Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Hii, Tutor Give answer to this Problem

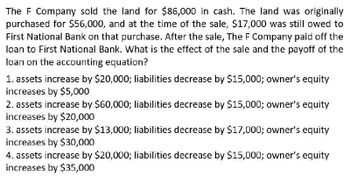

Transcribed Image Text:The F Company sold the land for $86,000 in cash. The land was originally

purchased for $56,000, and at the time of the sale, $17,000 was still owed to

First National Bank on that purchase. After the sale, The F Company paid off the

loan to First National Bank. What is the effect of the sale and the payoff of the

loan on the accounting equation?

1. assets increase by $20,000; liabilities decrease by $15,000; owner's equity

increases by $5,000

2. assets increase by $60,000; liabilities decrease by $15,000; owner's equity

increases by $20,000

3. assets increase by $13,000; liabilities decrease by $17,000; owner's equity

increases by $30,000

4. assets increase by $20,000; liabilities decrease by $15,000; owner's equity

increases by $35,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The F Company sold the land for $86,000 in cash. The land was originally purchased for $56,000, and at the time of the sale, $17,000 was still owed to First National Bank on that purchase. After the sale, The F Company paid off the loan to First National Bank. What is the effect of the sale and the payoff of the loan on the accounting equation? 1. assets increase by $20,000; liabilities decrease by $15,000; owner's equity increases by $5,000. 2. assets increase by $60,000; liabilities decrease by $15,000; owner's equity increases by $20,000. 3. assets increase by $13,000; liabilities decrease by $17,000; owner's equity increases by $30,000. 4. assets increase by $20,000; liabilities decrease by $15,000; owner's equity increases by $35,000arrow_forwardThe F Company sold the land for $86,000 in cash. The land was originally purchased for $56,000, and at the time of the sale, $17,000 was still owed to First National Bank on that purchase. After the sale, The F Company paid off the loan to First National Bank. What is the effect of the sale and the payoff of the loan on the accounting equation? 1. assets increase by $20,000; liabilities decrease by $15,000; owner's equity increases by $5,000. 2. assets increase by $60,000; liabilities decrease by $15,000; owner's equity increases by $20,000. 3. assets increase by $13,000; liabilities decrease by $17,000; owner's equity increases by $30,000. 4. assets increase by $20,000; liabilities decrease by $15,000; owner's equity increases by $35,000. I want answer to this accounting questionarrow_forwardSubject: General Accountingarrow_forward

- Determine the effects of the following transactions on Current assets, Current liabilities, and Working Capital. Write “Inc” for an Increase, “Dec” for a Decrease, or “NE” if there is No Effect. Write your answers in the blanks provided. Current Asset Current Liability Net Working Capital 1. Sale of merchandise on account 2. Acquired shares of ABS CBN for cash 3. Pays the long-term debt of P150,000 4. Sells old machine for P10,000 cash 5. Issued shares of stock to cash investors 6. Declared cash dividends 7. Payment of advance rentals (asset method) 8. One year loan from a bank 9. Issued shares of stock to pay short term loan 10. Collection of receivables 11. Cash redemption of bonded debt 12. Six months interest received in advance(liability method is used) 13. Issued stock dividends 14. Payment of cash dividends declared in #6 15. Sell of equipment for P50,000;…arrow_forwardKendall Corners Inc. recently reported net income of $2.9 million and depreciation of $700,000. What was its net cash flow? Assume it had no amortization expense. Enter your answer in dollars. For example, an answer of $1.2 million should be entered as 1,200,000. Round you answer to the nearest dollar.arrow_forwardAustin Land Company sold land for $60,550 in cash. The land was originally purchased for $35,250. At the time of the sale, $13,730 was still owed to Regions Bank. After the sale, Austin Land Company paid off the loan. Explain the effect of the sale and the payoff of the loan on the accounting equation. Enter all dollar amounts as positive numbers. Total assets Total liabilities Stockholders' equityarrow_forward

- Return on assets The financial statements of The Hershey Company (HSY) are shown in Exhibits 6 through 9. Based upon these statements, answer the following questions. 1. What are Hershey's sales (in millions)? 2. What is Hershey's cost of sales (in millions)? 3. What is Hershey's net income (in millions)? 4. What is Hershey's percent of the cost of the sales to sales? Round to one decimal place. 5. The percent that a company adds to its cost of sales to determine the selling price is called a markup. What is Hershey's markup percent? Round to one decimal place. 6. What is the percentage of net income to sales for Hershey? Round to one decimal place. 7. Hershey had total assets of $5,554 (millions) at the beginning of the year. Compute the return on assets for Hershey for the year shown in Exhibits 6–9. Round to one decimal place.arrow_forward44.On December 31, 2020, Empresas La Sidrita acquired a building. La Sidrita paid a third of the purchase price in cash and signed a note payable with the seller for the difference. The company closes books on December 31. In the Statement of Cash Flows for 2020, how much will La Sidrita report in the investment activities section? Select one: a. The purchase price of the building. b. Only cash paid. c. Zero. d. The principal of the document payable.arrow_forwardPlease answer the following 2 questions: 10. A decrease in Accounts Payable should be added to the net income. a) True b) False 7. Any decrease in Liability should be .. a) It depends on the circumstances b) Dedected from Net Income c) Added to Net Income d) None of the above.arrow_forward

- i need the answer quicklyarrow_forwardWhat is the gain or loss realized by Larsen Industries on these general accounting question?arrow_forwardQUESTION 5 Below are relevant extracts from Pitzer Bhd's financial statements for the financial year ended 31 December 2020 and 31 December 2021: 2020 (RM) 2021 (RM) ASSETS: Freehold land Plant and machinery at cost Inventories Bank Tax recoverable 386,000 182,000 44,000 13,000 6,000 20,000 86,400 737,400 477,000 212,000 52,000 55,000 Fixed deposits Account receivables 27,000 97,200 920,200 LIABILITIES & EQUITIES Ordinary Share Capital General reserve Retained earnings 5% Bank loan Bank overdraft Account payables Tax payable Accumulated depreciation of Plant & Machinery 264,000 112,420 36,400 169,400 13,400 69,780 364,000 112,420 135,280 135,400 7,600 62,340 9,960 93,200 920,200 72,000 737,400arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub