Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

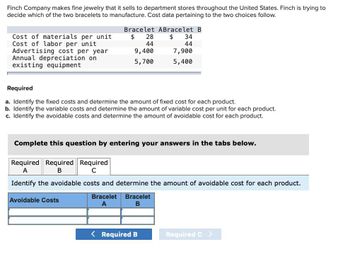

Transcribed Image Text:Finch Company makes fine jewelry that it sells to department stores throughout the United States. Finch is trying to

decide which of the two bracelets to manufacture. Cost data pertaining to the two choices follow.

Bracelet ABracelet B

Cost of materials per unit

$

28

$ 34

Cost of labor per unit

44

44

Advertising cost per year

9,400

7,900

Annual depreciation on

5,700

5,400

existing equipment

Required

a. Identify the fixed costs and determine the amount of fixed cost for each product.

b. Identify the variable costs and determine the amount of variable cost per unit for each product.

c. Identify the avoidable costs and determine the amount of avoidable cost for each product.

Complete this question by entering your answers in the tabs below.

Required Required Required

A

B

C

Identify the avoidable costs and determine the amount of avoidable cost for each product.

Avoidable Costs

Bracelet Bracelet

A

B

< Required B

Required C >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Boyle Company makes fine jewelry that it sells to department stores throughout the United States. Boyle is trying to decide which of the two bracelets to manufacture. Cost data pertaining to the two choices follow: Bracelet A Bracelet B Cost of materials per unit Cost of labor per unit Advertising cost per year $ 10 $ 20 15 15 5,000 5,000 3,000 Annual depreciation on existing equipment 4,000 Required a. Identify the fixed costs and determine the amount of fixed cost for each product. b. Identify the variable costs and determine the amount of variable cost per unit for each product. c. Identify the avoidable costs and determine the amount of avoidable cost for each product.arrow_forward4arrow_forwardAdams Company makes fine jewelry that it sells to department stores throughout the United States. Adams is trying to decide which of the two bracelets to manufacture. Cost data pertaining to the two choices follow. Cost of materials per unit Cost of labor per unit Advertising cost per year Annual depreciation on existing equipment Required a. Identify the fixed costs and determine the amount of fixed cost for each product. b. Identify the variable costs and determine the amount of variable cost per unit for each product. c. Identify the avoidable costs and determine the amount of avoidable cost for each product. Required A Complete this question by entering your answers in the tabs below. Fixed Costs Required B Total fixed costs Bracelet A $13 42 8,400 5,500 Required C Bracelet B $26 42 Identify the fixed costs and determine the amount of fixed cost for each product. Bracelet A Required A Bracelet B 6,100 5,100 Required B >arrow_forward

- Solve both parts with proper explanationarrow_forwardLook Good Jewels (LGJ) is considering a special order for 30 handcrafted gold bracelets for a wedding. The gold bracelets are to be given as gifts to members of the wedding party. The normal selling price of a gold bracelet is $295.00 and its unit product cost is $214.00, as shown: Materials Direct labour Manufacturing overhead Unit product cost $ 110.00 64.00 40.00 $ 214.00 S The manufacturing overhead is largely fixed and unaffected by variations in how much jewellery is produced in any given period. However, 20% of the overhead is variable with respect to the number of bracelets produced. The customer interested in the special bracelet order would like special filigree applied to the bracelets. This would require additional materials costing $2.00 per bracelet and would also require acquisition of a special tool costing $440 that would have no other use once the special order was completed. This order would have no effect on the company's regular sales, and the order could be…arrow_forwardH1. Accountarrow_forward

- both parts of the questionarrow_forwardImperial Jewelers manufactures and sells a gold bracelet for $402.00. The company's accounting system says the unit product cost for this bracelet is $270.00, as shown below: Direct materials Direct labor Manufacturing overhead Unit product cost $ 150 84 36 $ 270 A wedding party has approached Imperial Jewelers about buying 25 gold bracelets for the discounted price of $362.00 each. The wedding party would like special filigree applied to the bracelets that would increase the direct materials cost per bracelet by $5. Imperial Jewelers would have to buy a special tool for $458 to apply the filigree to the bracelets. The special tool would have no other use once the special order is completed. To analyze this special order, Imperial Jewelers determined most of its manufacturing overhead is fixed and unaffected by variations in how much jewelry is produced in any given period. However, $6.00 of the overhead is variable with respect to the number of bracelets produced. The company also…arrow_forwardImperial Jewelers manufactures and sells a gold bracelet for $404.00. The company's accounting system says the unit product cost for this bracelet is $267.00, as shown below: Direct materials Direct labor Manufacturing overhead Unit product cost $148 82 37 $ 267 A wedding party has approached Imperial Jewelers about buying 29 gold bracelets for the discounted price of $364.00 each. The wedding party would like special filigree applied to the bracelets that would increase the direct materials cost per bracelet by $10. Imperial Jewelers would have to buy a special tool for $465 to apply the filigree to the bracelets. The special tool would have no other use once the special order is completed. To analyze this special order, Imperial Jewelers determined most of its manufacturing overhead is fixed and unaffected by variations in how much jewelry is produced in any given period. However, $11.00 of the overhead is variable with respect to the number of bracelets produced. The company also…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College