Financial Accounting

15th Edition

ISBN: 9781337272124

Author: Carl Warren, James M. Reeve, Jonathan Duchac

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 6, Problem 36E

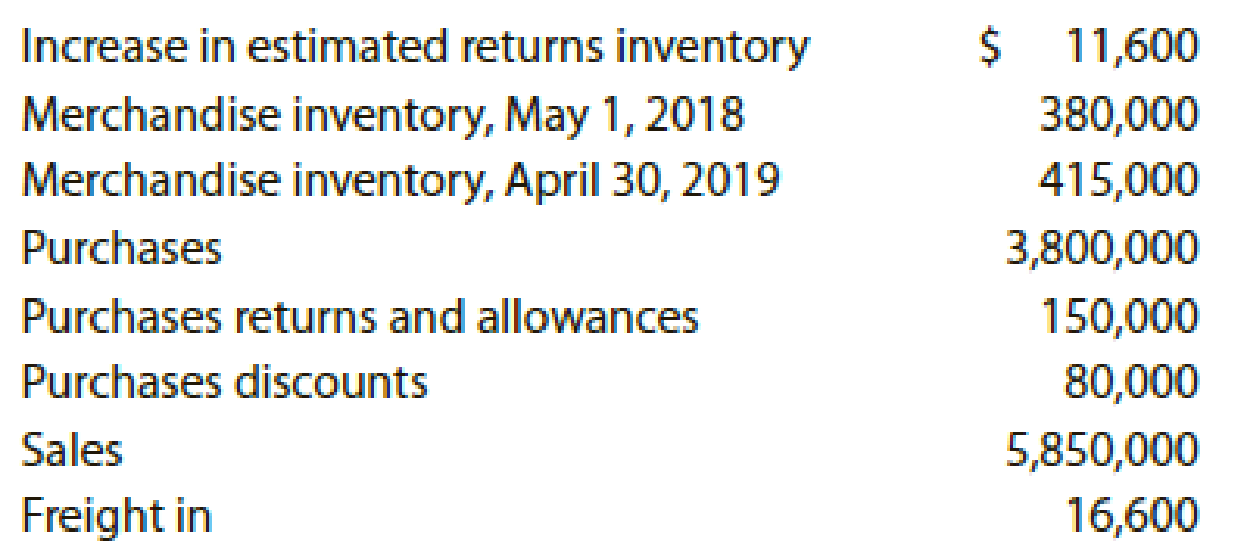

The following data were extracted from the accounting records of Harkins Company for the year ended April 30, 2019:

- a. Prepare the cost of merchandise sold section of the income statement for the year ended April 30, 2019, using the periodic inventory system.

- b. Determine the gross profit to be reported on the income statement for the year ended April 30, 2019.

- c.

Would gross profit be different if the perpetual inventory system was used instead of the periodic inventory system?

Would gross profit be different if the perpetual inventory system was used instead of the periodic inventory system?

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Garner Grocers began operations in 2005. Garner has

reported the following levels of taxable income (EBT)

over the past several years. The corporate tax rate was

34% each year. Assume that the company has taken

full advantage of the Tax Code's carry-back, carry-

forward provisions, and assume that the current

provisions were applicable in 2005. What is the

amount of taxes the company paid in 2008?

Year Taxable Income

2005-$3,200,000

2006 $200,000

2007 $500,000

2008 $2,800,00

a. $92,055

b. $96,900

c. $102,000

d. $107,100

e. $112,455

??!!

How much gain will Harper recognize on these accounting question?

Chapter 6 Solutions

Financial Accounting

Ch. 6 - Prob. 1DQCh. 6 - Can a business earn a gross profit but incur a net...Ch. 6 - The credit period during which the buyer of...Ch. 6 - What is the meaning of (a) 1/15, n/60; (b) n/30;...Ch. 6 - Prob. 5DQCh. 6 - Prob. 6DQCh. 6 - Prob. 7DQCh. 6 - Name four accounts that would normally appear in...Ch. 6 - Prob. 9DQCh. 6 - Assume that Audio Outfitter Inc. in Discussion...

Ch. 6 - Prob. 1PEACh. 6 - Prob. 1PEBCh. 6 - Halibut Company purchased merchandise on account...Ch. 6 - Hoffman Company purchased merchandise on account...Ch. 6 - Journalize the following merchandise transactions:...Ch. 6 - Journalize the following merchandise transactions:...Ch. 6 - Prob. 4PEACh. 6 - Journalize the following merchandise transactions:...Ch. 6 - Prob. 5PEACh. 6 - Prob. 5PEBCh. 6 - Prob. 6PEACh. 6 - Journalize the following merchandise transactions:...Ch. 6 - Assume the following data for Lusk Inc. before its...Ch. 6 - PE 6-7B Customer allowances and returns

Assume the...Ch. 6 - Financial statement data for years ending December...Ch. 6 - Financial statement data for years ending December...Ch. 6 - During the current year, merchandise is sold for...Ch. 6 - For a recent year, Best Buy reported sales of...Ch. 6 - Monet Paints Co. is a newly organized business...Ch. 6 - Prob. 4ECh. 6 - A retailer is considering the purchase of 500...Ch. 6 - The debits and credits for four related entries...Ch. 6 - Prob. 7ECh. 6 - Prob. 8ECh. 6 - Journalize the entries for the following...Ch. 6 - After the amount due on a sale of 28,000, terms...Ch. 6 - The debits and credits for four related entries...Ch. 6 - Prob. 12ECh. 6 - Prob. 13ECh. 6 - Showcase Co., a furniture wholesaler, sells...Ch. 6 - Prob. 15ECh. 6 - Prob. 16ECh. 6 - Journalize the entries to record the following...Ch. 6 - What is the normal balance of the following...Ch. 6 - Paragon Tire Co.s perpetual inventory records...Ch. 6 - Assume the following data for Oshkosh Company...Ch. 6 - Zell Company had sales of 1,800,000 and related...Ch. 6 - For the fiscal year, sales were 191,350,000 and...Ch. 6 - The following expenses were incurred by a...Ch. 6 - One item is omitted in each of the following four...Ch. 6 - On March 31, 2019, the balances of the accounts...Ch. 6 - Identify the errors in the following income...Ch. 6 - Summary operating data for Custom Wire Tubing...Ch. 6 - From the following list, identify the accounts...Ch. 6 - Based on the data presented in Exercise 6-25,...Ch. 6 - On July 31, 2019, the balances of the accounts...Ch. 6 - The Home Depot reported the following data (in...Ch. 6 - Kroger Co., a national supermarket chain, reported...Ch. 6 - Complete the following table by indicating for (a)...Ch. 6 - The following selected transactions were completed...Ch. 6 - Prob. 35ECh. 6 - The following data were extracted from the...Ch. 6 - Prob. 37ECh. 6 - Based on the following data, determine the cost of...Ch. 6 - Identify the errors in the following schedule of...Ch. 6 - United Rug Company is a small rug retailer owned...Ch. 6 - The following selected transactions were completed...Ch. 6 - The following selected transactions were completed...Ch. 6 - Prob. 3PACh. 6 - The following selected transactions were completed...Ch. 6 - The following selected accounts and their current...Ch. 6 - Selected accounts and related amounts for...Ch. 6 - Selected transactions for Capers Company during...Ch. 6 - Selected transactions for Babcock Company during...Ch. 6 - On December 31, 2019, the balances of the accounts...Ch. 6 - The following selected transactions were completed...Ch. 6 - The following selected transactions were completed...Ch. 6 - The following were selected from among the...Ch. 6 - The following selected transactions were completed...Ch. 6 - The following selected accounts and their current...Ch. 6 - Selected accounts and related amounts for Kanpur...Ch. 6 - Selected transactions for Niles Co. during March...Ch. 6 - Selected transactions for Essex Company during...Ch. 6 - On June 30, 2019, the balances of the accounts...Ch. 6 - Palisade Creek Co. is a merchandising business...Ch. 6 - Prob. 1CPCh. 6 - Prob. 2CPCh. 6 - Prob. 4CPCh. 6 - Prob. 5CPCh. 6 - Prob. 6CP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Chapter 6 Merchandise Inventory; Author: Vicki Stewart;https://www.youtube.com/watch?v=DnrcQLD2yKU;License: Standard YouTube License, CC-BY

Accounting for Merchandising Operations Recording Purchases of Merchandise; Author: Socrat Ghadban;https://www.youtube.com/watch?v=iQp5UoYpG20;License: Standard Youtube License