Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN: 9781285595047

Author: Weil

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Need help this question general accounting

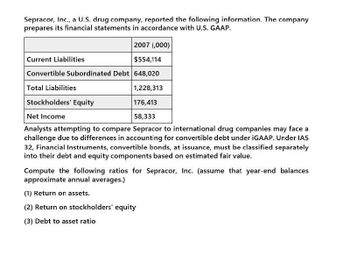

Transcribed Image Text:Sepracor, Inc., a U.S. drug company, reported the following information. The company

prepares its financial statements in accordance with U.S. GAAP.

Current Liabilities

2007 (,000)

$554,114

Convertible Subordinated Debt 648,020

Total Liabilities

Stockholders' Equity

1,228,313

176,413

Net Income

58,333

Analysts attempting to compare Sepracor to international drug companies may face a

challenge due to differences in accounting for convertible debt under iGAAP. Under IAS

32, Financial Instruments, convertible bonds, at issuance, must be classified separately

into their debt and equity components based on estimated fair value.

Compute the following ratios for Sepracor, Inc. (assume that year-end balances

approximate annual averages.)

(1) Return on assets.

(2) Return on stockholders' equity

(3) Debt to asset ratio

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The question relates to either Chapter 9 ( Foreign Currency Translations and Hedging Foreign Exchange Risk ) or Chapter 10 ( Translation of Foreign Currency Financial Statements ) For Advanced Accounting 13th Edition by Joe B. Hoyle, Thomas F, Schaefer, and Timothy S. Doupnik. Details are included in the image Need all calculations, journal entries, work, etc.arrow_forwardThe following balance sheet accounts of a foreign subsidiary at December 31, 2011, have been translated into U.S. dollars as follows: Translated at Current Rates Historical Rates Accounts receivable, current $ 600,000 $ 660,000 Accounts receivable, long-term 300,000 324,000 Inventories carried at market 180,000 198,000 Goodwill 190,000 220,000 $1,270,000 $1.402,000 What total should be included in the translated balance sheet at December 31, 2011, for the above items? Assume the U.S. dotlar is the functional currency $1,300,000 $1.288.000 10:56 EN lenovoarrow_forwardJDW Corporation reported the following for 20X1: net sales $2,929,500; cost of goods sold $1,786,995; selling and administrative expenses $585,900; unrealized holding loss on available-for-sale securities (considered other comprehensive income) $22,000; a positive foreign currency translation adjustment $26,250 (considered other comprehensive income); and an unrealized loss from pension adjustment (considered other comprehensive income) $7,000. JDW’s tax rate was 21%. Ignore income taxes related to amounts in other comprehensive income. prepare a statement of comprehensive income using the two-statement format. Ignore earnings per share.arrow_forward

- The entity sold its inventory to a foreign entity with credit term of n/60. On the 60th day from invoice, the entity accepted the $200 payment from a client. It converted this amount on the spot rate. The entity's approach to the foreign exchange risk is A. AvoidanceB. MitigationC. Acceptancearrow_forwardFinancearrow_forwardCertain balance sheet accounts in a foreign subsidiary of Monument Company on December 31, 20X1, have been restated in U.S. dollars as follows: Accounts Receivable, Current Accounts Receivable, Long-Term Prepaid Insurance Patents Total O $160,000. O $168,000. O $172,000. O $188,000. Current Rates $80,000 40,000 10,000 30,000 Restated at $160,000 Historical Rates $96,000 44,000 12,000 Assume the U.S. dollar is the functional currency. What total should be included in Monument's balance sheet for December 31, 20X1, for these items? 36,000 $188,000arrow_forward

- Use the following information of Prescrip Co. to prepare a calendar year-end statement of comprehensive income. Total comprehensive income (final total) $ 9,400 Other comprehensive income (subtotal) $ (600) Net income . 10,000 Change in foreign currency translation 1,400 Change in value of available-for-sale securities (2,000)arrow_forwardRequired: 1. Calculate the exchange gain or loss to be reported in 20X7. (Do not round intermediate calculations.) 2. Calculate the accounts receivable on the 31 December 20X7 statement of financial position. 3. Calculate the sales revenue to be recorded from the transactions listed above. Thumb up if you have the correct answer! Thanksarrow_forwardWhich of the following is true? The component of the current account include direct foreign investment and portfolio investment. The transaction regarding an Australian consulting firm receiving AUD5 million (i.e., Australian 5 million dollars) for consulting services provided to a German company is recorded as a debit under the current account of Australia. The transaction regarding a U.S. citizen receiving an interest payment as a result of his investment in a bond of a British firm issued in the United Kingdom is recorded as a credit under the current account of U.S.. When the BOP (balance of payment) accounts are recorded correctly, by BOP identity, under purely floating exchange rate regime, BCA (balance of current accounts) + BKA (balance of capital accounts) = - BRA (Balance of official reserve accounts).arrow_forward

- 5. Certain balance sheet accounts of a foreign subsidiary of Rowan, Inc. at December 31, 2020, have been translated into Philippine pesos as follows: Translated at Current rate Historical rate Note receivable, long-term 240,000 200,000 Prepaid rent 85,000 80,000 Patent 150,000 170,000 What total amount should be included in Rowan's December 31, 2021, consolidated balance sheet for the above accounts using the translation method? wwwn (Ctrl) -arrow_forwardNn.71. Subject :- Accountarrow_forwardNexus Tech Industries' Consolidate Earnings. Nexus Tech is a U.S.-based multinational manufacturing firm with wholly-owned subsidiaries in Brazil, Germany, and China, in addition to domestic operations in the United States. NexusTech is traded on the NASDAQ. NexusTech currently has 650,000 shares outstanding. The basic operating characteristics of the various business units is as follows: Nexus Tech must pay corporate income tax in each country in which it currently has operations. a. After deducting taxes in each country, what are Nexus Tech's consolidated earnings and consolidated earnings per share in U.S. dollars? b. What proportion of Nexus Tech's consolidated earnings arise from each individual country? c. What proportion of Nexus Tech's consolidated earnings arise from outside the United States?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you