Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

FINANCIAL ACCOUNTING PROBLEM, EXPERT ANSWER THIS WITH EXPLANATION

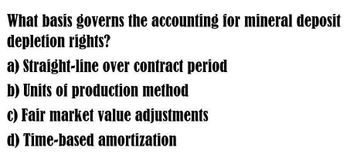

Transcribed Image Text:What basis governs the accounting for mineral deposit

depletion rights?

a) Straight-line over contract period

b) Units of production method

c) Fair market value adjustments

d) Time-based amortization

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Borrowing costs on qualifying assets are? a) Always expensed b) Capitalized during the construction period c) Added to reserves d) Deducted from the asset costarrow_forwardWhich of the following amortization methods is most likely to evenly distribute the cost ofan intangible asset over its useful life?A. Straight-line methodB. Units-of-production methodC. Double-declining balance methodarrow_forwardExplanationarrow_forward

- the amortization of intangible assets with finite useful lives is justified by the : a- economic entity assumption b- going concern assumption c- monetary unit assumption d- historical cost assumptionarrow_forwardThe allocation of the cost of a tangible asset to expense in the periods in which the asset is used is termed as: Select one: a. Depreciation b. None of the given options c. Appreciation d. Fluctuationarrow_forwardWhich of the following values for an intangible asset would a company capitalize and amortize? a.) purchase price b.) research costs c.) residual value d.) development costsarrow_forward

- Describe the important properties of fixed assets? Compare and contrast the straight-line, units-of-activity, and double-declining balance depreciation methods ? Describe the accounting for intangible assets, such as patents, copyrights, and goodwill ? Describe current liabilities, including those related to accounts payable, accruals, notes payable, and the current portion of long-term debt?arrow_forwardHow do amortization methods differ for intangible assets with finite useful lives versus those with indefinite useful lives, and what impact do these methods have on a company's financial statements?arrow_forwardWhat is the purpose of charging depreciation in financial statements? A To allocate the cost of a non-current asset over the accounting periods expected to benefit from its use B To ensure that funds are available for the eventual replacement of the asset C To reduce the cost of the asset in the statement of financial position to its estimated market value D To account for the ‘wearing-out’ of the asset over its lifearrow_forward

- What is the ability to revalue fixed assets under IFRS provides flexibility in reflecting the true value of assets? And also GAAP?arrow_forwardWhat is the purpose of amortisation? To allocate the cost of an intangible non-current asset over its useful life To ensure that funds are available for the eventual purchase of a replacement non-current asset To reduce the cost of an intangible non-current asset in the statement of financial position to its estimated market value To account for the risk associated with intangible assetsarrow_forwardCan the selection of a depreciation method affect a company’s asset replacement policy (i.e., the timing of its asset replacement)? If so, how?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT