Financial Accounting

15th Edition

ISBN: 9781337272124

Author: Carl Warren, James M. Reeve, Jonathan Duchac

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Based on the above information, calculate the amount that should appear on Harris's

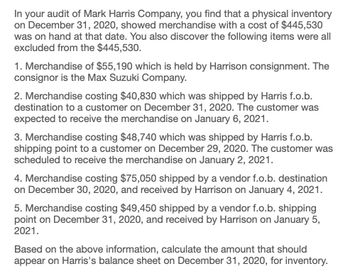

Transcribed Image Text:In your audit of Mark Harris Company, you find that a physical inventory

on December 31, 2020, showed merchandise with a cost of $445,530

was on hand at that date. You also discover the following items were all

excluded from the $445,530.

1. Merchandise of $55,190 which is held by Harrison consignment. The

consignor is the Max Suzuki Company.

2. Merchandise costing $40,830 which was shipped by Harris f.o.b.

destination to a customer on December 31, 2020. The customer was

expected to receive the merchandise on January 6, 2021.

3. Merchandise costing $48,740 which was shipped by Harris f.o.b.

shipping point to a customer on December 29, 2020. The customer was

scheduled to receive the merchandise on January 2, 2021.

4. Merchandise costing $75,050 shipped by a vendor f.o.b. destination

on December 30, 2020, and received by Harrison on January 4, 2021.

5. Merchandise costing $49,450 shipped by a vendor f.o.b. shipping

point on December 31, 2020, and received by Harrison on January 5,

2021.

Based on the above information, calculate the amount that should

appear on Harris's balance sheet on December 31, 2020, for inventory.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Selected data on merchandise inventory, purchases, and sales for Celebrity Tan Co. and Ranchworks Co. are as follows: Instructions 1. Determine the estimated cost of the merchandise inventory of Celebrity Tan Co. on August 31 by the retail method, presenting details of the computations. 2. a. Estimate the cost of the merchandise inventory of Ranchworks Co. on November 30 by the gross profit method, presenting details of the computations. b. Assume that Ranchworks Co. took a physical inventory on November 30 and discovered that 369,750 of merchandise was on hand. What was the estimated loss of inventory due to theft or damage during March through November?arrow_forwardSelected data on merchandise inventory, purchases, and sales for Jaffe Co. and Coronado Co. are as follows: Instructions 1. Determine the estimated cost of the merchandise inventory of Jaffe Co. on February 28 by the retail method, presenting details of the computations. 2. a. Estimate the cost of the merchandise inventory of Coronado Co. on October 31 by the gross profit method, presenting details of the computations. b. Assume that Coronado Co. took a physical inventory on October 31 and discovered that 366,500 of merchandise was on hand. What was the estimated loss of inventory due to theft or damage during May through October?arrow_forwardThe following data were extracted from the accounting records of Harkins Company for the year ended April 30, 2019: a. Prepare the cost of merchandise sold section of the income statement for the year ended April 30, 2019, using the periodic inventory system. b. Determine the gross profit to be reported on the income statement for the year ended April 30, 2019. c. Would gross profit be different if the perpetual inventory system was used instead of the periodic inventory system?arrow_forward

- In your audit of James Smith Company, you find that a physical inventory on December 31, 2020, showed merchandise with a cost of $449,390 was on hand at that date. You also discover the following items were all excluded from the $449,390. 1. 2. 3. 4. 5. Merchandise of $61,150 which is held by Smith on consignment. The consignor is the Max Suzuki Company. Merchandise costing $36,420 which was shipped by Smith f.o.b. destination to a customer on December 31, 2020. The customer was expected to receive the merchandise on January 6, 2021. Merchandise costing $47,720 which was shipped by Smith f.o.b. shipping point to a customer on December 29, 2020. The customer was scheduled to receive the merchandise on January 2, 2021. Merchandise costing $83,030 shipped by a vendor f.o.b. destination on December 30, 2020, and received by Smith on January 4, 2021. Merchandise costing $49,200 shipped by a vendor f.o.b. shipping point on December 31, 2020, and received by Smith on January 5, 2021. Based on…arrow_forwardIn your audit of Joseph Moore Company, you find that a physical inventory on December 31, 2020, showed merchandise with a cost of $411,580 was on hand at that date. You also discover the following items were all excluded from the $411,580. 1. Merchandise of $60,710 which is held by Moore on consignment. The consignor is the Max Suzuki Company. 2. Merchandise costing $38,360 which was shipped by Moore f.o.b. destination to a customer on December 31, 2020. The customer was expected to receive the merchandise on January 6, 2021. 3. Merchandise costing $46,920 which was shipped by Moore f.o.b. shipping point to a customer on December 29, 2020. The customer was scheduled to receive the merchandise on January 2, 2021. 4. Merchandise costing $82,010 shipped by a vendor f.o.b. destination on December 30, 2020, and received by Moore on January 4, 2021. 5. Merchandise costing $55,300 shipped by a vendor f.o.b. shipping point on December 31, 2020, and received by Moore on…arrow_forwardIn your audit of Thomas Taylor Company, you find that a physical inventory on December 31, 2025, showed merchandise with a cost of $403,730 was on hand at that date. You also discover the following items were all excluded from the $403,730. 1. 2. 3. 4. 5. Merchandise of $61,080 which is held by Taylor on consignment. The consignor is the Max Suzuki Company. Merchandise costing $35,400 which was shipped by Taylor f.o.b. destination to a customer on December 31, 2025. The customer was expected to receive the merchandise on January 6, 2026. Merchandise costing $43,270 which was shipped by Taylor f.o.b. shipping point to a customer on December 29, 2025. The customer was scheduled to receive the merchandise on January 2, 2026. Merchandise costing $84,630 shipped by a vendor f.o.b. destination on December 30, 2025, and received by Taylor on January 4, 2026. Merchandise costing $47,400 shipped by a vendor f.o.b. shipping point on December 31, 2025, and received by Taylor on January 5, 2026.…arrow_forward

- In your audit of Chris Anderson Company, you find that a physical inventory on December 31, 2020, showed merchandise with a cost of $439,750 was on hand at that date. You also discover the following items were all excluded from the $439,750. 1. Merchandise of $63,260 which is held by Anderson on consignment. The consignor is the Max Suzuki Company. Merchandise costing $34,870 which was shipped by Anderson f.o.b. destination to a customer on December 31, 2020. The customer was expected to receive the merchandise on January 6, 2021. 2. 3. Merchandise costing $44,590 which was shipped by Anderson f.o.b. shipping point to a customer on December 29, 2020. The customer was scheduled to receive the merchandise on January 2, 2021. 4. Merchandise costing $76,380 shipped by a vendor f.o.b. destination on December 30, 2020, and received by Anderson on January 4, 2021. 5. Merchandise costing $54,450 shipped by a vendor f.o.b. shipping point on December 31, 2020, and received by Anderson on January…arrow_forwardQuestion 5:In your audit of Garcia Company, you find that a physical inventory on December 31, 2022, showed merchandise with a cost of $439,470 was on hand at that date. You also discover the following items were all excluded from the $439,470. 1. Merchandise of $57,370 which is held by Garcia on consignment. The consignor is the Bontemps Company. 2. Merchandise costing $38,090 which was shipped by Garcia f.o.b. destination to a customer on December 31, 2022. The customer was expected to receive the merchandise on January 6, 2023. 3. Merchandise costing $46,760 which was shipped by Garcia f.o.b. shipping point to a customer on December 29, 2022. The customer was scheduled to receive the merchandise on January 2, 2023. 4. Merchandise costing $85,260 shipped by a vendor f.o.b. destination on December 30, 2022, and received by Garcia on January 4, 2023. 5. Merchandise costing $50,750 shipped by a vendor f.o.b. shipping point on December 31, 2022,…arrow_forwardReggie Company has just completed a physical inventory count at year-end, December 31, 2020. Only the items on the shelves, in storage, and in the receiving area were counted and costed on a FIFO basis. The inventory amounted to $65,000. During the audit, the auditor developed the following additional information: a. Goods costing $750 were being used by a customer on a trial basis and were excluded from the inventory count at December 31, 2020. b. Goods costing $900 were in transit to Reggie on December 31, 2020, with terms F.O.B. destination (explained below). Because these goods had not arrived, they were excluded from the physical inventory count. c. On December 31, 2020, goods in transit to customers, with terms F.O.B. shipping point, amounted to $1,300 (the expected delivery date was January 10, 2021), Because the goods had been shipped, they were excluded from the physical inventory count. d. On December 28, 2020, a customer purchased goods for $2,650 cash and left them "for…arrow_forward

- You have been assigned to examine the financial statements of PC corp. for the year ended December 31, 2021, as prepared following IFRS. You discover the following situations: 1. Physical inventory count on Dec 31, 2021, improperly included merchandise costing $3,800 that had been sold but not delivered until Jan 5, 2022. PC uses a periodic inventory system. 2. Depreciation of $1,700 for 2021 on delivery vehicles was not recorded. 3. A collection of $4,600 on account from a customer received on Dec 31, 2021, was not recorded. 4. At the beginning of 2020, the company purchased equipment for $225,000 (residual value $22,500) and had a useful life of 6 years. The accountant used straight-line amortization but failed to deduct the residual value in the calculation of the depreciation for 2020 and 2021. Instructions: Prepare the required journal entries (if any) to correct PC accounts, assuming each transaction is independent and assuming 2021 books are not closed.arrow_forwardDo not give solution in imagearrow_forwardMetlock Company asks you to review its December 31, 2020, inventory values and prepare the necessary adjustments to the books. The following information is given to you. 1. Metlock uses the periodic method of recording inventory. A physical count reveals $352,335 of inventory on hand at December 31, 2020. 2. Not included in the physical count of inventory is $20,130 of merchandise purchased on December 15 from Browser. This merchandise was shipped f.o.b. shipping point on December 29 and arrived in January. The invoice arrived and was recorded on December 31. 3. Included in inventory is merchandise sold to Champy on December 30, f.o.b. destination. This merchandise was shipped after it was counted. The invoice was prepared and recorded as a sale on account for $19,200 on December 31. The merchandise cost $11,025, and Champy received it on January 3. 4. Included in inventory was merchandise received from Dudley on December 31 with an invoice price of $23,445. The…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning