Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

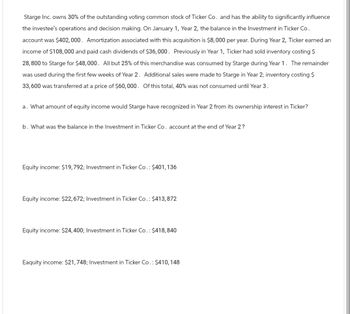

Transcribed Image Text:Starge Inc. owns 30% of the outstanding voting common stock of Ticker Co. and has the ability to significantly influence

the investee's operations and decision making. On January 1, Year 2, the balance in the Investment in Ticker Co.

account was $402,000. Amortization associated with this acquisition is $8,000 per year. During Year 2, Ticker earned an

income of $108,000 and paid cash dividends of $36,000. Previously in Year 1, Ticker had sold inventory costing $

28,800 to Starge for $48,000. All but 25% of this merchandise was consumed by Starge during Year 1. The remainder

was used during the first few weeks of Year 2. Additional sales were made to Starge in Year 2; inventory costing $

33,600 was transferred at a price of $60,000. Of this total, 40% was not consumed until Year 3.

a. What amount of equity income would Starge have recognized in Year 2 from its ownership interest in Ticker?

b. What was the balance in the Investment in Ticker Co. account at the end of Year 2?

Equity income: $19,792; Investment in Ticker Co.: $401,136

Equity income: $22, 672; Investment in Ticker Co.: $413,872

Equity income: $24,400; Investment in Ticker Co.: $418,840

Eaquity income: $21,748; Investment in Ticker Co.: $410,148

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- On January 1, Barnyard Corporation acquired common stock of Fresh Hay Corporation. At the time of acquisition, the book value and the fair value of Fresh Hay Corporation's net assets were $1 billion. During the year, Fresh Hay Corporation reported net income of $480 million and declared dividends of $160 million. The fair value of the shares increased by 10 percent during the year. How much income would Barnyard Corporation report for the year related to its investment under the assumption that it: A. Paid $150 million for 15 percent of the common stock and uses the fair value method to account for its investment in Fresh Hay Corporation. (Pay attention to the "fair value method" mention, others who attempted to answer this question got it wrong because they missed that). B. Paid $300 million for 30 percent of the common stock and uses the equity method to account for its investment in Fresh Hay Corporation. Please show all your steps so we can follow what…arrow_forwardMatthew, Inc. owns 30 percent of the outstanding stock of Lindman Company and has the ability to significantly influence the investee's operations and decision making. On January 1, 2018, the balance in the Investment in Lindman account is $422,000. Amortization associated with this acquisition is $15.000 per year. In 2018, Lindman earns an income of $138,000 and declares cash dividends of $46,000. Previously, in 2017, Lindman had sold inventory costing $35,000 to Matthew for $50,000. Matthew consumed allI but 25 percent of this merchandise during 2017 and used the rest during 2018. Lindman sold additional inventory costing $42,900 to Matthew for $65,000 in 2018. Matthew did not consume 40 percent of these 2018 purchases from Lindman until 2019. a. What amount of equity method income would Matthew recognize in 2018 from its ownership interest in Lindman? b. What is the equity method balance in the Investment in Lindman account at the end of 2018? a. Equity income b. Investment in…arrow_forwardAs a long-term investment, Fair Company purchased 20% of Midlin Company’s 120,000 shares for $144,000 at the beginning of the reporting year of both companies. During the year, Midlin earned net income of $117,000 and distributed cash dividends of $0.30 per share. At year-end, the fair value of the shares is $150,000. Required: 1. Assume no significant influence was acquired. Record the transactions from the purchase through the end of the year, including any adjustment for the investment’s fair value, if appropriate.arrow_forward

- Matthew, Inc. owns 30 percent of the outstanding stock of Lindman Company and has the ability to significantly influence the investee’s operations and decision making. On January 1, 2018, the balance in the Investment in Lindman account is $335,000. Amortization associated with this acquisition is $9,000 per year. In 2018, Lindman earns an income of $90,000 and declares cash dividends of $30,000. Previously, in 2017, Lindman had sold inventory costing $24,000 to Matthew for $40,000. Matthew consumed all but 25 percent of this merchandise during 2017 and used the rest during 2018. Lindman sold additional inventory costing $28,000 to Matthew for $50,000 in 2018. Matthew did not consume 40 percent of these 2018 purchases from Lindman until 2019.a. What amount of equity method income would Matthew recognize in 2018 from its ownership interest in Lindman?b. What is the equity method balance in the Investment in Lindman account at the end of 2018?arrow_forwardMatthew, Inc. owns 30 percent of the outstanding stock of Lindman Company and has the ability to significantly influence the investee’s operations and decision making. On January 1, 2018, the balance in the Investment in Lindman account is $365,000. Amortization associated with this acquisition is $12,600 per year. In 2018, Lindman earns an income of $132,000 and declares cash dividends of $33,000. Previously, in 2017, Lindman had sold inventory costing $33,600 to Matthew for $56,000. Matthew consumed all but 20 percent of this merchandise during 2017 and used the rest during 2018. Lindman sold additional inventory costing $44,800 to Matthew for $80,000 in 2018. Matthew did not consume 40 percent of these 2018 purchases from Lindman until 2019. What amount of equity method income would Matthew recognize in 2018 from its ownership interest in Lindman? What is the equity method balance in the Investment in Lindman account at the end of 2018?arrow_forwardOn January 1, Big Company acquires all of the common stock of Little Company by issuing 400,000 shares of $1 par value stock with a market value of $12 per share. Little reports earnings of $864,000 and pays dividends of $240,000 in the year of acquisition. The amortization of allocations related to the investment was $48,000. Big’s net income, not including the investment, was $6,360,000, and it paid dividends of $400,000. What is the amount of consolidated net income?arrow_forward

- Matthew Inc. owns 30 percent of the outstanding stock of Lindman Company and has the ability to significantly influence the investee's operations and decision making. On January 1, 2018, the balance in the Investment in Lindman account is $335,000. Amortization associated with this acquisition is $9,000 per year. In 2018, Lindman earns an income of $90,000 and declares cash dividends of $30,000. Previously, in 2017, Lindman had sold inventory costing $24,000 to Matthew for $40,000. Matthew consumed all but 25 percent of this merchandise during 2017 and used the rest during 2018. Lindman sold additional inventory costing $28,000 to Matthew for $50,000 in 2018. Matthew did not consume 40 percent of these 2018 purchases from Lindman until 2019. What amount of equity method income would Matthew recognize in 2018 from its ownership interest in Lindman? What is the equity method balance in the Investment in Lindman account at the end of 2018? I need help with the second part (#2) since…arrow_forwardOn May 20, Montero Co. paid $150,000 to acquire 30 shares (4%) of ORD Corp. as a long-term investment. On August 5, Montero sold one-tenth of the ORD shares for $18,000. 1. Prepare entries to record both (a) the acquisition and (b) the sale of these shares. 2. Should this stock investment be reported at fair value or at cost on the balance sheet?arrow_forwardAs a long-term investment at the beginning of the current fiscal year, Company A purchased 30% of Company B's 20 million shares for $60 million. The fair value and book value of the shares were the same at that time. During the year, Company B earned net income of $70 million and distributed cash dividends of $2.00 per share. At the end of the year, the fair value of the shares is $56 million. Required: Prepare the appropriate journal entries from the purchase through the end of the year. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions, (i.e., 10,000,000 should be entered as 10). View transaction list Journal entry worksheet < 1 2 3 Record the investor's share of net income. Note: Enter debits before credits. Transactions 2 General Journal Debit Credit Investment in equity affiliate 21 Retained earnings 21 Record entry Clear entry View general journalarrow_forward

- On May 20, Montero Company paid $240,000 to acquire 105 shares (5%) of ORD Corporation as a long-term investment. On August 5, Montero sold one-tenth of the ORD shares for $25,500. 1. Prepare entries to record both the acquisition and the sale of these shares. 2. Should this stock investment be reported at fair value or at cost on the balance sheet? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare entries to record both the acquisition and the sale of these shares. View transaction listarrow_forwardWillard Co. acquired a 30% interest in Diltronics for $420,000 and appropriately applied the equity method. During the first year, Diltronics reported net income of $250,000 and paid cash dividends totaling $50,000. What amount will Willard report as it relates to the investment at the end of the first year on its income statement? Show the calculation used to get the answer Investment earnings totaling $75,000 Investment earnings totaling $45,000 Net investment earnings totaling $150,000 Receipt of dividends totaling $15,000arrow_forwardOn June 1, 2022, Madison Corporation purchased 100,000 shares of Steller, Inc., common stock for $2,000,000. The investment represents a 20% interest in the net assets of Steller. On October 30, 2022, Madison received dividends of $0.50 per share on the Steller investment. Steller reported net income of $500,000 for the year ended December 31, 2022. The market value of the Steller stock was $28 per share on December 31, 2022. On June 1, 2022, the book value of Steller's net assets was $7,000,000. The fair value of Steller's depreciable assets, with an average remaining useful life of ten years, exceeded their book value by $200,000. Steller depreciates its assets by the straight-line method. The remainder of the excess of the cost of the investment over the book value of net assets purchased was attributable to goodwill. INSTRUCTIONS: a) Prepare all appropriate journal entries related to the investment during 2022, assuming the 20% interest does gives Madison the ability to exercise…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning