International Financial Management

14th Edition

ISBN: 9780357130698

Author: Madura

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

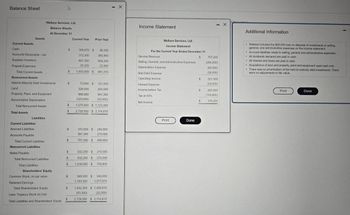

Transcribed Image Text:Balance Sheet

Current Assets

Assets

M

Wallace Services, Ltd.

Balance Sheets

At December 31

Current Year Prior Year

X

Income Statement

Wallace Services, Ltd.

Income Statement

Cash

308,675 $

Accounts Receivable - net

Supplies Inventory

312,300

807,350

99,160

265,905

604,250

For the Current Year Ended December 31

Service Revenue

$

707,200

Prepaid Expenses

25,225

22,000

Selling, General, and Administrative Expenses

Depreciation Expense

(280,200)

(80,000)

Total Current Assets

Noncurrent Assets

Held-to-Maturity Debt Investments

Land

Property, Plant, and Equipment

69

$

1,453,550 $ 991,315

Bad Debt Expense

(26,000)

Operating Income

321,000

EA

$

73,000 $

121,000

Interest Expense

(24,000)

326,000

204,000

Income before Tax

297,000

999,000

841,300

Tax at 40%

(118,800)

Accumulated Depreciation

(123,000)

(43,000)

$

178,200

Net Income

Total Noncurrent Assets

1,275,000 $ 1,123,300

$

2,728,550 $ 2,114,615

Total Assets

Liabilities

Print

Done

Current Liabilities

Accrued Liabilities

$

310,000 $ 284,800

Accounts Payable

397,300

215,000

$

Total Current Liabilities

707,300 $

499,800

Noncurrent Liabilities

Notes Payable

532,250 $

210,000

$

Total Noncurrent Liabilities

Total Liabilities

532,250 $ 210,000

1,239,550 $ 709,800

Shareholders' Equity

Common Stock, no par value

$

349,000 $ 349,000

1,193,300

1,077,815

Retained Earnings

Total Shareholders' Equity

$

1,542,300 $ 1,426,815

Less: Treasury Stock at Cost

(53,300)

(22,000)

2,728,550 $ 2,114,615

Total Liabilities and Shareholders' Equity

enter a zero

Additional Information

•

Wallace included the $26,000 loss on disposal of investments in selling,

general, and administrative expenses on the income statement.

Accrued liabilities relate to selling, general and administrative expenses.

All dividends declared are paid in cash.

All interest and taxes are paid in cash.

Acquisitions of land and property, plant and equipment used cash only.

There was no amortization of the held-to-maturity debt investments. There

were no adjustments to fair value.

Print

Done

Transcribed Image Text:Wallace Services, Ltd. provided the following comparative balance sheets and income statement for the current year.

(Click the icon to view the balance sheets.)

(Click the icon to view the statement of net income.)

(Click the icon to view the additional information.)

Requirement

Prepare Wallace's cash flow statement for the current year under the indirect method. Assume that accrued liabilities relate to selling, general, and administrative expenses.

Complete the statement one section at a time, beginning with the cash flows from operating activities. (Use a minus sign or parentheses for any numbers to be subtracted and/or for cash outflows. If an input field is not used in the statement, leave the field empty; do not select a label or enter a zero.)

Ferragosto Services, Ltd.

Statement of Cash Flows (Indirect Method)

For the Year Ended December 31

Current Year

Operating Activities:

Adjustments to Reconcile Net Income to Net

Cash Provided by Operating Activities:

Changes in Operating Working Capital Accounts:

Net Cash Provided (Used) by Operating Activities

Investing Activities:

Net Cash Provided (Used) by Investing Activities

Financing Activities:

Net Cash Provided (Used) by Financing Activities

Net Increase (Decrease) in Cash and Cash Equivalents

Cash and Cash Equivalents, Beginning of Year

Cash and Cash Equivalents, End of Year

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Golden Corporation's current year income statement, comparative balance sheets, and additional information follow. For the year, (1) all sales are credit sales, (2) all credits to Accounts Receivable reflect cash receipts from customers, (3) all purchases of inventory are on credit, (4) all debits to Accounts Payable reflect cash payments for inventory, and (5) any change in Income Taxes Payable reflects the accrual and cash payment of taxes. Assets Cash Accounts receivable Inventory Total current assets Equipment Accumulated depreciation-Equipment Total assets Liabilities and Equity Accounts payable Income taxes payable Total current liabilities GOLDEN CORPORATION Comparative Balance Sheets December 31 Equity Common stock, $2 par value Paid-in capital in excess of par value, common stock Retained earnings Total liabilities and equity GOLDEN CORPORATION Income Statement For Current Year Ended December 31 Sales Cost of goods sold Gross profit Operating expenses (excluding depreciation)…arrow_forwardGolden Corporation's current year income statement, comparative balance sheets, and additional information follow. For the year, (1) all sales are credit sales, (2) all credits to Accounts Receivable reflect cash receipts from customers, (3) all purchases of inventory are on credit, (4) all debits to Accounts Payable reflect cash payments for inventory, and (5) any change in Income Taxes Payable reflects the accrual and cash payment of taxes. Assets Cash Accounts receivable Inventory Total current assets Equipment Accumulated depreciation-Equipment Total assets Liabilities and Equity Accounts payable Income taxes payable Total current liabilities Equity Common stock, $2 par value Paid-in capital in excess of par value, common stock. Retained earnings Total liabilities and equity Sales Cost of goods sold Gross profit GOLDEN CORPORATION Comparative Balance Sheets December 31 GOLDEN CORPORATION Income Statement For Current Year Ended December 31 Operating expenses (excluding depreciation)…arrow_forwardThe income statement and additional data of Newbury Travel Products, Inc., follow: (Click the icon to view the income statement.) (Click the icon to view the additional data.) Requirements 1. Prepare Newbury's statement of cash flows for the year ended December 31, 2021, using the indirect method. 2. Evaluate the company's cash flows for the year. In your evaluation, mention all three categories of cash flows and give the rationale for your evaluation. Data table Newbury Travel Products, Inc. Income Statement Year Ended December 31, 2021 Revenues: Service revenue $ 238,000 Dividend revenue 8,600 $ 246,600 Expenses: Cost of goods sold 97,000 Salary expense 61,000 Depreciation expense 21,000 Advertising expense 3,000 Interest expense 2,100 12,000 196,100 Income tax expense ge $ 50,500 Net income - Xarrow_forward

- Prepare the statement of cash flows of Metagrobolize for the year ended December 31, 2021. Present cash flows from operating activities by the direct method. (Enter your answers in thousands (i.e., 10,000 should be entered as 10). Amounts to be deducted should be indicated with a minus sign.)arrow_forwardIdentify the section of the statement of cash flows (a–d) where each of the following items would be reported.a. Operating activitiesb. Financing activitiesc. Investing activitiesd. Schedule of noncash financing and investing Increase in income taxes payable Where does this will be on the cash flow statement ?arrow_forwardHararrow_forward

- Yang Company recognized accrued salary expense. The recognition will affect which of the following financial statements?arrow_forwardSalus Mea Inc., is developing its annual financial statements at December 31, current year. The statements are complete except for the statement of cash flows. The completed comparative balance sheets and income statement are summarized as follows: Balance sheet at December 31 Cash Accounts receivable Merchandise inventory Property and equipment Less: Accumulated depreciation Accounts payable Wages payable Note payable, long-term Common stock and additional paid-in capital Retained earnings Income statement for current year Sales Cost of goods sold Depreciation expense Other expenses Net income Additional Data: 1. Bought equipment for cash, $48,900. 2. Paid $14,700 on the long-term note payable. Current Year $ 73,250 15,250 23,450 209,250 (57.450) $263,750 $ 16,500 2,000 56,300 103,950 $5,000 $263.750 $205,000 (123,500) (11,700) (4),000) $26.800 3. Issued new shares of stock for $38,050 cash. 4. Dividends of S650 were declared and paid. 5. Other expenses all relate to wages. 6.…arrow_forwardPanzarella Corporation's current year income statement, comparative balance sheets, and additional information follow. For the year, (1) all sales are credit sales, (2) all credits to Accounts Receivable reflect cash receipts from customers, (3) all purchases of inventory are on credit, (4) all debits to Accounts Payable reflect cash payments for inventory, (5) Other Expenses are all cash expenses, and (6) any change in Income Taxes Payable reflects the accrual and cash payment of taxes. Assets Cash Accounts receivable Inventory Total current assets PANZARELLA CORPORATION Comparative Balance Sheets December 31 Equipment Accumulated depreciation-Equipment Total assets Liabilities and Equity Accounts payable Income taxes payable Total current liabilities Equity Common stock, $2 par value Paid-in capital in excess of par value, common stock Retained earnings Total liabilities and equity PANZARELLA CORPORATION Income Statement For Year Ended December 31 Sales Cost of goods sold Gross…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,