FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Please given correct answer general accounting

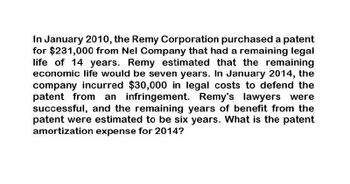

Transcribed Image Text:In January 2010, the Remy Corporation purchased a patent

for $231,000 from Nel Company that had a remaining legal

life of 14 years. Remy estimated that the remaining

economic life would be seven years. In January 2014, the

company incurred $30,000 in legal costs to defend the

patent from an infringement. Remy's lawyers were

successful, and the remaining years of benefit from the

patent were estimated to be six years. What is the patent

amortization expense for 2014?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Belkin Plc purchased a patent for $135,000 on September 1, 2016. It had a useful life of 10 years. On January 1, 2018, Belkin spent $33,000 to successfully defend the patent in a lawsuit. Belkin feels that as of that date, the remaining useful life is 5 years. What amount should be reported for patent amortization expense for 2018?arrow_forwardOn January 1, 2020, Purple Inc. purchased a patent for $33, 300. Legal fees paid in this purchase amounted to $1,700. The legal remaining life of the patent is 14 years, but Purple believes it will only help increase sales for the next 10 years. On January 1, 2023, Purple was sued for patent infringement and had to spend $4,900 of legal fees in the successful defense of this patent. What is the book value of this patent on December 31, 2023? Select one: a. $24,500 b. $21,000 c. $ 25,200 d. $30, 240 e. $19,600arrow_forwardA patent was acquired by Renfro Corporation on January 1, 2014, at a cost of $90,000. The useful life of the patent was estimated to be 10 years. At the beginning of 2017, Renfro spent $15,000 in successfully defending an infringement of the patent. At the beginning of 2018, Renfro purchased a patent for $22,000 that was expected to prolong the life of its original patent for 5 additional years. Instructions Calculate the following amounts for Renfro Corporation. (а) Amortization expense for 2014. The balance in the Patent account at the beginning of (b) 2017, immediately after the infringement suit. Amortization expense for 2017. (c) The balance in the Patent account at the beginning of (d) 2018, after purchase of the additional patent. Amortization expense for 2018. (e)arrow_forward

- During 2017, Summer Company spent P500,000 for the research and development of its patent. On January 1, 2018, the company paid P120,000 to apply for and obtain right to the patent. The useful life of the patent is 10 years.On January 1, 2019, Summer Company purchased a new patent for P1,200,000 which is expected to prolong the life of the original patent by six years. On December 31, 2020, a competitor obtained rights to a patent that rendered Summer Company's patent obsolete.Required: Prepare all entries relative to the patent from 2017 through 2020.arrow_forwardBrazen Company purchased a patent on January 1, 2015 for P6,000,000. The original life of the patent was estimated to be 15 years. However, in December 2020, the controller received information proving conclusively that the product protected by the patent would be obsolete within four years. The entity decided to write off the unamortized portion of the patent cost over five years beginning in 2020. What is the patent amortization for 2020?arrow_forwardDazzle Corporation purchased a patent for P7,140,000 on January 2014. The patent is being amortized over the remaining legal life of 15 years expiring on January 2029. During 2017, Dazzle Corporation determined that the economic benefits of the patent would not last longer than ten years from the date of acquisition. Using the same information on number (33), what amount should be charged to patent amortization expenses for the year ended December 31, 2017, assuming there is no change in the patent's useful life? OP816,000 O P476,000 O None of the above OP571.200 OP4,896,000arrow_forward

- Ice Giant Company purchased a patent on January 1, 2015 for P6,000,000. The original useful life was estimated to be 15 years. However, in December 2020 Icegiant’s controller received information proving conclusively that the product protected by the Ice Giant patent would be obsolete within four years. Accordingly, the entity decided to write off the unamortized portion of the patent cost over five years beginning in 2020. What is the patent amortization for 2015?arrow_forwardOn January 2, 2016, David Corporation purchased a patent for $500,000. The remaining legal life is 12 years, but the company estimated that the patent will be useful only for eight years. In January 2018, the company incurred legal fees of $45,000 in successfully defending a patent infringement suit. The successful defense did not change the company’s estimate of useful life. Required: Prepare journal entries related to the patent for 2016, 2017, and 2018.arrow_forwardRuby Ltd. purchased a patent for $450,000 on September 1, 2020. It had a useful life of 10 years. On January 1, 2022, Ruby spent $220,000 to successfully defend the patent in a lawsuit. Ruby feels that as of that date, the remaining useful life is 5 years. What amount should be reported for patent amortization expense for 2022? $arrow_forward

- Larkspur Limited purchased a patent for $86,400 on June 1, 2022. Larkspur has a calendar fiscal year end. Straight-line amortization is used for the patent, based on a five-year useful life, although the remaining legal life was 10 years. On May 31, 2024, Larkspur paid $28,800 in legal fees to successfully defend this patent in court and now wants to revise the estimate of the patent's remaining useful life to 8 years, which is the same as its remaining legal life. (a) (b) (c) (d) Record any necessary amortization prior to the change in the useful life of the patent. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter O for the amounts. List debit entry before credit entry)arrow_forwardOn January 3, 2012, the July Company spent P196,000 to apply for and obtain a patent on a newly developed product. The patent had an estimated useful life of 10 years. At the beginning of 2014, the company spent P28,000 in successfully prosecuting an attempted infringement of the patent.. At the beginning of 2017, the company purchased for P60,000 a patent that was expected to prolong the life of its original patent by 5 years. On July 1, 2020, a competitor obtained rights to a patent that made the company's patent obsolete. REQUIRED: Prepare journal entries to record the transactions relative to the patents from January 3, 2012 to July 1, 2020, inclusive.arrow_forwardSandhill Corporation purchased a patent for $147000 on September 1, 2024. It had a useful life of 10 years. On January 1, 2026, Sandhill spent $41000 to successfully defend the patent in a lawsuit. Sandhill feels that as of that date, the remaining useful life is 5 years. What amount should be reported for patent amortization expense at the company's December 31, 2026 year-end if the straight-line method is used? O $25480. O $33680. O $31720. O $34660.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education