FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:Required:

Reggie is required to include in inventory all goods for which it has title. Note that the point where title (ownership) changes hands is

determined by the shipping terms in the sales contract. When goods are shipped "F.O.B. shipping point," title changes hands at

shipment and the buyer normally pays for shipping. When they are shipped "F.O.B. destination," title changes hands on delivery, and

the seller normally pays for shipping. Begin with the $65,000 inventory amount and compute the correct amount for the ending

inventory.

Correct inventory, December 31, 2020

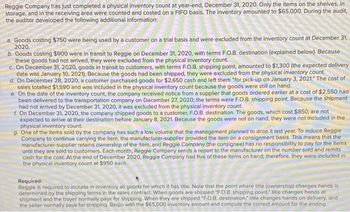

Transcribed Image Text:Reggie Company has just completed a physical inventory count at year-end, December 31, 2020. Only the items on the shelves, in

storage, and in the receiving area were counted and costed on a FIFO basis. The inventory amounted to $65,000. During the audit,

the auditor developed the following additional information:

a. Goods costing $750 were being used by a customer on a trial basis and were excluded from the inventory count at December 31,

2020.

b. Goods costing $900 were in transit to Reggie on December 31, 2020, with terms F.O.B. destination (explained below). Because

these goods had not arrived, they were excluded from the physical inventory count.

c. On December 31, 2020, goods in transit to customers, with terms F.O.B. shipping point, amounted to $1,300 (the expected delivery

date was January 10, 2021), Because the goods had been shipped, they were excluded from the physical inventory count.

d. On December 28, 2020, a customer purchased goods for $2,650 cash and left them "for pick-up on January 3, 2021." The cost of

sales totalled $1,590 and was included in the physical inventory count because the goods were still on hand.

e. On the date of the inventory count, the company received notice from a supplier that goods ordered earlier at a cost of $2,550 had

been delivered to the transportation company on December 27, 2020; the terms were F.O.B. shipping point. Because the shipment

had not arrived by December 31, 2020, it was excluded from the physical inventory count.

f. On December 31, 2020, the company shipped goods to a customer, F.O.B. destination. The goods, which cost $850, are not

expected to arrive at their destination before January 8, 2021. Because the goods were not on hand, they were not included in the

physical inventory count.

One of the items sold by the company has such a low volume that the management planned to drop it last year. To induce Reggie.

Company to continue carrying the item, the manufacturer-supplier provided the item on a consignment basis. This means that the

manufacturer-supplier retains ownership of the item, and Reggie Company (the consignee) has no responsibility to pay for the items

until they are sold to customers. Each month, Reggie Company sends a report to the manufacturer on the number sold and remits

cash for the cost. At the end of December 2020, Reggie Company had five of these items on hand; therefore, they were included in

the physical inventory count at $950 each.

Required:

Reggie is required to include in inventory all goods for which it has title. Note that the point where title (ownership) changes hands is a

determined by the shipping terms in the sales contract. When goods are shipped "F.O.B. shipping point," title changes hands at

shipment and the buyer normally pays for shipping. When they are shipped "F.O.B. destination," title changes hands on delivery, and

the seller normally pays for shipping. Begin with the $65,000 inventory amount and compute the correct amount for the ending

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The Swifty Company has just completed a physical inventory count at year end, December 31, 2022. Only the items on the shelves, in storage, and in the receiving area were counted and costed on the FIFO basis. The inventory amounted to $78,400. During the audit, the independent CPA discovered the following additional information: (a) (b) (c) (d) (e) (f) There were goods in transit on December 31, 2022, from a supplier with terms FOB destination, costing $9,600. Because the goods had not arrived, they were excluded from the physical inventory count. On December 27, 2022, a regular customer purchased goods for cash amounting to $900 and had them shipped to a bonded warehouse for temporary storage on December 28, 2022. The goods were shipped via common carrier with terms FOB shipping point. The customer picked the goods up from the warehouse on January 4, 2023. Swifty Company had paid $450 for the goods and, because they were in storage, Swifty included them in the physical inventory…arrow_forwardA purchases cut-off procedure was rendered by your audit staff in line with your audit of the financial statements of Friday Corp. for the period ended December 31, 2021. Inventories were physically counted on December 29 as a result, all goods received on or before December 29 has been included in the physical count which amounted to P449,000. Purchases and Accounts Payable balances per books were at P2,895,000 and P578,000, respectively. Receiving Report No. Receipt Date Invoice Price Remarks 816913 Dec. 28 10,600 Received on consignment basis 816914 Dec. 29 13,600 FOB Destination 816915 Dec. 30 15,000 FOB Shipping Point 816917 Dec, 31 10,800 FOB Shipping Point 816918 Dec. 31 7,200 Free Alongside the Vessel 816919 Dec. 31 14,500 FOB Destination 816920 Jan. 2 8,200 FOB Shipping Point 816921 Jan. 2 9,600 FOB Seller (In-transit) 816922 Jan. 2 9,100…arrow_forwardProblem 11: The GANDA CO is on a calendar year basis. The following data were found during your audit: a. Goods in transit shipped FOB Shipping point on December 28 by a supplier in the amount of P100,000 had been excluded from the inventory, and further testing revealed that the purchase had been recorded. b. Goods costing P30,000 had been received, included in inventory, and recorded as a purchase. However, upon your inspection, the goods were found to de defective and would be immediately returned. c. Materials costing P170,000 and billed on December 30 at a selling price of P264,000 had been segregated in the warehouse for shipment to a customer. The materials had been excluded from inventory as a signed purchase order had been received from the customer, terms FOB destination. d. Goods costing P70,000 was out on consignment with Gandanva, inc. since the monthly statement from Gandanva listed those materials on hand, the items had been excluded from the final inventory and invoiced…arrow_forward

- PLEASE ANSWER ASAP Problem No. 6 In conducting your audit of AACA Corporation, a company engaged in import and wholesale business, for the year ended December 31, 2022, you determined that its internal control system was good. Accordingly, you observed the physical inventory at an interim date, November 30, 2022 instead of at December 31, 2022. You obtained the following information from the company’s general ledger. Sales for eleven months ended November 30, 2022 P1,120,000 Sales for the year ended December 31, 2022 1,536,000 Purchases for eleven months ended November 30, 2022 (before audit adjustments) 856,000 Purchases for the year ended December 31, 2022 1,280,000 Inventory, January 1, 2022 140,000 Physical inventory, November 30, 2022 220,000 Your audit disclosed the following additional information. Shipments costing P12,000 were received in November and included in the physical inventory but recorded as December purchases. Deposit of…arrow_forwardYou are the senior accountant for a shoe wholesaler that uses the periodic inventory method. You have determined the following information from your company’s records, which you assume is correct: Inventory of $296,064 was on hand at the start of the year. Purchases for the year totalled $2,028,000. Of this, $1,694,400 was purchased on account; that is, accounts payable was credited for this amount at the time of the purchase. A year-end inventory count revealed inventory of $389,760 Required: b) Assume now that your company uses the perpetualmethod of inventory control, and that your records show that $1,857,990 of inventory (at cost) was sold during the year. What is the adjustment needed to correct the records, given the inventory count in item 3 above?arrow_forwardDuring the audit of BAC Company's 2029 financial statements, the auditors discovered that the 2029 ending inventory had been understated by $12,000 and that the 2029 beginning inventory was overstated by $9,000. Before the effect of these errors, 2029 pretax income had been computed as $115,000. What should be reported as the correct 2029 pretax income? A) $112,000 B) $94,000 C) $118,000 D) $136,000 E) $103,000arrow_forward

- In January 2020, Susquehanna Inc. requested and secured permission from the commissioner of the Internal Revenue Service to compute inventories under the last-in, first-out (LIFO) method and elected to determine inventory cost under the dollar- value LIFO method. Susquehanna Inc. satisfied the commissioner that cost could be accurately determined by use of an index number computed from a representative sample selected from the company's single inventory pool. Instructions a. Why should inventories be included in (1) a balance sheet and (2) the computation of net income? b. The Internal Revenue Code allows some accountable events to be considered differently for income tax reporting purposes and financial accounting purposes, while other accountable events must be reported the same for both purposes. Discuss why it might be desirable to report some accountable events differently for financial accounting purposes than for income tax reporting purposes. c. Discuss the ways and…arrow_forwardTamarisk, Inc. took a physical inventory on December 31 and determined that goods costing $190,000 were on hand. Not included in the physical count were $29,000 of goods purchased from Sheffield Corp., FOB, shipping point, and $24,000 of goods sold to Wildhorse Co. for $33,000, FOB destination. Both the Sheffield purchase and the Wildhorse sale were in transit at year-end. What amount should Tamarisk report as its December 31 inventory? Ending Inventory $arrow_forwardThe DENR RO5 operates a perpetual inventory system and performs quarterly physical inventory counts to reflect actual quantities counted. During the auditor interim visit, the result of the last physical count is reviewed. It appears that several numbers of high-value items included in the records were not counted. Also, returns to the supplier are deducted from the physical inventory but are not recorded in the inventory records. Required: State the points of concern in your report to management with respect to the control issues and comment on their possible impact on your year-end audit work by identifying: a) weaknesses b) risks, and c) give recommendations.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education