FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

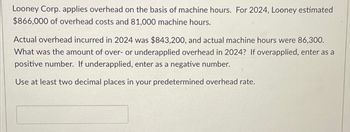

Transcribed Image Text:Looney Corp. applies overhead on the basis of machine hours. For 2024, Looney estimated

$866,000 of overhead costs and 81,000 machine hours.

Actual overhead incurred in 2024 was $843,200, and actual machine hours were 86,300.

What was the amount of over- or underapplied overhead in 2024? If overapplied, enter as a

positive number. If underapplied, enter as a negative number.

Use at least two decimal places in your predetermined overhead rate.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- During 2019, Sheridan Company expected Job no. 59 to cost $200000 of overhead, $500000 of materials, and $100000 in labor. Sheridan applied overhead based on direct labor cost. Actual production required an overhead cost of $195000, $660000 in materials used, and $310000 in labor. All of the goods were completed. How much is the amount of over- or underapplied overhead? $5000 overapplied $5000 underapplied $425000 overapplied $425000 underappliedarrow_forwardDuring 2022, Vaughn Manufacturing estimated that Job No. 26 would incur $300000 of overhead, $500000 of materials, and $200000 in labor. Vaughn applied overhead based on direct labor cost. Actual production required an overhead cost of $340000, $450000 in materials used, and $320000 in labor. All of the goods were completed. What amount was transferred to Finished Goods Inventory? O $1250000 O $1000000 O $1110000 O $970000arrow_forwardAt the end of the year, overhead applied was $3,657,000. Actual overhead was $3,326,000. Closing over/underapplied overhead into Cost of Goods Sold would cause net income toarrow_forward

- Miguel Manufacturing Company uses a predetermined manufacturing overhead rate based on direct labor hours. At the beginning of 2023, they estimated total manufacturing overhead costs at $2,352,000, and they estimated total direct labor hours at 7,000. The administration and selling overheads are to be absorbed in each job cost at 15% of prime cost. Distribution cost should be added to each job according to quotes from outside carriage companies. The company wishes to quote for job # 222. Job stats are as follows: Direct Materials $173,250 Direct Labour Cost $240,000 Direct Labour Hours 500 hours Special Design Cost $8,750 Distribution quote from haulage company $21,700 Units of product produced 400 cartons Compute Miguel’s Manufacturing Company predetermined manufacturing overhead rate for 2023.arrow_forwardA company estimated 112,500 direct labor hours and $835,635 in overhead. The actual overhead was $881,112, and there were 106,132 direct labor hours. How much is overhead under- or over- applied? Round to the nearest penny, two decimal places. Enter an overapplied overhead as a negative amount. For example, if it is overapplied by 500.00, the input would be -500.00 do not use parenthesis.arrow_forwardA company expected its annual overhead costs to be $813200 and machine hours to equal 107000 hours. Actual overhead was $749000, and actual machine hours totalled 98000 hours. How much overhead was over or underapplied? $4200 underapplied O $68400 underapplied O $69000 over-applied O $64400 underappliedarrow_forward

- Manufacturing overhead was estimated to be OMR 200,000 for the year along with 20,000 direct labor hours. Actual manufacturing overhead was OMR 215,000, and actual labor hours were 21,000. Which of the following would be correct? Overhead is underapplied by OMR 15,000. a. O b. None of the given answer is correct Overhead is underapplied by OMR 5,000. O c. O d. Overhead is overapplied by OMR 5.00O. De. Overhead is overapplied by OMR 15.000. NEXT DAGEarrow_forward???arrow_forwardDuring 2022, Carla Vista Company incurred the following direct labor costs: January $19,200 and February $28,800. Carla Vista uses a predetermined overhead rate of 120% of direct labor cost. Estimated-overhead for the 2 months, respectively, totaled $18,720 and $34,272. Actual overhead for the 2 months, respectively, totaled $24,000 and $32,160. Calculate overhead applied. January February $ Determine if overhead is over- or underapplied for each of the two months and the respective amounts. January $ February Iarrow_forward

- please explain in stepsarrow_forwarda) Compute Everlast Manufacturing Company predetermined manufacturing overhead rate for 2020. b) Determine how much manufacturing overhead was allocated to Job #B4000? c) Calculate the total cost & quotation price of Job #B4000, given that a margin of 20% is applied.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education