FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

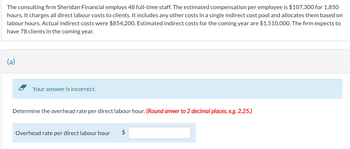

Transcribed Image Text:The consulting firm Sheridan Financial employs 48 full-time staff. The estimated compensation per employee is $107,300 for 1,850

hours. It charges all direct labour costs to clients. It includes any other costs in a single indirect cost pool and allocates them based on

labour hours. Actual indirect costs were $854,200. Estimated indirect costs for the coming year are $1,510,000. The firm expects to

have 78 clients in the coming year.

(a)

Your answer is incorrect.

Determine the overhead rate per direct labour hour. (Round anwer to 2 decimal places, e.g. 2.25.)

Overhead rate per direct labour hour $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Henkes Corporation bases its predetermined overhead rate on the estimated labor-hours for the upćoming year. At the beginning of the most recently completed year, the company estimated the labor-hours for the upcoming year at 80,000 labor-hours. The estimated variable manufacturing overhead was $10.70 per labor-hour and the estimated total fixed manufacturing overhead was $1,440,000. The actual labor-hours for the year turned out to be 84,000 labor-hours. Required: Compute the company's predetermined overhead rate for the recently completed year. (Round your answer to 2 decimal places.) Predetermined overhead rate per labor-hourarrow_forwardCullumber Company estimates that annual manufacturing overhead costs will be $768,000. Estimated annual operating activity bases are: direct labor cost $588,800, direct labor hours 40,000 and machine hours 80,000. The actual manufacturing overhead cost for the year was $769,280 and the actual direct labor cost for the year was $583,680. Actual direct labor hours totaled 39,800 and machine hours totaled 79,000. Cullumber applies overhead based on direct labor hours. Compute the predetermined overhead rate and determine the amount of manufacturing overhead applied. Determine if overhead is over- or underapplied and the amount. (Round predetermined overhead rate to 2 decimal places, e.g. 15.25 and all other answers to O decimal places, e.g. 1,525.) Predetermined overhead rate $ Manufacturing overhead applied $ $ per direct labor hourarrow_forwardGibson Manufacturing Co. expects to make 30,800 chairs during the year 1 accounting period. The company made 3,300 chairs in January. Materials and labor costs for January were $17,800 and $24,500, respectively. Gibson produced 1,400 chairs in February. Material and labor costs for February were $9,400 and $12,900, respectively. The company paid the $770,000 annual rental fee on its manufacturing facility on January 1, year 1. The rental fee is allocated based on the total estimated number of units to be produced during the year. Required Assuming that Gibson desires to sell its chairs for cost plus 25 percent of cost, what price should be charged for the chairs produced in January and February? (Round intermediate calculations and final answers to 2 decimal places.)arrow_forward

- Your Corporation uses a predetermined overhead rate based on direct labor hours to apply manufacturing overhead to jobs. Last year, the company's estimated manufacturing overhead was $1,200,000 and its estimated level of activity was 50,000 direct labor-hours. The company's direct labor wage rate is $12 per hour. Actual manufacturing overhead amounted to $1,240,000, with actual direct labor cost of $650,000. By how much was manufacturing overhead overapplied or underapplied?arrow_forwardCavy Company estimates that the factory overhead for the following year will be $2,829,000. The company has determined that the basis for applying factory overhead will be machine hours, which is estimated to be 34,500 hours. There are 4,690 machine hours for all of the jobs in the month of April. What amount will be applied to all of the jobs for the month of April?arrow_forwardPocono Cement Forms expects $700,000 in overhead during the next year. It does not know whether it should apply overhead on the basis of its anticipated direct labor hours of 50,000 or its expected machine hours of 25,000. Determine the product cost under each predetermined allocation rate if the last job incurred $1,560 in direct material cost, 102 direct labor hours, and 85 machine hours. Wages are paid at $15 per hour. Labor Hours Machine Hours Cost of the job $ $arrow_forward

- Thornton Construction Company expects to build three new homes during a specific accounting period. The estimated direct materials and labor costs are as follows. Expected Costs Home 1 Home 2 Home 3 Direct labor $ 66,000 $ 100,000 $ 178,000 Direct materials 109,000 139,000 181,000 Assume Thornton needs to allocate two major overhead costs ($51,600 of employee fringe benefits and $30,030 of indirect materials costs) among the three jobs.RequiredChoose an appropriate cost driver for each of the overhead costs and determine the total cost of each house. (Round "Allocation rate" to 2 decimal places.)arrow_forwardA worker takes 13 hours to complete a work on daily wages and 8 hours on a scheme of þayment by results. The worker's day rate is P90 per hour. The cost of material of the product is P300 and the overheads are recovered at 200% of the total wages. The company has an incentive plan of giving bonus for the time saved in a certain job. Bonus is computed as time saved over time allowed to complete the job multiplied by the time taken by the worker multiplied by the rate per hour. Mr. X completed the job within 8 hours including a 30-minute idle time. How much is the wage of Mr. X?arrow_forwardStuart Corporation expects to incur indirect overhead costs of $102,000 per month and direct manufacturing costs of $13 per unit. The expected production activity for the first four months of the year are as follows. Estimated production in units Required a. Calculate a predetermined overhead rate based on the number of units of product expected to be made during the first four months of the year. b. Allocate overhead costs to each month using the overhead rate computed in Requirement a. c. Calculate the total cost per unit for each month using the overhead allocated in Requirement b. Required A Required B Complete this question by entering your answers in the tabs below. January February March 4,500 8,200 5,000 Required C Predetermined overhead rate $ Answer is complete but not entirely correct. Calculate a predetermined overhead rate based on the number of units of product expected to be made during the first four months of the year. April 6,300 4 X per unit Required A Required B >arrow_forward

- Subject:arrow_forwardAdams Corporation estimated its overhead costs would be $23,000 per month except for January when it pays the $179,400 annual insurance premium on the manufacturing facility. Accordingly, the January overhead costs were expected to be $202,400 ($179,400 + $23,000). The company expected to use 7,700 direct labor hours per month except during July, August, and September when the company expected 9,900 hours of direct labor each month to build inventories for high demand that normally occurs during the Christmas season. The company's actual direct labor hours were the same as the estimated hours. The company made 3,850 units of product in each month except July, August, and September, in which it produced 4,950 units each month. Direct labor costs were $23.80 per unit, and direct materials costs were $11.50 per unit. Required a. Calculate a predetermined overhead rate based on direct labor hours. b. Determine the total allocated overhead cost for January, March, and August. c. Determine…arrow_forwardCustom Engines Company has the following estimated costs for the upcoming year: Direct labor costs $62,800 Direct materials used $25,600 Salary of factory supervisor $37,800 Sales commissions $8300 Heating and lighting costs for factory $22,900 Depreciation on factory equipment $5500 Advertising expense $33,100 The company estimates that 2000 direct labor hours will be worked in the upcoming year, while 2800 machine hours will be used during the year. The predetermined manufacturing overhead rate per direct labor hour is closest toarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education