5,000,000 $550,000 $2,400,000 Division F 4,800,000 860,000 2,500,000 Division G 7,000,000 860,000 2,900,000 a. Using the DuPont formula, determine the profit margin, investment turnover, and rate of return on investment for each division. Round profit margin to two decimal places, investment turnover to four decimal places and rate of return on investment to one decimal place. Division E Division F Division G Profit Margin % % % Investment Turnover Rate of return on investment % % % b. Which division is the most profitable per dollar invested?arrow_forwardDelisa Corporation has two divisions: Division L and Division Q. Data from the most recent month appear below: Total Company Division L Division QSales $ 517,000 $ 156,000 $ 361,000 Variable expenses 255,960 82,680 173,280 Contribution margin 261,040 73,320 187,720 Traceable fixed expenses 171,000 49,000 122,000 Segment margin 90,040 $ 24,320 $ 65,720 Common fixed expenses 87,890 Net operating income $ 2,150 The break-even in sales dollars for Division Q is closest to:arrow_forwardVernon transport company divides its operations into four divisions. A recent statement for its West Division folows Vernon Transport Comapny Wesy division Income Statement for year 3 Revenue $670,000 Salaries for drivers (520,000) Fuel expenses (67,000) Insurance (87,000) Division-level facility- sustaining costs (57,000) Companywide facility-sustaining costs (147,000) Net loss $208,000 Required a) By how much would cormpanywide income increase or decrease if West Division is estimated? Should West Division be eliminated? b) assume that West Division is able to increase its revenue to $760,000 by raising its prices. Determine the amount of the increase or decrease that would occur in companywide net income if the segemnt were eliminated. Should West Division be eliminated if revenue were $760,000? c) What is the mininum amount of revenue required to Jusify continuing the operation of West Divison? Complete this question by entering your answer in the table below. Income Would…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning